– Why Seven Million Student Loan Defaulters Are In A Standoff With Uncle Sam:

As the 2016 election cycle heats up, we suspect the debate over student loan forgiveness will become an ever bigger issue with the Hillary camp looking to woo young voters that aren’t quite as “enthusiastic” about her Presidency as they were about Obama’s. We also suspect that students, helpless “victims” of predatory lenders looking to give them $200,000 to pursue their dreams of becoming anthropologists while consuming copious amount of free beer at frat parties, will grow increasingly vocal in asking why the Nanny State would have given them so much money to pursue non-existent “careers”.

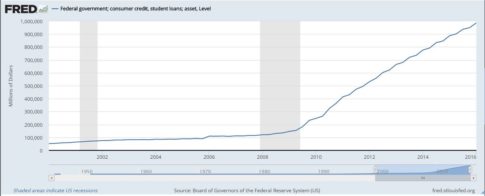

To put the student loan issue into perspective, there is roughly $1.3 trillion of student loans outstanding to 43mm Americans, an average balance of $30k per student. Roughly 16% of borrowers are currently in long-term default with outstanding balances totaling $125 billion, or an average balance of $18k per student.

To our point above, the Wall Street Journal recently recounted the story of Jason Osborne and his wife, a Medford, Oregon couple, who took out $46,500 in student loans to take classes at Abdill Career College to become phlebotomists. After completing their studies the couple said they couldn’t find steady work in the healthcare industry had to look elsewhere. Mr. Osborne now makes $13 an hour in selling solar panels and his wife works as a maid. The couple is now asking why the government would loan them so much money to pursue a career with such limited opportunity?

“The government should have never extended [us] so much debt for jobs that are in low demand.”

“Do you think I’m going to give them one penny I’m making to pay back the loan for a job I’m never going to hold?”

Well we guess that’s one way to look at it.

In another example, Illinois resident Jim Lopko, 36, racked up an astounding $122,000 of student loans but just has an associate degree to show for it after dropping out of a bachelor’s program in 2009. Mr. Lopko, who lives in a Chicago suburb, now earns $32,000 a year as a customer-service agent for an Illinois manufacturer. He says he tries to be frugal but admits he occasionally splurges. He recently upgraded to a one-bedroom apartment from a studio and took out a loan for a brand new Subaru WRX that carries a $445 monthly payment, saying:

“Are you supposed to stay in inside all the time, never go out, and pay these loans?”

No, Mr. Lopko, it would be crazy to penalize you alone for your personal decisions. We feel your pain and see no better option than an to hastily socialize your “stellar” financial decision making.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP