What she really is, is a sad elite puppet.

– Janet Yellen Is An Insult To Americans (ZeroHedge, Aug 22, 2014):

By Raul Ilargi Meijer of The Automatic Earth

Janet Yellen Is An Insult To Americans

Dorothea Lange Siler City, North Carolina Jul 1939

If you’re a girl and you’re old and you’re grey and you’re the size of a hobbit, who’s going to get angry at you? If your predecessor had all the qualities anyone could look for in a garden gnome, and his predecessor was known mainly as a forward drooling incoherent oracle, how bad could it get? Think they select Fed heads them on purpose for how well they would fit into the Shire?

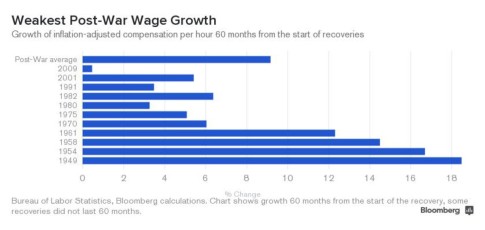

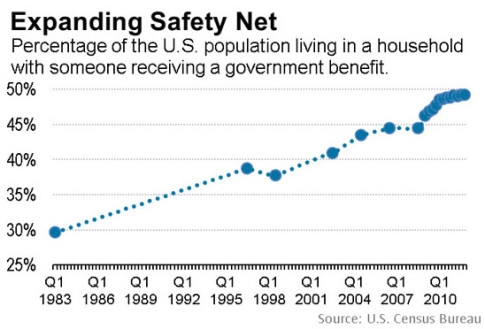

Janet Yellen has a serious problem: the story no longer fits. The Fed under Bernanke said in its forward guidance that it would taper if certain job market conditions were met. And now they have been, at least on paper, but Yellen knows only too well that those are not the real numbers [ZH: as we explicitly warned would happen in December 2012].