YES!!!

And it has only just begun.

– Is This The Biggest Crisis In History?:

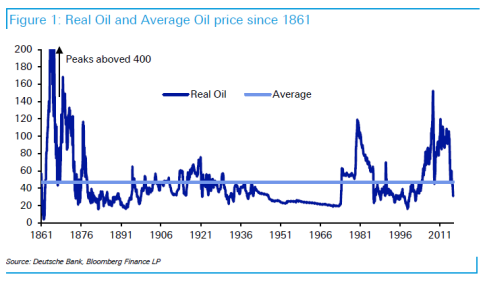

Talking of Oil and Gold, last week Deutsche Bank showed a long-term graph of Oil in real adjusted terms, showing that the average real price since 1861 was $47.

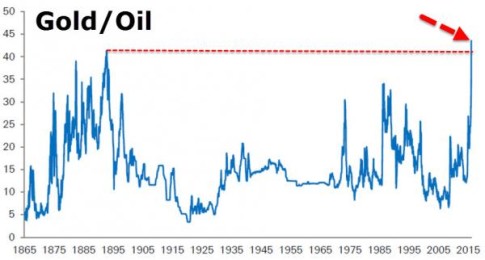

Following on from that, Deutsche notes one ratio they occasionally look at is the ratio of various assets to the price of Gold…

Today we update the Oil/Gold ratio back to 1865 and find that the Gold price has just hit an all time high at around 44 times the price of Oil.

The previous high of 41 in 1892 has just been exceeded.

For perspective, the ratio was at 6.6 in June 2008 and only 12 in May 2014. The long-term average is 15.5. While this says nothing about where the ratio is going in the short-term surely this looks a good trade to exploit over the longer-term for those who care about such things.

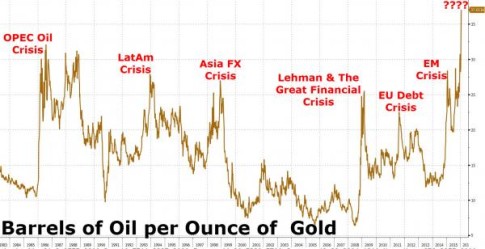

However, as we noted recently, it merely predicts a crisis and according to the chart above it is the biggest crisis in history…

The previous “biggest crisis in history” was in 1893 when a serious economic depresion hit America. We just topped that in terms of the gold/oil “crisis” ratio, making us wonder: what crisis is just around the corner, and just how big will it be?