– Update on Bundesbank Gold Repatriation 2015:

Deutsche Bundesbank has just released a progress report on its gold bar repatriation programme for 2015 – “Frankfurt becomes Bundesbank’s largest gold storage location“.

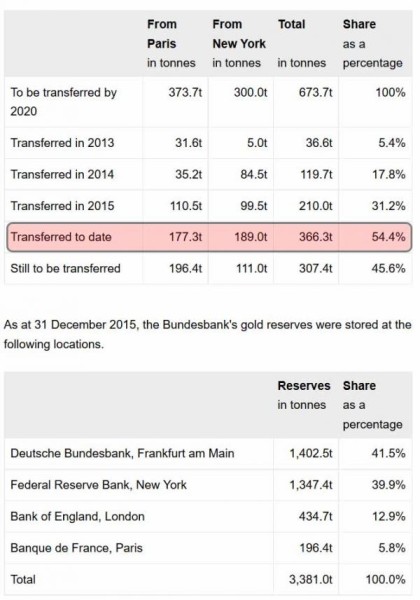

During the calendar year to December 2015, the Bundesbank claims to

have transported 210 tonnes of gold back to Frankfurt, moving circa 110

tonnes from Paris to Frankfurt, and just under 100 tonnes from New York

to Frankfurt.As a reminder, the Bundesbank is engaged in an unusual multi-year

repatriation programme to transport 300 tonnes of gold back to Frankfurt

from the vaults of the Federal Reserve Bank of New York (FRBNY), and

simultaneously to bring back 374 tonnes of gold back to Frankfurt from

the vaults of the Banque de France in Paris. This programme began in

2013 and is scheduled to complete by 2020. I use the word ‘unusual’

because the Bundesbank could technically transport all 674 tonnes of

this gold back to Frankfurt in a few weeks or less if it really wanted

to, so there are undoubtedly some unpublished limitations as to why the

German central bank has not yet done so.

Given the latest update from the German central bank today, the

geographic distribution of the Bundesbank gold reserves is now as

follows, with the largest share of the German gold now being stored

domestically:

- 1,347.4 tonnes, or 39.9%, stored in New York;

- 196.4 tonnes, or 5.8%, stored in Paris;

- 434.7 tonnes or 12.9% stored at the Bank of England vaults in London;

- 1402.5 tonnes, or 41.5% now stored domestically by the Bundesbank at its storage vaults in Frankfurt, Germany

In January 2013, prior to the commencement of the programme, the

geographical distribution of the Bundesbank gold reserves was 1,536

tonnes or 45% at the FRBNY, 374 tonnes or 11%, at the Banque de France,

445 tonnes or 13% at the Bank of England, and 1036 tonnes or 31% in

Frankfurt.The latest moves now mean that over 3 years from January 2013 to

December 2015, the Bundesbank has retrieved 366 tonnes of gold back to

home soil (189 tonnes from New York (5 tonnes in 2013, 85 tonnes in

2014, and between 99-100 tonnes in 2015), as well as 177 tonnes from

Paris (32 tonnes in 2013, 35 tonnes in 2014, and 110 tonnes in 2015).

The latest transfers still leave 110 tonnes of gold to shift out of New

York in the future and 196.4 tonnes to move the short distance from

Paris to Frankfurt.In the first year of operation of the repatriation scheme during

2013, the Bundesbank transferred a meagre 37 tonnes of gold in total to

Frankfurt, of which a tiny 5 tonnes came from the FRBNY and only 32

tonnes from Paris. Whatever those excessive limitations were in 2013,

they don’t appear to be so constraining now. In 2014, 85 tonnes were let

out of the FRBNY and 35 tonnes made the trip from Paris. See Koos

Jansen’s January 2015 blog titled “Germany Repatriated 120 Tonnes Of Gold In 2014” for more details on the 2014 repatriation.Those who track the “Federal Reserve Board Foreign Official Assets Held at Federal Reserve Banks” foreign earmarked gold table

may notice that between January 2015 and November 2015 , circa 4

million ounces, or 124 tonnes of gold, were withdrawn from FRB gold

vaults. Given that the Bundesbank claims to have moved 110 tonnes from

New York during 2015, this implies that there were also other

non-Bundesbank withdrawals from the FRB during 2015. Unless of course

other gold was withdrawn from the FRB, shipped to Paris, and then became

part of the Paris withdrawals for the account of the Bundesbank. The

FRB will again update its foreign earmarked gold holdings table this

week with December 2015 withdrawals (if any) which may show an even

larger non-Bundesbank gold delta for year-end 2015.Notably, the latest press release today does not mention whether any

of the gold withdrawn from the FRBNY was melted down / recast into Good

Delivery bars. Some readers will recall that the Bundesbank’s updates

for 2013 and 2014 did refer to such remelting/recasting events.Today’s press release does however include some ‘assurances’ from the

Bundesbank about the authenticity and quality of the returned bars:“The Bundesbank assures the identity

and authenticity of German gold reserves throughout the transfer process

– from when they are removed from the storage locations abroad until

they are stored in Frankfurt am Main. Once they arrive in Frankfurt am

Main, all the transferred gold bars are thoroughly and exhaustively

inspected and verified by the Bundesbank. When all the inspections of

transfers to date had been concluded, no irregularities came to light

with regard to the authenticity, fineness and weight of the bars.”But why the need to for such a general comment on the quality of the

bars while not providing any real details of the bars transferred, their

serial numbers, their refiner brands, or their years of manufacture?

Perhaps remelting/recasting of bars was undertaken during 2015 and the

Bundesbank is now opting for the cautious approach after getting some

awkward questions last year about these topics – i.e. the Bundesbank’s

approach may well be “don’t mention recasting / remelting and maybe no

one will ask”.

Limited Hangout

This bring us to an important point. Beyond the Bundesbank’s

hype, its important to note that the repatriation information in all of

the press releases and updates from the Bundesbank since 2013 has

excluded most of the critical information about the actual gold bars

being moved. So, for example, in this latest update concerning the 2015

transport operations, there is no complete bar list (weight list) of the

bars repatriated, no explanation of the quality of gold transferred and

whether bars of various purities were involved, no comment on whether

any bars had to be re-melted and recast, no indication of which

refineries, if any, were used, and no explanation of why it takes a

projected 7 years to bring back 300 tonnes of gold that could be flown

from New York to Frankfurt in a week using a few C-130 US transporter

carriers.There is also no explanation from the Bundesbank as to why these 100

tonnes of gold were available from New York in 2015 but not available

during 2014 or 2013, nor why 110 tonnes of gold somehow became available

in Paris during 2015 when these bars were not available in 2014 or

2013.The crucial questions to ask in my view are where the repatriated

gold that has so far been supplied to the Bundesbank from New York and

Paris has been sourced from, what were the refiner brands and years of

manufacture for the bars, what was the quality (fineness) of the gold,

and are these bars the same bars that the Bundesbank purchased when it

accumulated its large stock of gold bars during the 1950s and especially

the 1960s.In essence, all of these updates from Frankfurt could be termed

‘limited hangouts’, a term used in the intelligence community, whereby

the real behind the scenes details are left unmentioned, and questions

about the real information is invariably left unasked by the mainstream

media. Overall, it’s important to realise that the Bundesbank’s

repatriation updates, press releases, and interviews since 2013 are

carefully stage-managed, and that the German central bank continually

dodges genuine but simple questions about its gold reserves and the

physical gold that is being transported back to Frankfurt.For example, in October 2015, the Bundesbank released a partial

inventory bar list/weight list of it gold holdings. At that time, on 8

October 2015, I asked the Bundesbank:Hello Bundesbank Press Office,

Regarding the gold bar list published by the Bundesbank yesterday (07 October https://www.bundesbank.de/Redaktion/EN/Topics/2015/2015_10_07_gold.html), could

the Bundesbank clarify why the published bar list does not include,for

each bar, the refiner brand, the bar refinery serial number, and the

year of manufacture, as per the normal convention for gold bar weight

lists, and as per the requirements of London Good Delivery (LGD) gold

bars?Bundesbank bar list:https://www.bundesbank.de/Redaktion/EN/Downloads/Topics/2015_10_07_gold.pdf?__blob=publicationFile

From the London Good Delivery Rules, the following attributes are required on LGD bars http://www.lbma.org.uk/good-delivery-rules

“Marks:

Serial number (see additional comments in section 7 of the GDL Rules)

Assay stamp of refiner

Fineness (to four significant figures)

Year of manufacture (see additional comments in section 7 of the GDL Rules)”

“The marks should include

the stamp of the refiner (which, if necessary for clear identification,

should include its location), the assay mark (where used), the fineness,

the serial number (which must not comprise of more than eleven

digits or characters) and the year of manufacture as a four digit

number unless incorporated as the first four digits in the bar number.

If bar numbers are to be reused each year, then it is strongly

recommended that the year of production is shown as the first four

digits of the bar number although a separate four digit year stamp may

be used in addition. If bar numbers are not to be recycled each year

then the year of production must be shown as a separate four digit number.”http://www.lbma.org.uk/assets/market/gdl/GD_Rules_15_Final.pdfBest Regards, Ronan Manly

The Bundesbank actually sent back two similar replies to the above email:

Answer 1:

“Dear Mr Manly,

Thank you for your query. Information

on the refiner and year of production are not relevant for storage or

accounting purposes, which require the weight data, the fineness and a

unique number identifying each bar or melt. The Bundesbank has all of this information for each of its gold bars. By contrast, particulars relating to the refiner and year of production merely provide supplementary information. They tell us part of the gold bar’s history but do not describe its entire ‘life cycle’.”Yours sincerely,

DEUTSCHE BUNDESBANK Communication

Answer 2:

“Dear Mr Manly,

The crucial data for storage and

accounting purposes are the weight, the fineness and a unique number

identifying each bar or melt. The Bundesbank has all of this information

for each of its gold bars, which it records electronically and also

makes available to the public. In addition to the data on weight and

fineness, the Bundesbank, the Bank of England and the Banque de France

identify gold bars exclusively on the basis of internally assigned

inventory numbers and not using the serial numbers provided by the

refiners. These custodians do not classify the bar numbers stamped onto

the gold bars by the refiner as individual inventory criteria. They do

not use the refiner’s bar numbers as these are not based on a unique

numbering system that can be used for identification purposes. Stating

the refiner and the year of production is not required for storage or

accounting purposes.”

Yours sincerely,

DEUTSCHE BUNDESBANK Communication

Even the large gold ETFs produce detailed weight lists of their bar

holdings, so you can see from the above answers that the Bundesbank is

resorting to flimsy excuses in its inability to explain why it is not

following standard practice across the gold industry.For additional Bundesbank’s prevarications on its gold bars, please see my blog “The Keys to the Gold Vaults at the New York Fed – Part 3: ‘Coin Bars’, ‘Melts’ and the Bundesbank” in a section titled “The Curious Case of the German Bundesbank”.

Finally, see BullionStar guest post from 8 October 2015 by Peter Boehringer, founder of the ‘Repatriate our Gold’ campaign – “Guest Post: 47 years after 1968, Bundesbank STILL fails to deliver a gold bar number list“.

This guest post adeptly takes apart the Deutsche Bundesbank’s

stage-managed communication strategy in and around its gold repatriation

exercise, and asks the serious questions that the mainstream media fear

to ask.