– The IMF Just Confirmed The Nightmare Scenario For Central Banks Is Now In Play (ZeroHedge, Sep 4, 2015):

The most important piece of news announced today was also, as usually happens, the most underreported: it had nothing to do with US jobs, with the Fed’s hiking intentions, with China, or even the ongoing “1998-style” carnage in emerging markets. Instead, it was the admission by ECB governing council member Ewald Nowotny that what we said about the ECB hitting a supply brick wall, was right. Specifically, earlier today Bloomberg quoted the Austrian central banker that the ECB asset-backed securities purchasing program “hasn’t been as successful as we’d hoped.”

Why? “It’s simply because they are running out. There are simply too few of these structured products out there.”

So six months later, the ECB begrudgingly admitted what we said in March 2015, in “A Complete Preview Of Q€ — And Why It Will Fail“, was correct. Namely this:

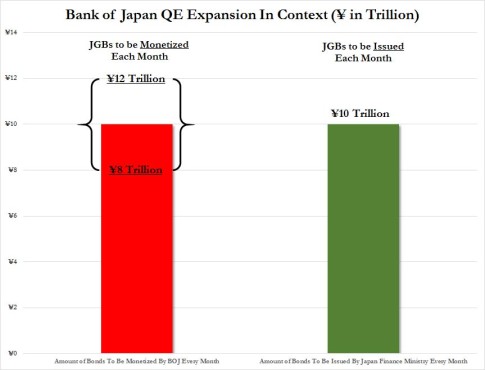

… the ECB is monetizing over half of gross issuance (and more than twice net issuance) and a cool 12% of eurozone GDP. The latter figure there could easily rise if GDP contracts and Q€ is expanded, a scenario which should certainly not be ruled out given Europe’s fragile economic situation and expectations for the ECB to remain accommodative for the foreseeable future. In fact, the market is already talking about the likelihood that the program will be expanded/extended.

… while we hate to beat a dead horse, the sheer lunacy of a bond buying program that is only constrained by the fact that there simply aren’t enough bonds to buy, cannot possibly be overstated.

Among the program’s many inherent absurdities are the glaring disparity between the size of the program and the amount of net euro fixed income issuance and the more nuanced fact that the effects of previous ECB easing efforts virtually ensure that Q€ cannot succeed.

(Actually, we said all of the above first all the way back in 2012, but that’s irrelevant.)

So aside from the ECB officially admitting that it has become supply*constrained even with security prices at near all time highs, why is this so critical?

Readers will recall that just yesterday we explained why “Suddenly The Bank Of Japan Has An Unexpected Problem On Its Hands” in which we quoted BofA a rates strategist who said that “now that GPIF’s selling has finished, the focus will be on who else is going to sell. Unless Japan Post Bank sells JGBs, the BOJ won’t be able to continue its monetary stimulus operations.”

We also said this:

“in 6-9 months, following the next major market swoon when everyone is demanding more action from the BOJ, “suddenly” pundits will have discovered the biggest glitch in the ongoing QE monetization regime, namely that the BOJ simply can not continue its current QE program, let along boost QE as many are increasingly demanding, unless it finds willing sellers, and having already bought everything the single biggest holder of JGBs, the GPIF, had to sell, the BOJ will next shakedown the Post Bank, whose sales of JPY45 trillion in JGBs are critical to keep Japan’s QQE going.

The sale of that amount, however, by the second largest holder of JGBs, will only last the BOJ for the next 3 months. What next? Which other pension fund will have the massive holdings required to keep the BOJ’s going not only in 2016 but also 2017 and onward. The answer: less and less.

Once again to be accurate, the first time we warned about the biggest nightmare on deck for the BOJ (and ECB, and Fed, and every other monetizing central bank) was back in October 2014, when we cautioned that the biggest rish was a lack of monetizable supply.

We cited Takuji Okubo, chief economist at Japan Macro Advisors in Tokyo, who said that at the scale of its current debt monetization, the BOJ could end up owning half of the JGB market by as early as in 2018. He added that “The BOJ is basically declaring that Japan will need to fix its long-term problems by 2018, or risk becoming a failed nation.”

This was our summary:

The BOJ will not boost QE, and if anything will have no choice but to start tapering it down – just like the Fed did when its interventions created the current illiquidity in the US govt market – especially since liquidity in the Japanese government market is now non-existant and getting worse by the day. All that would take for a massive VaR shock scenario to play out in Japan is one exogenous JGB event for the market to realize just how little actual natural buyers and sellers exist.

That said, our conclusion, which was not to “expect the media to grasp the profound implications of this analysis not only for the BOJ but for all other central banks: we expect this to be summer of 2016’s business” may have been a tad premature.

The reason: overnight the IMF released a working paper written by Serkan Arslanalp and Dennis Botman (which was originally authored in August), which confirmed everything we said yesterday… and then some.

Here is Bloomberg’s summary of the paper:

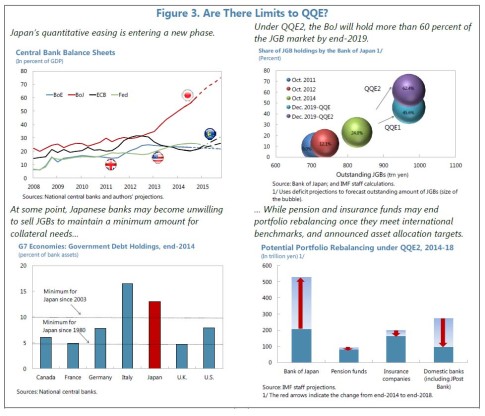

The Bank of Japan may need to reduce the pace of its bond purchases in a few years due to a shortage of sellers, said economists at the International Monetary Fund.

There is likely to be a “minimum” level of demand for Japanese government bonds from banks, pension funds, and insurance companies due to collateral needs, asset allocation targets, and asset-liability management requirements, said IMF economists Serkan Arslanalp and Dennis Botman.

Here are the excerpts from the paper:

We construct a realistic rebalancing scenario, which suggests that the BoJ may need to taper its JGB purchases in 2017 or 2018, given collateral needs of banks, asset-liability management constraints of insurers, and announced asset allocation targets of major pension funds.

… there is likely to be a “minimum” level of demand for JGBs from banks, pension funds, and insurance companies due to collateral needs, asset allocation targets, and asset-liability management (ALM) requirements. As such, the sustainability of the BoJ’s current pace of JGB purchases may become an issue.

Back to Bloomberg:

While Governor Haruhiko Kuroda said in May that he expects no obstacles in buying government bonds, the IMF analysts join Nomura Securities Co. and BNP Paribas SA in questioning the sustainability of the unprecedented debt purchases.

Who in turn merely joined Zero Hedge who warned about precisely this in October of last year.

Back to the IMF paper, which notes that in Japan, where there is a limited securitization market, the only “high quality collateral” assets are JGBs, and as a result of the large scale JGB purchases by the JGB, “a supply-demand imbalance can emerge, which could limit the central bank’s ability to achieve its monetary base targets. Such limits may already be reflected in exceptionally low (and sometimes negative) yields on JGBs, amid a large negative term premium, and signs of reduced JGB market liquidity.”

To the extent markets anticipate limits, the rise in inflation expectations could be contained, which may mitigate incentives for portfolio rebalancing and create a self-fulfilling cycle that undermines the BoJ’s objectives.

For those surprised by the IMF’s stark warning and curious how it is possible that the BOJ could have put itself in such a position, here is the explanation:

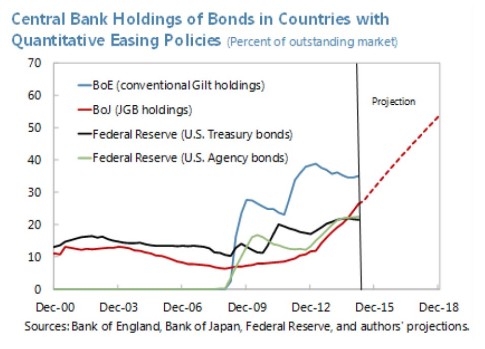

So far, the BoJ’s share of the government bond market is similar to those of the Federal Reserve and still below the Bank of England (BOE) at the height of their QE programs. Indeed, the BoE held close to 40 percent of the conventional gilt market at one point without causing significant market impairment. Japan is not there yet, as the BoJ held about a quarter of the market at end-2014. But, at the current pace, it will hold about 40 percent of the market by end-2016 and close to 60 percent by end-2018. In other words, beyond 2016, the BoJ’s dominant position in the government bond market will be unprecedented among major advanced economies.

As we expanded yesterday, the biggest issue for the BOJ is not that it has problems buying paper, but that there are simply not enough sellers: “under QQE1, only around 5 percent of BoJ’s net JGB purchases from the market came from institutional investors. In contrast, under QQE2, close to 40 percent of net purchases have come from institutional investors between October 2014 and March 2015.”

This is where things get back for the BOJ, because now that the BOJ is buying everything official institutions have to sell, the countdown has begun:

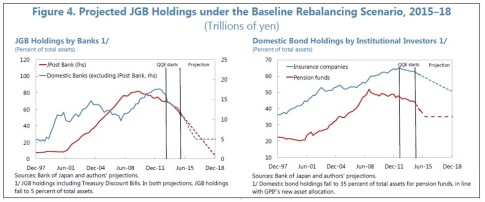

given the pace of BoJ purchases under QQE2 and projected debt issuance by the government (based on April 2015 IMF WEO projections of the fiscal deficit), we estimate that Japanese investors could shed some ¥220 trillion of JGBs until end-2018 (Table 2, Figure 4). In particular, Japanese insurance companies and pension funds could reduce their government bond holdings by ¥44 trillion, while banks could sell another ¥176 trillion by end-2018, which would bring their JGB holdings down to 5 percent of total assets. At that point, the BoJ may have to taper its JGB purchases.

Then there are the liquidity issues:

As the BoJ ascends to being a dominant player in the JGB market, liquidity is likely to be affected, implying that economic surprises may trigger larger volatility in JGB yields with potential financial stability implications. As noted in IMF (2012), demand-supply imbalances in safe assets could lead to deteriorating collateral quality in funding markets, more short-term volatility jumps, herding, and cliff effects. In an environment of persistent low interest rates and heightened financial market uncertainty, these imbalances can raise the frequency of volatility spikes and potentially lead to large swings in asset prices.

This, too, is precisely what we warned yesterday would be the outcome: “the BOJ will not boost QE, and if anything will have no choice but to start tapering it down – just like the Fed did when its interventions created the current illiquidity in the US govt market – especially since liquidity in the Japanese government market is now non-existant and getting worse by the day.”

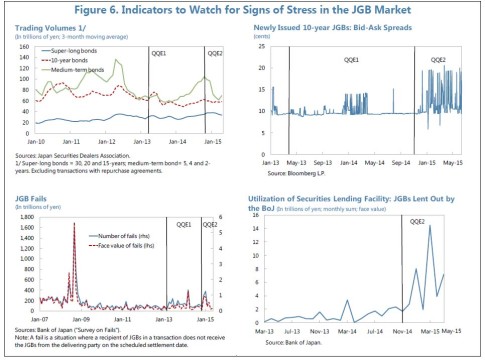

The IMF paper conveniently provides some useful trackers to observe just how bad JGB liquidity is in real-time.

The IMF is quick to note that the BOJ does have a way out: it can simply shift its monetization to longer-dated paper, expand collateral availability using tthe BOJ’s Securited Lending Facility (which basically is a circular check kiting scheme, where the BOJ lends banks the securities it will then repurchase from them), or simply shift from bonds to other assets: “the authorities could expand the purchase of private assets. At the moment, Japan has a relatively limited corporate bond market (text chart). Hence, this would require jumpstarting the securitization market for mortgages and bank loans to small and medium-sized enterprises which could generate more private assets for BoJ purchases.”

But the biggest risk is not what else the BOJ could monetize – surely the Japanese government can always create “monetizable” kitchen sinks… but what happens when the regime shifts from the current buying phase to its inverse:

As this limit approaches and once the BoJ starts to exit, the market could move from a situation of shortage to one with excess supply. The term premium could jump depending on whether the BoJ shrinks its balance sheet and on the fiscal deficit over the medium term.

When considering that by 2018 the BOJ market will have become the world’s most illiquid (as the BOJ will hold 60% or more of all issues), the IMF’s final warning is that “such a change in market conditions could trigger the potential for abrupt jumps in yields.”

At that moment the BOJ will finally lose control. In other words, the long-overdue Kyle Bass scenario will finally take place in about 2-3 years, tops.

But ignoring the endgame for Japan, and recall that BofA triangulated just this when it said that “the BOJ is basically declaring that Japan will need to fix its long-term problems by 2018, or risk becoming a failed nation“, what’s worse for Abe is that the countdown until his program loses all credibility has begun.

What happens then? As BNP wrote in an August 28-dated report, “Once foreign investors lose faith in Abenomics, foreign outflows are likely to trigger a Japanese equities meltdown similar to the one observed during 2007-09.”

And from there, the contagion will spread to the entire world, whose central banks incidentally, will be faced with precisely the same question: who will be responsible for the next round of monetization and desperately kicking the can one more time.

But before we get to the QE endgame, we first need to get the interim point: the one where first the markets and then the media realizes that the BOJ – the one central banks whose bank monetization is keeping the world’s asset levels afloat now that the ECB has admitted it is having “problems” finding sellers – will have no choice but to taper, with all the associated downstream effects on domestic and global asset prices.

It’s all downhill from there, and not just for Japan but all other “safe collateral” monetizing central banks, which explains the real reason the Fed is in a rush to hike: so it can at least engage in some more QE when every other central bank fails.

But there’s no rush: remember to give the market and the media the usual 6-9 month head start to grasp the significance of all of the above.

Source: IMF