– Markets Turmoiled As 5th Hindenburg Looms (ZeroHedge, Dec 9, 2014)

Economy

Anyone That Believes That Collapsing Oil Prices Are Good For The Economy Is Crazy

– Anyone That Believes That Collapsing Oil Prices Are Good For The Economy Is Crazy (Economic Collapse, Dec 8, 2014):

Are much lower oil prices good news for the U.S. economy? Only if you like collapsing capital expenditures, rising unemployment and a potential financial implosion on Wall Street. Yes, lower gasoline prices are good news for the middle class. I certainly would rather pay two dollars for a gallon of gas than four dollars. But in order to have money to fill up your vehicle you have got to have an income first. And since the last recession, the energy sector has been the number one creator of good jobs in the U.S. economy by far. Barack Obama loves to stand up and take credit for the fact that the employment picture in this country has been improving slightly, but without the energy industry boom, unemployment would be through the roof. And now that the “energy boom” is rapidly becoming an “energy bust”, what will happen to the struggling U.S. economy as we head into 2015?

Read moreAnyone That Believes That Collapsing Oil Prices Are Good For The Economy Is Crazy

America in decline: 1 in 7 Kentuckians now rely on food banks

– America in decline: 1 in 7 Kentuckians now rely on food banks (Natural News, Dec 9, 2014):

The U.S. economy, despite rosy characterizations by President Obama recently, is still abysmal for far too many Americans who are still struggling to make ends meet, put food on the table and remain in their homes — a condition that will only worsen with the president’s recent executive amnesty, “legalizing” millions of illegal aliens.

Some of the country’s historically poor states — many of them in the South — have been especially hard-hit, as a recent report from Kentucky points out. Local station WKYT in Lexington says that not only has hunger remained a “huge issue” in the state — one food pantry says one-in-seven Kentuckians are receiving food assistance from any number of charities — but it is even a problem on the state’s college campuses.

Read moreAmerica in decline: 1 in 7 Kentuckians now rely on food banks

Willem ‘Gold-Is-A-6000-Year-Bubble’ Buiter Joins Council on Foreign Relations As Senior Fellow

– Willem “Gold-Is-A-6000-Year-Bubble” Buiter Joins Council on Foreign Relations As Senior Fellow (ZeroHedge, Dec 9, 2014):

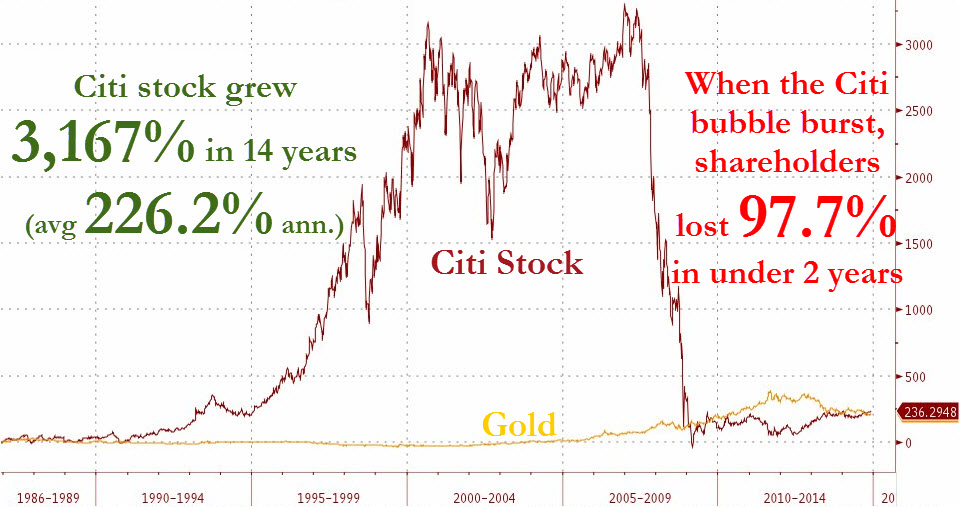

Less than two weeks after penning his “gold-is-a-6000-year-old bubble” propaganda, which understandably did not include the following chart…

… Citigroup’s Willem Buiter was just made an honorary member of the Council of Foreign Relations.

Distinguished Economist Willem Buiter Joins CFR as Senior Fellow

December 9, 2014—Willem H. Buiter, a renowned macroeconomist and global chief economist at Citigroup, has joined the Council on Foreign Relations (CFR) as an adjunct senior fellow. His work will focus on geoeconomics, deglobalization, international financial institutions, and global economic governance.

“We are thrilled to have someone of Willem Buiter’s experience and reputation joining CFR,” said CFR President Richard N. Haass. “His presence will make an already strong economics program that much stronger.”

It Wasn’t Only China: Here Is What Else Is Crashing Overnight

– It Wasn’t Only China: Here Is What Else Is Crashing Overnight (ZeroHedge, Dec 9, 2014):

It wasn’t just China’s long overdue crash last night. In addition to the Shanghai Composite suffering its biggest plunge since August 2009, there has been a sharp slide in the USDJPY which has broken its uptrend to +? (and hyperinflation), and around the time Chinese gamblers were panicking, the FX pair tumbled under 120, although since then the 120 tractor beam has been activated. Elsewhere, the Athens stock exchange is also crashing by over 10% this morning on the heels of news that the Greek government has accelerated the process to elect the next president and possibly, a rerun of the drama from the summer of 2012 when the Eurozone was hanging by a thread when Tsipras almost won the presidential vote and killed the world’s most artificial and insolvent monetary union. And finally, the crude plunge appears to have finally caught up with ground zero, with ADX General Index in Abu Dhabi plunging 3.5%, also poised for the biggest drop since 2009. In fact the only thing that isn’t crashing (at least not this moment), is Brent, which did drop to new 5 year lows earlier under $66, but has since staged a feeble rebound.

So… another record high in the fully decoupled from the rest of the world (as well as reality and reationality) S&P500 any minute now?

Read moreIt Wasn’t Only China: Here Is What Else Is Crashing Overnight

‘Cash-Strapped’ Venezuela Stares Into The Abyss … And Its Default Risk Goes Parabolic

– “Cash-Strapped” Venezuela Stares Into The Abyss… And Its Default Risk Goes Parabolic (ZeroHedge, Dec 8, 2014):

Some two weeks ago (when Venezuela CDS was trading at only 2300 bps) we previewed what – with almost absolute certainty – would be the first “casualty of the crude carnage” – Nicholas Maduro’s little socialist paradise that couldn’t: Venezuela. As a reminder, back then we learned that the OPEC member was in such dire straits it had burned through a third of a Chinese’ bailout loan in the matter of days.

Since then it only got worse, and as we reported early last week in How Goldman Sachs Became Broke Venezuela’s Loan Shark, Venezuela is now scrambling to obtain any cash even if it means doing deals with the devil, or, alternatively, god’s busy worker on this planet, Goldman Sachs.

Then, in a bout of desperation, late the same week, the country – desperate to give the impression that it is not terminally insolvent and still has some foreign reserves left – ordered its Central Bank to dramatically change the rules, in a step “that enables them to count a whole new set of ‘assets’ as potential international reserves including “stones” and “precious metals held in their vaults on behalf of foreign financial institutions.”

Read more‘Cash-Strapped’ Venezuela Stares Into The Abyss … And Its Default Risk Goes Parabolic

NIRP Arrives In The US: TBTF Banks Tell Customers To Move Their Cash Or Be Charged Fees

– NIRP Arrives In The US: TBTF Banks Tell Customers To Move Their Cash Or Be Charged Fees (ZeroHedge, Dec 8, 2014):

Back in June, the world was speechless when Goldman’s head of the ECB, Mario Draghi, stunned the world when he took Bernanke’s ZIRP and raised him one better by announcing the ECB would send deposit rates into negative territory, in the process launching the Neutron bomb known as N(egative)IRP and pushing European monetary policy into the “twilight zone”, forcing savers to pay (!) for the privilege of keeping the product of their labor in the form of fiat currency instead of invested in a global ponzi scheme built on capital market so broken even the BIS can no longer contain its shocked amazement.

Well, the US economy may be “decoupling” (just as it did right before Lehman) and one pundit after another are once again (incorrectly) predicting that the Fed may raise rates, but when it comes to the true “value” of money, US banks have just shown that when it comes to spread between reality and the economic outlook, the schism has never been deeper.

Enter US NIRP.

As the WSJ reports, far from paying for the privilege of holding other people’s cash (and why would they with nearly $3 trillion in positive carry excess reserves sloshing around) US banks – primarily of the TBTF variety – “are urging some of their largest customers in the U.S. to take their cash elsewhere or be slapped with fees, citing new regulations that make it onerous for them to hold certain deposits.”

Read moreNIRP Arrives In The US: TBTF Banks Tell Customers To Move Their Cash Or Be Charged Fees

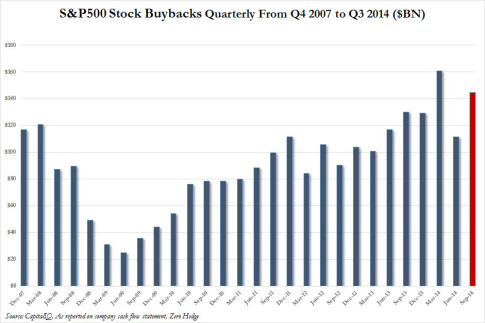

With Q3 Buybacks Surging, These Are The Top 20 Repurchasers Of Their Own Stock

– With Q3 Buybacks Surging, These Are The Top 20 Repurchasers Of Their Own Stock (ZeroHedge, Dec 8, 2014):

Back in September, when we looked at the total amount of stock buybacks by S&P 500 companies, we observed that the “Buyback Party Is Over: Stock Repurchases Tumble In The Second Quarter” – according to CapIQ data, after soaring to a record $160 billion in Q1, the amount of repurchased stock dropped 20% to “only” $110 billion, which perhaps also explains why the market went absolutely nowhere in the spring and early summer. Our conclusion was that, if indeed this was the end of the buyback party, then “the Fed will have no choice but to step in again, and the central-planning game can restart again from square 1, until finally the Fed’s already tenuous credibility is lost, the abuse of the USD’s reserve status will no longer be a possibility, and the final repricing of assets to their true levels can begin.”

As it turns out our conclusion that it’s all over was premature (with the Fed getting some breathing room thanks to desperate corner offices eager to pump up their CEO’s equity-linked compensation), and as the just concluded Q3 earnings seasons confirms, what went down, promptly soared right back up, with stock repurchases in Q3 surging by 30% following the 30% drop in Q2, and nearly offsetting all the lost “corporate wealth creation” in the second quarter, with the total amount of stock repurchases by S&P 500 companies jumping from $112 billion to $145 billion, just shy of the Q1 record, and the second highest single quarter repurhcase tally going back to 2007, and before.

So who are the most glaring offenders of engaging in what James Montier calls the “World’s Dumbest Idea“, i.e., maximizing shareholder value almost entirely through buybacks?

Here are the 20 S&P corporations who repurchased the most stock in Q3:

Read moreWith Q3 Buybacks Surging, These Are The Top 20 Repurchasers Of Their Own Stock

Betting On The ‘Other’ Oil Black Swan

– Betting On The ‘Other’ Oil Black Swan (ZeroHedge, Dec 8, 2014):

With oil prices plunging to 5-year lows, perhaps it is time to consider the cheapness of betting on the other oil black swan…

Via BofA’s Jake Greenberg,

In my base case, I remain structurally bearish oil. The world is making huge productivity and efficiency gains (lighter vehicles, new technology, etc.), and we are starting to see real substitution (e.g. to LNG and CNG). On the supply side, oil is not resource constrained (i.e. at the right price, you get more shale coming to market + Libya + KRG + North Sea’s Buzzard + Arctic, etc) and OPEC is a dysfunctional oligopoly. Francisco Blanch thinks we could see Brent drop below $60/bbl in the next six months.

Interestingly, lower oil prices may not incentive increased demand as both China and India are taking advantage of the drop to raise taxes on fuel consumption. Lower crude prices are not being passed on to the end consumers in the markets that matter most for demand growth. See the WSJ here: India raises taxes on fuels. And the Australian here: China lifts fuel tax

Oil’s black swan…

That said, if oil prices go “too low”, there are some very powerful State actors who could become incentivized to precipitate a geopolitical crisis in order to get oil prices back up. E.g. a Saudi Arabian spring, or an attack on a major pipeline? The ISIS-sponsored attack in November in Saudi Arabia’s oil-rich Al Ahsa region did not get a lot of air time, but this is definitely an article worth reading…again from the WSJ: ISIS urging attacks on Saudi

McDonalds Implodes, Reports Worst US Sales In Over A Decade

– McDonalds Implodes, Reports Worst US Sales In Over A Decade (ZeroHedge, Dec 8, 2014):

For those, who are leery of seasonally-adjusted government data (showing soaring low-wage jobs offset by crashing employment in the energy sector and M&A synergies which mysteriously are never captured), or sentiment surveys and confidence polls (of Wall Street executives and government workers), here is the latest data from McDonalds. Showing the worst US comp store sales in nearly 12 years at -4.6%, one does wonder if following America’s inability to even pay for sub-$1 meals, mass starvation will follow?

…

Belgium Investigating To Repatriate All Gold Reserves – Update: Dec 8, 2014 (Videos)

– Belgium Investigating To Repatriate All Gold Reserves (Bullion Star, Dec 5, 2014):

Just after I reported on the repatriation of 122.5 tonnes of gold by The Netherlands from the Federal Reserve Bank of New York (FRBNY) and about the Eurosystem allocating as much of its gold reserves as possible – a global run on gold which can only be seen in advance of a reform of the international monetary system, the next Eurosystem member has come forward, Belgium.

In Europe so far; Germany has been repatriating gold since 2012 from the US and France, The Netherlands has repatriated 122.5 tonnes a few weeks ago from the US, soon after Marine Le Pen, leader of the Front National party of France, penned an open letter to Christian Noyer, governor of the Bank of France, requesting that the country’s gold holdings be repatriated back to France, and now Belgium is making a move. Who’s next? And why are all these countries seemingly so nervous to get their gold ASAP on own soil?

VTM-nieuws has just reported the Belgium central bank has confirmed it’s investigating to repatriate all its gold reserves.

Read moreBelgium Investigating To Repatriate All Gold Reserves – Update: Dec 8, 2014 (Videos)

On Precious Metals, Patience, & Paper-Bugs

– On Precious Metals, Patience, & Paper-Bugs (ZeroHedge, Dec 8, 2014):

You can be for gold, or you can be for paper, but you cannot possibly be for both. It may soon be time to take a stand.

The arguments in favour of gold are well known. Yet they are widely ignored by the paperbugs, who have a curious belief system given that its end product (paper currency) is destined to fail. We just do not know precisely when.

The price of gold is weakly correlated to other prices in financial markets, as the last three years have clearly demonstrated.

Indeed gold may be the only asset whose price is being suppressed by the monetary authorities, as opposed to those sundry instruments whose prices are being just as artificially inflated to offer the illusion of health in the financial system (stocks and bonds being the primary financial victims).

Beware appearances in an unhinged financial system, because they can be dangerously deceptive.

Mike Maloney: The Coming Wealth Transfer

Flashback:

– Inflation, Hyperinflation and Real Estate (Price Collaps):

…

And when there is hyperinflation, real estate prices of all sorts—residential, commercial, industrial—go into a free-fall: Their prices crash and burn, completely and utterly.

…

The Great Hernán P.’s example is exactly what any sensible investor should do, in an inflationary or hyperinflationary period: Preserve capital at all costs, via commodities (… like gold and silver), while keeping a sharp eye out for real estate opportunities. As inflation rises and real estate prices collapse, be prepared to trade the commodities you own for real estate assets selling at depressed prices.

…

– Argentina’s Economic Collapse (Documentary)

Click the play button below to listen to Chris’ interview with Mike Maloney (43m:35s)

– Mike Maloney: The Coming Wealth Transfer (Peak Prosperity, Dec 6, 2014):

There’s nowhere to hide (except in hard assets)

History may not repeat but it sure does rhyme. Mike Maloney has studied monetary and financial breakdowns throughout history and concludes that there’s nothing new or different happening this time, except its global and far more massive than any other time in history.

Worse, there are echoes of 1911 where a series of diplomatic blunders and national pride and intransigence combined to create the still largely inexplicable start to WW I.

Chris Martenson: Well it’s global this time, right? This is — there’s nowhere to hide. (…) What has happened when we’ve tried to print our way to prosperity before? What has happen? Why has it happened and what have been the consequences always been?

Mike Maloney: Whenever you try to print your way to prosperity it transfers well from the masses to the few. The few being the people running the game and then also the hucksters that are very nimble, the con artists and so on. You see these people get rich during the Weimar Hyperinflation. There were quite a few of these fancy salespeople that got rich; they didn’t stay rich once things stabilized again.

But it creates such a topsy turvy world that the normal person that does not know how to operate under these weird economic conditions cannot possibly keep up with things and wealth is transferred away from those people to the people that are very good at observing what’s going on that second and adjusting to it. But the one thing that I see as a constant throughout history is that gold and silver eventually do an accounting of all this — the financial — you know financial finessing that the governments are doing.

And when it does that it — there is a transfer of wealth to the people that own gold and silver. And so — it’s very rare moments in history. This does not happen often. But it’s a great opportunity and I’ve just — you know if you look at gold right now the public’s opinion of gold is quite low because it’s been going down for three years.

Did Blackstone Just Call The Top In Commercial Real Estate?

– Did Blackstone Just Call The Top In Commercial Real Estate? (ZeroHedge, Dec 8, 2014):

Blackstone’s well-timed IPO in 2007 was almost the perfect top-tick indicator as ‘the smart money’ private-equity guys cashed out into the public markets at peak euphoria. Earlier this year we noted that, among others, Blackstone was drastically ratcheting down purchases (and in fact selling what it could) US residential real estate – and with it withdrew the only pillar holding up the housing market. And now, in the biggest deal in 7 years, Blackstone is dumping a $3.5 billion commercial real estate portfolio. Given the recent declines in CMBX pricing, perhaps, once again, Blackstone is calling the top in another bubble…

…

Stocks Suffer Mini Flash Crash Just As 4th Hindenburg Omen Spotted

– Stocks Suffer Mini Flash Crash Just As 4th Hindenburg Omen Spotted (ZeroHedge, Dec 8, 2014):

With someone desperate to sell 6,100 S&P 500 e-mini contracts in 1 second at 12:20:05, US stocks market indices hit a mini-flash-crash air-pocket as the 4th Hindenburg Omen signal flashed in the last 5 days… paging Waddell & Reed… We await the next Fed speaker to save stocks in a v-shaped recovery.

…

Are We Reliving The 1930s?

– Are We Reliving The 1930s? (ZeroHedge, Dec 7, 2014):

Seeing the two “depressions” as historically and generationally comparable, makes it easier to recognize other similarities between the 1930s and the 2010s. Many are economic, as we have seen. But others are demographic (falling fertility, migration, and mobility). Still others are social (growing localism, income inequality, and distrust of elites; stronger families; and declines in personal risk-taking). And still others, ominously, are geopolitical (rising isolationism, nationalism, and authoritarianism, and the unraveling of any “world order” consensus). The confluence of all these trends is not accidental…

…

When Goldman Writes The New York Fed’s Press Releases, Then All Is Lost

– When Goldman Writes The New York Fed’s Press Releases, Then All Is Lost (ZeroHedge; Dec 6, 2014):

Much has been said about Goldman’s control over the most important Federal Reserve of all, that of New York, where the all important Markets Group is located, which does as the name implies, “influences” markets (those who may have missed it are encouraged to read “Goldman “Whistleblower” Sues NY Fed For Wrongful Termination“, “How Goldman Controls The New York Fed: 47.5 Hours Of “The Secret Goldman Sachs Tapes” Explain“, “A Quick Look At Goldman’s Takeover Of The US Judicial System: NY Fed Edition“, and of course “I Am Putting Everything In Goldman Sachs Because These Guys Can Do Whatever The Hell They Want.”

And while it is very clear by now that nothing will change under the current corrupt and compromised executive, legislative and judicial system, because at the end of the day, Goldman has indirect control over all three branches of government , here is the one anecdote which, in a non banana republic, would be the straw that finally broke the camel’s back.

As the financial crisis raged in September 2008, Goldman Sachs and Morgan Stanley sought sanctuary from the Federal Reserve.

The last two big independent broker-dealers were allowed to become bank holding companies, giving them access to government liquidity that could keep them afloat.

Goldman drafted its own statement, quoting Lloyd Blankfein, chief executive, as saying: “We believe that Goldman Sachs, under Federal Reserve supervision, will be regarded as an even more secure institution.”

According to people familiar with the matter, Goldman then drafted another release and sent it to the New York Fed. This one was to be used as the central bank’s own statement.

Read moreWhen Goldman Writes The New York Fed’s Press Releases, Then All Is Lost

BP Set To Slash 100s Of Jobs Amid Oil’s ‘Unequivocally Good’ Slump

– BP Set To Slash 100s Of Jobs Amid Oil’s “Unequivocally Good” Slump (ZeroHedge, Dec 7, 2014):

The slump in oil prices has BP “concentrating minds on making the organisation more efficient” which means, as The FT translates, the ‘unequivocally good news’ of lower oil prices is accelerating plans for the oil giant to reduce its headcount. The Sunday Times reports, BP is to ax middle managers and freeze projects as Brian Gilvary, the finance director, said: “what you’ll see with this simplification plan is that headcounts are starting to come down across all of our activities in upstream, downstream and in the corporate centres — essentially the layers above operations.” Gilvary added that the company would slash the oil price assumption used to set its day-to-day budget.

BP will announce on Wednesday that hundreds of jobs will be lost at offices in London, Sunbury and Aberdeen as part of huge global staff cuts resulting from plunging oil prices and the Gulf of Mexico spill.

Read moreBP Set To Slash 100s Of Jobs Amid Oil’s ‘Unequivocally Good’ Slump

Even The BIS Is Shocked At How Broken Markets Have Become

The central bank of central banks is “shocked”?

Sure!!!

Imagine my total absence of shock.

From the article:

“The highly abnormal is becoming uncomfortably normal… There is something vaguely troubling when the unthinkable becomes routine.”

– Even The BIS Is Shocked At How Broken Markets Have Become (ZeroHedge, Dec 7, 2014):

Not a quarter passes without the Bank of International Settlements (BIS) aka central banks’ central bank (also the locus of some of the most aggressive manipulation of gold and FX in human history) reiterating a dire warning about the fire and brimstone that is about to be unleashed upon the global economy.

It started in June of 2013, when Jaime Caruana, certainly the most prominent doom and gloomer at the BIS (who also was Governor of the Bank of Spain from 2000 to 2007 when this happened) asked if “central banks [can] now really do “whatever it takes”? As each day goes by, it seems less and less likely… [seven] years have passed since the eruption of the global financial crisis, yet robust, self-sustaining, well balanced growth still eludes the global economy…. low-interest policies have made it easy for the private sector to postpone deleveraging, easy for the government to finance deficits, and easy for the authorities to delay needed reforms in the real economy and in the financial system. Overindebtedness is one of the major barriers on the path to growth after a financial crisis. Borrowing more year after year is not the cure…in some places it may be difficult to avoid an overall reduction in accommodation because some policies have clearly hit their limits.”

The BIS’ preaching did not end there, and hit a new crescendo in June of 2014, when in its 84th Annual Report, the BIS slammed “Market Euphoria”, and found a “Puzzling Disconnect” between the economy and the market”:

Read moreEven The BIS Is Shocked At How Broken Markets Have Become

Jim Grant Sums It All Up In 2 Stunning Paragraphs

– Jim Grant Sums It All Up In 2 Stunning Paragraphs (ZeroHedge, Dec 6, 2014):

What will futurity make of the [so-called] Ph.D. standard [that runs our world]?

Likely it will be even more baffled than we are. Imagine trying to explain the present-day arrangements to your 20-something grandchild a couple of decades hence – after the crash of, say, 2016, that wiped out the youngster’s inheritance and provoked a cenral bank response so heavy-handed as to shatter the confidence even of Wall Street in the Federal reserve’s methods…

I expect you’ll wind up saying something like this:

The Only Two Charts You Need to Understand the S&P 500

– The Only Two Charts You Need to Understand the S&P 500 (Washington’s Blog, Dec 6, 2014):

As long as corporations continue borrowing money to buy back their own stocks and the yen keeps dropping, the SPX will continue lofting higher.

…

Citi Faces $270 Million Loss; ‘In Panic’ Over Chinese Port Commodity Fraud

– Citi Faces $270 Million Loss; “In Panic” Over Chinese Port Commodity Fraud

Despite the near-record scream higher in Chinese stocks over the last few months, under the surface China is rattled and nowhere is that more evident than in the collapse of its commodity-backed ponzi-financing deals. Since we first uncovered the fraud at the port of Qingdao, another has appeared that is just as fraud-ridden – Penglai; and Citi and Mercuria Energy are arguing over who pays. According to Mercuria’s lawyer Graham Dunning, Citi was “in a state of panic,” when they uncovered the fraud. As Bloomberg reports, Dunning exclaimed “it appears that substantial quantities may be missing from the warehouses or may be the subject of multiple pledges,” and the bank says it is owed at least $270 million. Other ‘banks’ have been less forthcoming about their potential losses, but the government probe has so far uncovered almost $10 billion in fraudulent trade, including irregularities at Qingdao, according to the country’s currency regulator.

…

19 Signs That You Live In A Country That Has Gone Completely Insane

– 19 Signs That You Live In A Country That Has Gone Completely Insane (The American Dream, Dec 4, 2014):

Do you ever feel like you are living in a “Bizarro World”? That is how I feel much of the time. I look around and it seems as though some form of mass psychosis has descended on most of the population. Things that would have had Americans angrily marching in the streets a generation or two ago are now just accepted as “normal” by the “sheeple” that populate this nation. If the talking heads that endlessly spew nonsense at us through our televisions tell us to believe something, no matter how absurd it is, most people just go along with it. Before we had televisions and radios and computers and movies and the Internet, people actually had to do the hard work of thinking for themselves. But now we are all plugged into this giant “matrix” that tells us what to think, what to believe and how to feel about things. And unfortunately, the people that are telling us what to think and believe are delusional themselves. The blind are leading the blind, and as a result our nation is coming apart at the seams all around us.

