– After Crashing, Deutsche Bank Is Forced To Issue Statement Defending Its Liquidity:

The echoes of both Bear and Lehman are growing louder with every passing day.

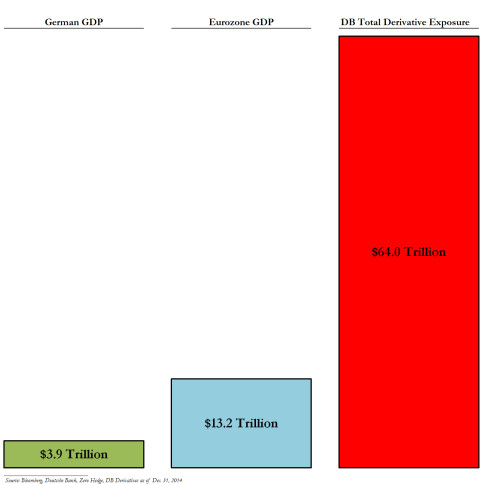

Just hours after Deutsche Bank stock crashed by 10% to levels not seen since the financial crisis, the German behemoth with over $50 trillion in gross notional derivative found itself in the very deja vuish, not to mention unpleasant, situation of having to defend its liquidity and specifically assuring investors that it has enough cash (about €1 billion in 2016 payment capacity), to pay the €350 million in maturing Tier 1 coupons due in April, which among many other reasons have seen billions in value wiped out from both DB’s stock price and its contingent convertible bonds which are looking increasingly more like equity with every passing day.

DB did not stop there, but also laid out that for 2017 it was about €4.3BN in payment capacity, however before the impact of 2016 results, which if recent record loss history is any indication, will severely reduce the full cash capacity of the German bank.

From the just issued press release:

Ad-hoc: Deutsche Bank publishes updated information about AT1 payment capacity

Frankfurt am Main, 8 February 2016 – Today Deutsche Bank published updated information related to its 2016 and 2017 payment capacity for Additional Tier 1 (AT1) coupons based on preliminary and unaudited figures.

The 2016 payment capacity is estimated to be approximately EUR 1 billion, sufficient to pay AT1 coupons of approximately EUR 0.35 billion on 30 April 2016.

The estimated pro-forma 2017 payment capacity is approximately EUR 4.3 billion before impact from 2016 operating results. This is driven in part by an expected positive impact of approximately EUR 1.6 billion from the completion of the sale of 19.99% stake in Hua Xia Bank and further HGB 340e/g reserves of approximately EUR 1.9 billion available to offset future losses.

The final AT1 payment capacity will depend on 2016 operating results under German GAAP (HGB) and movements in other reserves.

The updated information in question:

As a reminder, the last time serious “developed market” banks had to publicly defend their liquidity, the result was a multi-trillion taxpayer bailout.

However, there is probably some time before that happens: first German regulator Bafin will likely ban short selling in Deutsche Bank shares. That always is the first step in the endgame.

For now, however, the market is no longer asking questions but merely selling: Deutsche CDS has entered the dreaded “viagra” formation at 245 bps and going vertical.

Whenever we are getting the next full blown financial crisis and economic collapse, we are only months away from WW3.

WW3 will start at the end of July, beginning of August (= grain harvest time in the area of one of the best and accurate seers ever), but in the months before that we should see a financial collapse, hyperinflation, revolution and civil war.

Hyperinflation, Paris burning, the Pope fleeing the Vatican, a lot of new taxes are the signs to watch, which will just occur shortly before WW3.

All of this has been planned for us by TPTB.

Ever since this Rothschild puppet and Bilderberg bastard left Deutsche I’ve put it on my watchlist: