– UK PM Cameron Goes M.A.D. As Brexit Odds Hit Record High:

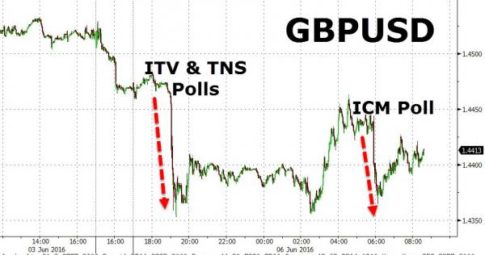

Following the two polls overnight pointing to a significant lead for “leave” over “remain” in the Brexit vote, as we noted, cable tumbled and volatility premia spiked as Brexit odds surge to their highest yet. This pushed UK PM David Cameron into full panic mode, explaining that “we’re not scaremongering,” Cameron then said during an interview that Brexit would put a “bomb under our economy, and the worst thing is, we’d have lit the fuse ourselves.”

Vocal Brexit supporter, Boris Johnson warned today about the “triple whammy of woe” if Britain votes to remain…

“The risks of remain are massive. Not only do we hand over more than £350 million a week to the EU, but if we vote to stay the British people will be on the hook for even more cash.

It is a triple whammy of woe: the eurozone is being strangled by stagnation, unemployment and a lack of growth, it could explode at any time and we will be forced to bail it out.

“The botched bureaucratic response to the migration crisis means the Eurocrats are demanding even more of our money. And now we find that there is a £20 billion black hole in the EU’s finances.“

Brexit support has never been higher…

And cable has retested the lows of the cycle…

“Today’s move was a function of reality sinking in for overseas investors — the referendum will be a close outcome,” said Viraj Patel, a foreign-exchange strategist at ING Groep NV in London. “We’re probably seeing some of those long post-Brexit pound bets unwind.”

It appears even the bankers are starting to realize this event will be chaos… as Bloomberg notes, U.K. politicians won’t be the only ones settling in for a long night as the polls close on June 23.

JPMorgan Chase & Co., Royal Bank of Scotland Group Plc, Morgan Stanley and Lloyds Banking Group Plc are among banks in London who plan to keep traders overnight to monitor the markets and handle client trades as results of the referendum on European Union membership trickle in, people with knowledge of the plans said. Currency traders, whose market stays open 24 hours, are among those most likely to remain in the office as they grapple with moves in the pound that have grown more volatile as the vote approaches.

Ironically, while senior bankers have warned that Brexit could reduce their numbers in the City of London, trading volumes around the vote may serve as a boon for struggling securities units. Currency trading revenue at the biggest investment banks fell 32 percent from a year earlier in the first quarter, part of a broader 28 percent drop in fixed-income revenue, according to Coalition Development Ltd.

“A volatile June driven by uncertainty around the U.K.’s EU referendum vote could help foreign-exchange revenues,” offsetting the normal seasonal slowdown, Kian Abouhossein, a bank analyst at JPMorgan, said in a note Monday.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP