You can’t make this stuff up.

– Buiter: Only “Helicopter Money” Can Save The World From The Next Recession (ZeroHedge, Sep 9, 2015):

It is to be expected that economists – even economists working for the same team – have different views about the likelihood of different future outcomes. Economics isn’t rocket science, and even rockets frequently land in the wrong place or explode in mid-air.

That rather hilarious characterization of the pseudoscience that is economics comes from the desk of Citi’s Chief Economist Willem Buiter and it’s apparently evidence that even if you don’t think too much of his views on “pet rocks” (gold is a 6,000 year-old bubble) or on the efficacy and/or utility of physical banknotes (ban cash), you’d be hard pressed to disagree with him when it comes to critiquing his profession. Of course we don’t want to give Buiter too much credit here because the quote shown above could simply be an attempt to stamp a caveat emptor on his latest prediction in case, like his predictions on when Greece would ultimately leave the euro, it turns out to be wrong.

As tipped by comments made at the Council of Foreign Relations in New York late last month, Buiter is out with a damning look at the global economy which he says will be drug kicking and screaming into a recession by the turmoil in China and the unfolding chaos in EM. Here’s the call:

In the Global Economics team, however, we believe that a moderate global recession scenario has become the most likely global macroeconomic scenario for the next two years or so. To clarify further, the most likely scenario, in our view, for the next few years is that global real GDP growth at market exchange rates will decline steadily from here on and reach or fall below 2%.

More specifically, Buiter says the odds of some kind of recession (either mild or terrifying) are 55%. Not 54%, or 56% mind you, but exactly 55%, because as indicated by the introductory excerpt above, economic outcomes are very amenable to precise forecasting:

In our view, the probability of some kind of recession, moderate or severe, is therefore 55%. A global recession of some kind is our modal forecast. A moderate recession is our modal forecast if we decompose recession outcomes into moderate and severe ones and assign separate probabilities to them.

The culprit, as mentioned above, is China (where Citi says real GDP growth is actually somewhere in the neighborhood of 4%) and EMs more broadly which are suffering mightily in the face of sluggish Chinese demand, slumping commodity prices, and, most recently, the devaluation of the yuan:

Should China enter a recession – and with Russia and Brazil already in recession – we believe that many other EMs, already weakened, will follow, driven in part by the effects of China’s downturn on the demand for their exports and, for the commodity exporters, on commodity prices.

The main driver of global underperformance during the past two years has been EM weakness. No EM of any significant size is outperforming our forecasts since the beginning of the year or earlier; most are underperforming. Even the success stories, like India, central and eastern Europe, and to a certain extent Mexico, are not outperforming our forecasts. Brazil and Russia are in recession, and GDP growth there has turned negative. South Africa is in a recession, with output below potential and output growth below potential output growth. The most significant underperformer is China. For reasons explained earlier, we don’t think there is much point in forecasting official GDP growth. We therefore focus on our best guess as to the ‘true’ growth rate of real GDP, which, as noted earlier, is probably somewhere around 4% now.

Evidence of weakness, Buiter continues, is everywhere:

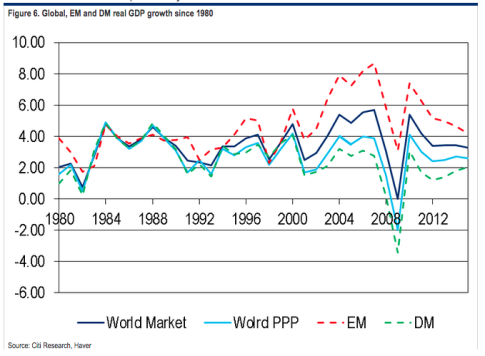

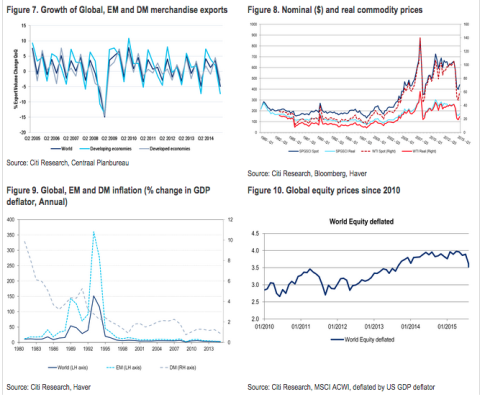

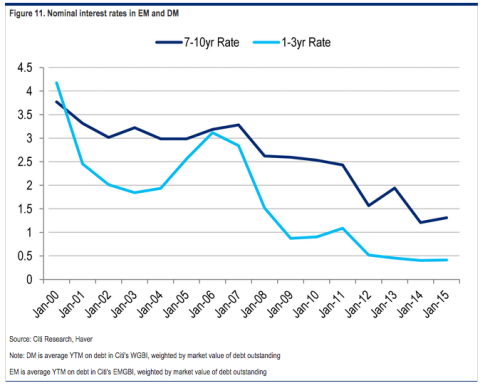

The evidence for a global slowdown is everywhere. Global growth is weakening since 2010 as is evident from Figure 6, which shows global real GDP growth since 1980 at both market and PPP exchange rates, as well as EM and DM real GDP growth at PPP exchange rates. A modest pickup in GDP growth in the DMs since 2012 is swamped by a sharp decline in EM growth. There are other informative indicators of global weakness, notably the very weak – indeed negative – world trade growth in the first half of 2015, the continued weakening of (real) commodity prices, the weakness of the global inflation rate (measured by the GDP deflator), the recent decline in global stock prices, measured by the MSCI ACWI, plus indications that corporate earnings growth is slowing down in most countries, and the unprecedented decline in nominal interest rates, shown in Figure 7 – Figure 11.

And China – the epicenter of it all – is ill-equipped to cope because, as we’ve discussed at length, the country’s many spinning plates have elicited an eye-watering array of conflicting directives and policies which are now tripping over each other at nearly every turn:

The policy response to the weakening of domestic (and external) demand in China is likely to be too little and too late. China is not a command economy or a centrally planned economy – indeed, unlike the former Soviet Union, it never was. Like most real-world economies today, it is a messy market economy of the state-capitalist/crony-capitalist variety, where policy ambitions are not matched with effective policy instruments and where macroeconomic management and financial crisis prevention and mitigation competence are in short supply.

The mishandling of the housing boom, bubble and bust, and of the latest stock market boom, bubble and bust together with the recent RMB kerfuffle don’t inspire confidence in the ability of the authorities to prevent a cyclical hard landing for China.

Finally, DM central planners are in no shape to combat the China/EM contagion because – and this will come as no surprise – they are simply out of ammunition having thrown everything in the Keynesian toolbox at their respective economies in the post-crisis years with limited (and swiftly diminishing) returns:

Most advanced economies are, as regards countercyclical policy ammunition, in the position that either they don’t have very much of it or are unwilling and/or unable (because of domestic or external political constraints) to use what ammunition they have.

Expansionary monetary policy in the US, the UK, the Eurozone, Japan and most smaller advanced economies is operating in the zone of severely diminishing returns.

As you might have guessed, Buiter thinks there’s only one way out of this: helicopter money.

And not just in the US, but in Europe (against the protestations of what Buiter calls the “Teutonic fringe”) and indeed across all DMs and also in China.

Helicopter money drops would be the best instrument to tackle a downturn in all DMs.

In the Eurozone, a significant Teutonic fringe believe that a fiscal stimulus is contractionary and that monetization of public debt and deficits is a sure road to hyperinflation. It is a widely held view that Article 123 of the Treaty on the Functioning of the European Union forbids monetization of public debt and thus makes a helicopter money drop in the Eurozone impossible. Debt-financed (non-monetised) fiscal expansions run into the twin obstacles of an already excessive public debt in most Eurozone member states and the pro-cyclical nature of the constraints imposed by the Stability and Growth Pact and its myriad offspring, operated out of Brussels.

In the US, the fiscal stance is, from a cyclical perspective, not unlike a clock that is halted and points at the right time only twice a day. Fortunately, today is one of these times. Should the country need a fiscal stimulus (or indeed a fiscal contraction), it is in our view highly unlikely that the Congressional gridlock could be overcome sufficiently to do what is necessary when it is necessary. So as regards countercyclical policy, the US, like the Eurozone, has to rely on progressively less effective monetary stimulus alone.

The fiscal position of the Japanese sovereign is by far the worst of any large advanced country, despite its large stock of foreign exchange reserves and the positive net foreign investment position of Japan as a whole. Only a permanently monetised fiscal stimulus would be feasible if the markets were to wake from their decades-long slumber and wonder whether, and how, the Japanese sovereign can reach the shores of solvency without inflating its debt away.

Fiscal policy can undoubtedly come to the rescue and prevent a recession in China. But what is needed is not another dose of the familiar post-2008 fiscal medicine: heavy-lifting capital expenditure on infrastructure with dubious financial and social returns, and capital expenditure by SOEs that are already struggling with excess capacity, all funded, as if these were commercially viable ventures, through the banking or shadow banking sectors. As regards funding the fiscal stimulus, only the central government has the deep pockets to do this on any significant scale. The first-best would be for the central government to issue bonds to fund this fiscal stimulus and for the PBOC to buy them and either hold them forever or cancel them, with the PBOC monetizing these Treasury bond purchases. Such a ‘helicopter money drop’ is fiscally, financially and macro-economically prudent in current circumstances, with inflation well below target and likely to fall further.

So basically, these central banks which Buiter just admitted are already “operating in the zone of severely diminishing returns,” should not only do more of the same, but a lot more of the same and in fact, they should all dive head first into the Keynesian abyss by simultaneously cranking the knob on their respective printing presses to the max:

We expect to see QE #N, where N could become a large integer, as part of the monetary policy response in the US and the UK, and QEE2 in Japan. The ECB will likely have to continue its asset purchases beyond September 2016 and it may cut its policy rates further. All this will not be enough to prevent most advanced economies from performing worse in 2016 and 2017 than in 2015, and worse than our current forecasts for the next two years.

There you have it. “QE#N where N could become a large integer”, and paradoxically, by not normalizing policy when it had the chance, the Fed has now made this inevitable because as we’ve shown, tightening into an EM FX reserve drawdown will only exacerbate said drawdown making an embarrassing about-face by the FOMC a foregone conclusion. In other words, this is game over. We’ve entered the monetary Twilight Zone where the only way to keep the increasingly wobbly house of cards standing is to continue to monetize everything that’s monetizable and when we hit the limit we must then move to issue more debt for the sole purpose of monetizing it and immediately canceling it.

But as Buiter noted at the outset, these are all just the musings of a pseudo-scientist, who, by the very nature of his profession, is prone to making predictions that, much like the Fed’s “liftoff”, are just as likely to “explode in mid-air” as not.