– Chart Of The Quarter: Nothing Else Matters:

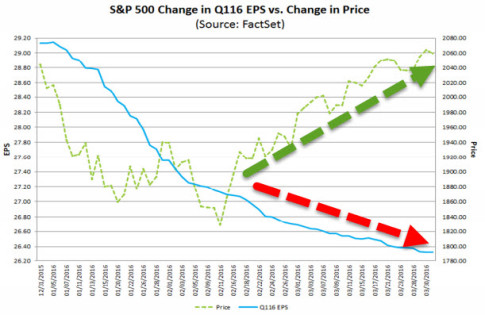

US equity markets rebounded by the greatest amount ever in Q1 to end the quarter with a “keep the dream alive” positive return. This ‘central-bank’-sponsored bounce occurred as S&P 500 earnings expectations plunged 9.6% – the biggest quarterly collapse since Q1 2009. As FactSet details,

During the first quarter, analysts lowered earnings estimates for companies in the S&P 500 for the quarter. The Q1 bottom-up EPS estimate (which is an aggregation of the estimates for all the companies in the index) dropped by 9.6% (to $26.32 from $29.13) during this period. How significant is a 9.6% decline in the bottom-up EPS estimate during a quarter? How does this decrease compare to recent quarters?

During the past year (4 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 4.4%. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 4.0%. During the past ten years, (40 quarters), the average decline in the bottom-up EPS estimate during a quarter has been 5.3%. Thus, the decline in the bottom-up EPS estimate recorded during the first quarter was larger than the 1-year, 5-year, and 10-year averages.

In fact, this was the largest percentage decline in the bottom-up EPS estimate during a quarter since Q1 2009 (-26.9%).

At the sector level, nine of the ten sectors recorded a percentage decline in the bottom-up EPS estimate for the first quarter that was larger than the 5-year average for that sector. Six of the ten sectors recorded a percentage decline in the bottom-up EPS estimate for the first quarter that was larger than the 10-year average for that sector.

As the bottom-up EPS estimate for the index declined during the quarter, the value of the S&P 500 increased during this same time frame. From December 31 through March 31, the value of the index increased by 0.8% (to 2059.74 from 2043.94). This quarter marked the 10th time in the past 12 quarters in which the bottom-up EPS estimate decreased during the quarter while the value of the index increased during the quarter.

What doe this idiocy look like?

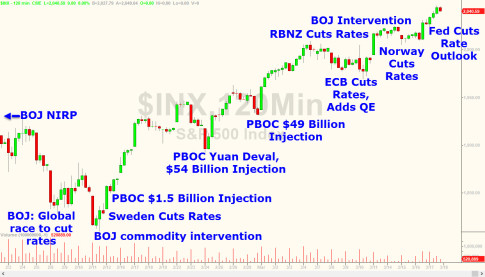

And all it took was the coordinated easing from most of the world’s largest central banks…

It’s not the first time Central Banks have lifted stocks away from reality…

Simply put, nothing else matters.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP