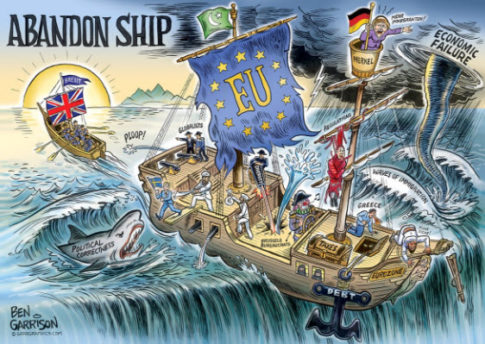

– EU Hikes Brexit “Bill” To €100 Billion Drawing Angry Response From UK, Pound Slumps:

Sterling slumped overnight, and tensions between the UK and Europe escalated after EU negotiators hiked their initial demand for Birtain’s Brexit bill over recent weeks, widening the divide between Brussels and London, which in turn questions whether it owes anything at all before Brexit talks start next month. Hours before chief negotiator Michel Barnier was due to give more details on the EU’s standpoint, the Financial Times said the EU might seek an upfront payment in 2019 of up to €100 billion, drawing an immediate rejection from Britain’s Brexit Secretary David Davis that he would pay that sum.

The European Commission had initially given a ballpark estimate of the bill of about €60 billion but the FT said the calculations it referred to would result in a net payment from Britain of roughly that level, after subsequent reimbursements. One senior EU official involved in preparing for the talks after a British election on June 8 said he did not recognize the 100-billion-euro figure, although a number of private calculations of the bill have gone as high or even higher.

According to Reuters, last month, the Bruegel think-tank in Brussels put the up-front payment for Britain as high as €109 billion under one of many scenarios for the calculation. Later reimbursement would bring the net figure to 65 billion, Bruegel’s study showed.

Shortly after the FT story hit, UK Brexit Secretary Davis said Britain won’t be paying a €100BN Brexit bill, and would have no obligation to pay Brexit bill if it leaves the EU without a deal. Speaking on BBC Radio 4’s “Today” program Wednesday, Davis said “nobody is looking for that outcome” and added that “the simple truth is that when we leave we’ll go outside the remit of the European Court of Justice.”

He then summarized the overnight media reports by saying “what you’re seeing is the tough early stages of the negotiation.”

Meanwhile, over the past month, the 27 other EU member states have drafted negotiating guidelines for the executive Commission that leaders agreed on Saturday. In the course of drafting, governments insisted on clarifying that Britain be made to pay up front for, among other things, contingent liabilities for guarantees on loans made by, for example, the European Investment Bank.

A document seen by Reuters outlining Barnier’s plans for negotiations, showed he has a plan to calculate up-front payment for contingent liabilities, to be repaid later: “This calculation will also identify the amounts covering or guaranteeing loans which have to be reimbursed to the United Kingdom if uncalled, on the basis of the maturity of the loans.” Barnier has repeatedly said that the final amount cannot be calculated until Britain is leaving, since the EU budget will change. However, EU leaders want agreement on the “methodology” for the calculation among several conditions for opening the talks on a future free trade deal that Britain is seeking.

As Reuters adds, Brexit negotiating leaders hope that agreement could be reached by December. However, concern is rising in Brussels that talks might collapse as the rhetoric from both sides intensifies and British Prime Minister Theresa May fights a snap election she called last month, increasing the possibility of Britain leaving in a legal limbo in March 2019 that would be damaging all round. European Commission President Jean-Claude Juncker was quoted as saying after a dinner with May last week that he saw a major risk of failure as the two sides were so far apart.

* * *

Markets reacted negatively to the latest row, and the pound fell against the dollar amid signs that negotiations for Britain’s exit from the European Union have got off to a rocky start.

Sterling first fell after The Times reported that U.K. PM Theresa May has been told she will be prevented from joining discussions at future EU heads of state meetings. The pressure was increased after David Davis threatened to walk away from the bloc without a deal if provoked, while – as noted above – flatly rejecting the reported €100 billion exit bill.

As Bloomberg notes, reports added to the already fractious public atmosphere surrounding the talks following leaked details of a dinner meeting between May and European Commission President Jean-Claude Juncker, which alleged the latter was shocked by the Prime Minister’s approach

May vowed on Tuesday she wouldn’t be pushed about, saying that Juncker is learning she can be “bloody difficult.” While that may not bode well for the coming negotiations, it won’t necessarily hurt May’s chances as she seeks re-election on June 8 in a campaign defined by Brexit.

“I am quite negative on the pound,” said Richard Falkenhall, a strategist at SEB AB in Stockholm. “There are several parts in the negotiations which to me seem very tricky to find solutions on.”

In recent days the pound soared despite mixed economic data out of the UK as a record number of sterling shorts rushed to cover their position. That technical pressure may now be largely over.

“This sort of political uncertainty will continue to be reflected in sterling going forward, and on top of that you have to add the signs we have seen since the beginning of the year, where you’re seeing slower growth in the U.K.” Falkenall said. “What you will end up with toward the second half of the year is the situation where you have the political uncertainty having a negative impact on capital spending in the U.K. and on top of that you have growth slowdown from more cautious consumers. That sort of mix is not very positive for sterling”

As a result, GBPUSD fell 0.2% to 1.2910, having earlier weakened 0.4%.

Finally, here is Mint’s Bill Blain on the overnight row:

I can just imagine Junker and Barnier asking for Euro 100 bln with their little fingers in the corner of their mouths – just like twin Dr Evils. They can ask. What they get is the question….

I for one am shooting them a hard stare and the most violent gesture we Brits can make… a slightly raised eyebrow. (Forget Dodgy Davis immediately declaring war on Europe this morning…. he’s an excitable boy, they all say.)

Do you think the EU is trying to wind us up? Perhaps. The mindset revealed over recent days confirms the EU’s leadership default is to punish. These perfidious Brits can be cowed into apologising for their temerity at even daring to think we could leave Europe. Is the goal to bring us back crawling to Brussels in supplication for re-admittance?

Hmm. I suspect these bally foreigners haven’t been reading their history books. I would remind them: Nemo Me Impune Lacessit! and the rest..

I am conflicted on Europe. I don’t particularly want to leave – I love Europe and Europeans. I reject the underswell of racism and demands for border controls and immigration limits. But, I’m not convinced there is any point staying in an economically unfeasible Europe, becoming part of a damaging currency experiment, nor in becoming part of a single European polity. I’m quite happy to remain a Scotsman first, British second and associate European somewhere down the list.

I’m perfectly willing to support Europe becoming a homogenous political unity. I’m utterly convinced it will be our largest and most important trading partner – but that doesn’t mean we have to be part of it – just close to it.

But the EU leadership aren’t thinking that way. They fear, maybe rightly, if one country walks away, maybe others will.

Many writers are looking for historical parallels. The one that frightens me is America in 1860. Maybe that sounds like hyperbole… but..

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP