– The US Dollar Is About To Inflict Carnage All Around The Planet (Th Automatic Earth, Oct 3, 2014):

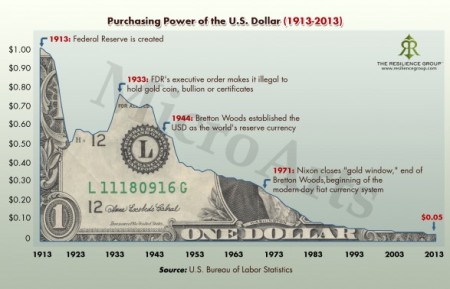

As I watch the euro losing another 1.3% against the dollar today, it’s now at $1.25, and down from close to $1.40 recently, it’s getting clearer all the time: the greenback is busy eating currencies and economies alive.

There is of course the fact that Abenomics in Japan is living up to its longstanding promise of utter failure. And there is Mario Draghi torn between two lovers, one the one hand the Germany/Austria camp – with France as a surprise third – who don’t want the ECB to buy up junk paper, and on the other hand those EU members whose sole road to survival inside the EU is for Draghi to buy up anything that even looks like it was once toilet paper.

But Japan and Europe have been in the economic doghouse for a long time. It wasn’t until the Fed pulled the trigger on the dollar steamroller that they started paying the real price for it.

Read moreThe US Dollar Is About To Inflict Carnage All Around The Planet