The following are 19 signs that you live in a country that has gone completely insane…

#1 When those occupying the highest offices in the land tell you that an $18,000,000,000,000 debt is “under control“, you live in a country that has gone completely insane.

Read more19 Signs That You Live In A Country That Has Gone Completely Insane

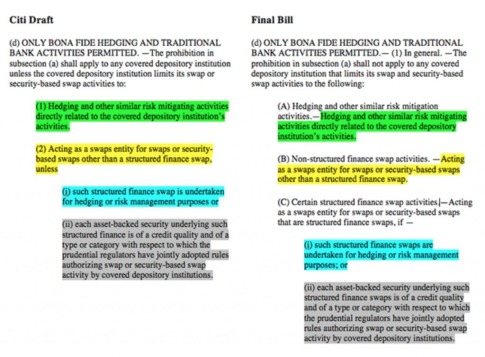

Wall Street Moves To Put Taxpayers On The Hook For Derivatives Trades

– Wall Street Moves to Put Taxpayers on the Hook for Derivatives Trades (Liberty Blitzkrieg, Dec 5, 2014):

Wall Street has for some time attempted to put taxpayers on the hook for its derivatives trades. I highlighted this a year ago in the post: Citigroup Written Legislation Moves Through the House of Representatives. Here’s an excerpt:

Five years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

Unsurprisingly, the main backer of the bill is notorious Wall Street lackey Jim Himes (D-Conn.), a former Goldman Sachs employee who has discovered lobbyist payoffs can be just as lucrative as a career in financial services. The last time Mr. Himes made an appearance on these pages was in March 2013 in my piece: Congress Moves to DEREGULATE Wall Street.

Fortunately, that bill never made it to a vote on the Senate floor, but now Wall Street is trying to sneak it into a bill needed to keep the government running.

You can’t make this stuff up.

From the Huffington Post:

WASHINGTON — Wall Street lobbyists are trying to secure taxpayer backing for many derivatives trades as part of budget talks to avert a government shutdown.

According to multiple Democratic sources, banks are pushing hard to include the controversial provision in funding legislation that would keep the government operating after Dec. 11. Top negotiators in the House are taking the derivatives provision seriously, and may include it in the final bill, the sources said.

The bank perks are not a traditional budget item. They would allow financial institutions to trade certain financial derivatives from subsidiaries that are insured by the Federal Deposit Insurance Corp. — potentially putting taxpayers on the hook for losses caused by the risky contracts. Big Wall Street banks had typically traded derivatives from these FDIC-backed units, but the 2010 Dodd-Frank financial reform law required them to move many of the transactions to other subsidiaries that are not insured by taxpayers.

Read moreWall Street Moves To Put Taxpayers On The Hook For Derivatives Trades

Is the Auto Loan Bubble Bursting? Delinquent Loans Jump 27% Year-Over-Year

– Is the Auto Loan Bubble Bursting? Delinquent Loans Jump 27% Year-Over-Year (Liberty Blitzkrieg, Dec 5, 2014):

I’ve covered the ever expanding subprime auto loan market on several occasions over the past couple of years, most recently in the post: Chinese Homebuilders Expand in America as U.S. Auto Loans Hit Record Levels. As they always do, it appears that the chickens are starting to come home to roost.

The New York Times reports the following:

An increasing number of borrowers are falling behind on their car payments, even as the total amount of outstanding debt reaches new heights, according to the latest report by Experian, the credit and research firm.

In a presentation on Wednesday, Experian said the balance of loans that were 60 days delinquent increased 27 percent, to roughly $4 billion, in the third quarter from the same period a year ago.

Read moreIs the Auto Loan Bubble Bursting? Delinquent Loans Jump 27% Year-Over-Year