Having purged virtually all of his domestic political enemies, it will probably not come as a surprise the head of research as well as the chief strategist at one of Turkey’s largest brokerages was stripped of his professional license and is facing criminal charges over a report analyzing the impact of the July 15 coup attempt, marking the first expansion of the president’s unprecedented crackdown on the nation’s private financial sector.

According to Bloomberg, the Capital Markets Board published a decision in which it said the strategist, Mert Ulker, failed to “fulfill his responsibilities” in the preparation and publication of a July 18 report produced by Ak Investment, the brokerage arm of Turkey’s second-largest bank. Ulker also faces charges under articles 299 and 301 of the penal code, which make insulting Turkey’s president, the nation or its institutions a crime. The CMB license is required to work in capital markets in Turkey. The statement didn’t say whether Ak Investment’s status was affected.

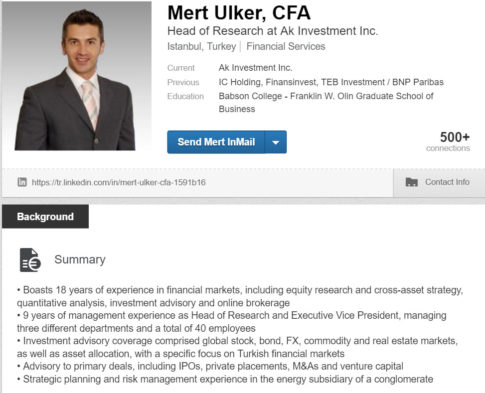

Mert’s LinkedIn profile is shown below.

- Head of Research at Ak Investment

- Boasts 18 years of experience in financial markets, including equity research and cross-asset strategy, quantitative analysis, investment advisory and online brokerage

- 9 years of management experience as Head of Research and Executive Vice President, managing three different departments and a total of 40 employees

- Investment advisory coverage comprised global stock, bond, FX, commodity and real estate markets, as well as asset allocation, with a specific focus on Turkish financial markets

- Advisory to primary deals, including IPOs, private placements, M&As and venture capital

- Strategic planning and risk management experience in the energy subsidiary of a conglomerate

Ulker is the first financial analyst to have his license revoked amid a purge of tens of thousands of bureaucrats, educators and security-forces personnel in the wake of the failed attempt by a faction of Turkey’s military to overthrow Erdogan’s government 12 days ago. Turkish regulators have been requesting that banks hand over their analysis of the putsch, with Mehmet Ali Akben, head of the banking regulator, saying on July 21 that it disapproved of the publication of “reports that would turn expectations and the atmosphere negative.”

What did Ulker say that so displeased Erdogan? Did he ref out an excel model? Or did he overwrite a spreadheet with “paste values“? Or, gasp, use a mouse with Excel?

As Bloomberg adds, in a 2,750-word report published on the Monday after coup, Ak Investment summarized the most recent developments and offered forecasts for the Turkish lira, the stock market and the impact on the economy: in other words it merely did what every other professional and armchair analyst in the world has done over the past two weeks. It also analyzed the likely trajectory of Turkish politics, saying the developments had “resulted in more power being concentrated in President Erdogan’s hands.”

Again, hardly a controversial statement.

However, one segment that certainly enraged Turkey’s new authoritarian despot is the one exposing the truth. One section of the report outlined various explanations of who was behind the coup, addressing speculation that it could have been a so-called false flag operation “stage-managed to give President Erdogan an opportunity to purge the military of opponents and extend his grip on Turkey.” Even so, it downplayed that explanation as not being the most “rational” possibility. Erdogan holds Fethullah Gulen, an Islamic preacher based in the U.S., responsible for the coup attempt and is seeking his extradition for trial in Turkey. Meanwhile, Gulen has accused Erdogan of staging the coup himself to, you guessed it, concentrated more power in Erdogan’s hands.

Needless to say, this is an absolute outrage… which is why not a single ‘democratic’ nation will speak up.

When Bloomberg tried to get a statement from the Turkish CMB, the agency declined to comment referring to the bulletin.

“Mert Ulker’s contract with Ak Investment has been canceled as of July 25, Monday and since then he is no longer an employee,” said Mert Erdogmus, chief executive officer of Ak Investment, in a telephone interview on Wednesday.

And just like that Turkey officially joined the ranks of the world’s most repressed banana republics, or as Bloomberg puts it more tactfully, “government censorship is an inevitable reality for doing business in many emerging markets. Chinese authorities have installed the “Great Firewall” online and pay millions of people to monitor content that is critical of the government. And in Argentina, former President Cristina Fernandez ordered a crackdown on independent inflation estimates ahead of her 2011 re-election bid.”

The chilling effect of Erdogan’s crackdown on financial analysis is set to spread like wildfire. According to Bloomberg, some brokerages with operations in Turkey are scaling back their commentary in the wake of the coup attempt. At least five brokerages, which cited regulator requests for their research as well as investigations into their e-mail traffic, declined to comment to Bloomberg this week.

Needless to say, Erdogan’s decision will backfire dramatically as no foreign investors will have any faith in Turkey’s economic data or analysis going forward.

The regulator’s ruling institutionalizes self-censorship that was already widespread in Turkey and will undermine the credibility of the nation’s brokerages, according to Nathan Griffiths, who helps oversee about $1.1 billion as a senior money manager at NN Investment Partners in The Hague.

“In practical terms, it means I have little interest in reading research from local brokers because they are effectively unable to offer balanced commentary,” Griffiths said. “It’s terrible for the integrity of the Turkish brokerage community.”

Others agreed. “Punishing analysts is likely to backfire”, according to Ghanem Nuseibeh, the founder of London-based risk consulting firm Cornerstone Global Associates. “Everything that comes out of Turkey will now be taken with a pinch of salt. If this environment persists, Turkey will reach a point where confidence in its financial sector and economy will crumble, as far as foreign investors are concerned.”

Not only will the environment persist, but it is set to get far worse.

Unless of course, Erdogan realizes that the real way to manipulate data is not by brute force and repression, as he did in this case, but the way the US does it: by incentivizing analysts with fatter paychecks but only if they write bullish reports. As for the preferred data manipulation mechanism of choice, Turkey should simply adopt what the US Department of Commerce has gotten so good at when the underlying data is ugly: use seasonal adjustments. Lots of seasonal adjustments.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP