Flashback:

– David Stockman: The Entire Economy Is A Ponzi Scheme!

– Former OMB Director David Stockman: ‘We’re At The Fiscal Endgame’ (Video)

– Former Budget Director David Stockman: Warns on US ‘Bond Armageddon’; First Default Could Be to IMF

– David Stockman Explains The Keynesian State-Wreck Ahead – Sundown In America (ZeroHedge, Oct 5, 2013):

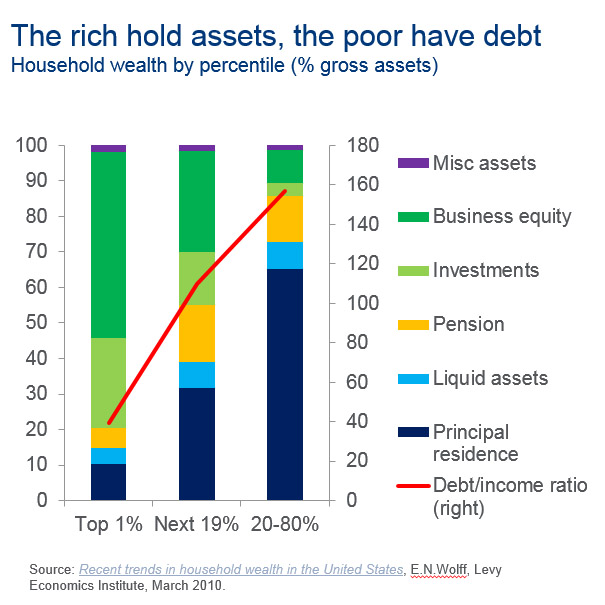

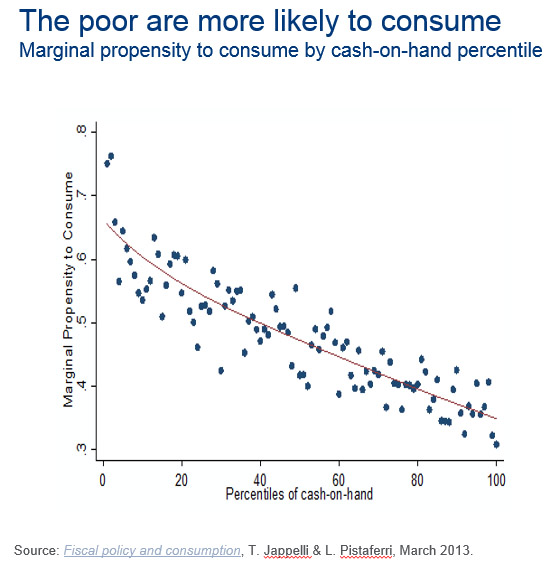

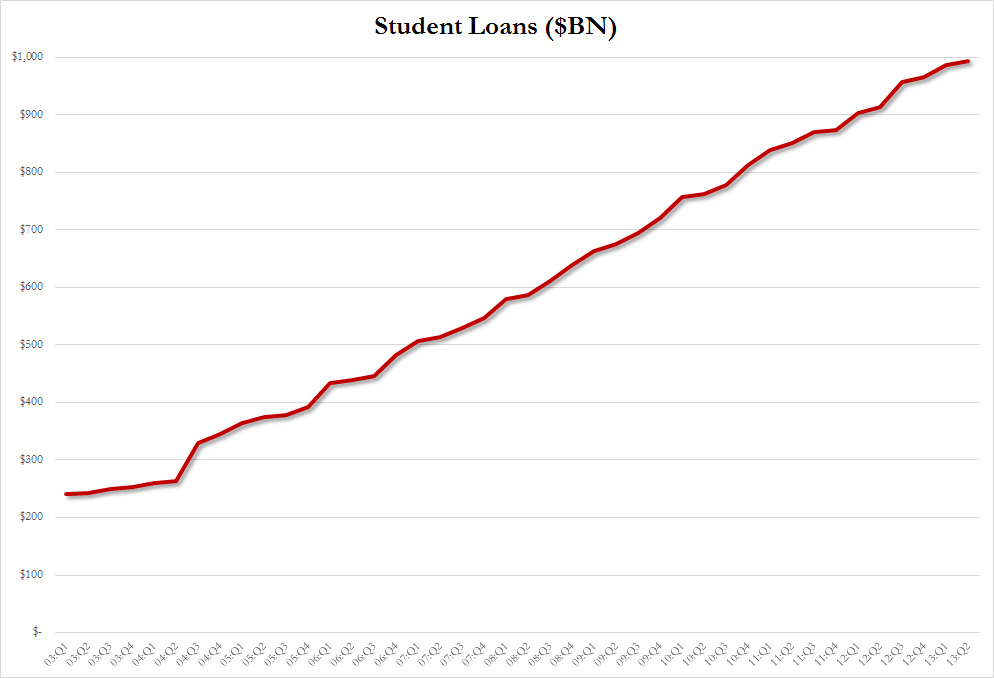

David Stockman, author of The Great Deformation, summarizes the last quarter century thus: What has been growing is the wealth of the rich, the remit of the state, the girth of Wall Street, the debt burden of the people, the prosperity of the beltway and the sway of the three great branches of government – that is, the warfare state, the welfare state and the central bank… What is flailing is the vast expanse of the Main Street economy where the great majority have experienced stagnant living standards, rising job insecurity, failure to accumulate material savings, rapidly approach old age and the certainty of a Hobbesian future where, inexorably, taxes will rise and social benefits will be cut… He calls this condition “Sundown in America”.

SUNDOWN IN AMERICA: THE KEYNESIAN STATE-WRECK AHEAD

Remarks of David A. Stockman at the Edmond J. Safra Center for Ethics, Harvard University, September 26, 2013

The median U.S. household income in 2012 was $51,000, but that’s nothing to crow about. That same figure was first reached way back in 1989— meaning that the living standard of Main Street America has gone nowhere for the last quarter century. Since there was no prior span in U.S. history when real household incomes remained dead-in-the-water for 25 years, it cannot be gainsaid that the great American prosperity machine has stalled out.

Even worse, the bottom of the socio-economic ladder has actually slipped lower and, by some measures, significantly so. The current poverty rate of 15 percent was only 12.8 percent back in 1989; there are now 48 million people on food stamps compared to 18 million then; and more than 16 million children lived poverty households last year or one-third more than a quarter century back.

Likewise, last year the bottom quintile of households struggled to make ends meet on $11,500 annually —-a level 20 percent lower than the $14,000 of constant dollar income the bottom 20 million households had available on average twenty-five years ago.

Read moreFormer US Budget Director David Stockman Explains The Keynesian State-Wreck Ahead – Sundown In America