– The Layoffs Return: Energy Giants Chevron, Saipem To Fire Over 10,000 Workers (ZeroHedge, July 29, 2015):

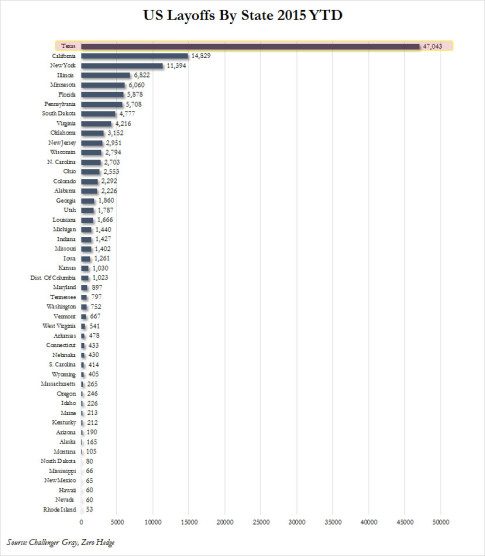

In the beginning of 2015 the biggest threat to the economy as a result of the collapse in oil prices, both in the US and worldwide, was the surge in layoffs among highly-paid energy sector job. This was confirmed in April when we showed the Challenger layoffs data for the energy-heavy state of Texas, and the energy sector in general where the 37,811 job cuts in Q1 were some 3,900% higher than a year earlier.

Then in Q2, after the price of oil staged a substantial rebound of about 50% from the year to date lows in the $40’s, energy-related layoffs trickled to a halt as corporations hoped the worst is behind them, and as a result would merely bide their time before redeploying their workforce toward exploration and production.

Alas, this was not meant to be, and as the events of the last month have shown, oil has resumed its downward slide. And, as expected, so have layoffs.

Overnight, US energy major Chevron announced it will cut 1,500 jobs globally “as the company aims to reduce internal costs in multiple operating units and the corporate center.” According to Rigzone, “the San Ramon, Calif.-based energy company will cut 950 positions in Houston, 500 positions in San Ramon and 50 positions internationally.”

Chevron is cutting jobs due to the current market environment and is “focused on increasing efficiency, reducing costs and focusing on work that directly supports business priorities,” Chevron spokesperson Melissa Ritchie said in an email to Rigzone.

Chevron will be cutting 1,500 employee positions across the 24 groups that comprise the corporate center; 270 of the positions are existing vacancies that will not be filled. Additionally, 600 staff augmentation contractor positions will be cut in the corporate center.

The cost reductions due to cuts in the corporate center are expected to total $1 billion with additional cost savings expected across the company.

Ritchie said Chevron’s cost-cutting initiatives are currently underway and will continue in coming months. The company plans to have a majority of the cuts completed by mid-November of 2015 as well as cost-saving initiatives in place by 1Q 2016.

As a reminder, Chevron was the first major which in January suspended its stock buyback blaming the collapse in cash flows. Is the dividend next?

But it’s not just the US, because moments ago Italy’s biggest oil and gas industry contractor Saipem announced that not only is it cutting its guidance, sending its stock plunging, but also reported that it plans to cut 8,800 workers by 2017.

According to ANSA, the reductions are part of a restructuring plan that follows more than 900 million euros in writedowns.

The company, which is 43% owned by energy giant ENI, says it has been hit hard by the global collapse in oil prices.

The company revised down its 2015 outlook but said it expected its restructuring plan to save 1.3 billion euros over two years. It said it now expects to post a net loss this year of about 800 million euros.

But the return of the “energy sector turmoil” on the labor market won’t be complete until hollow chatterboxes once again start predicting how the latest crash in energy prices is “unambiguously good” for if not the economy, then the US consumer: a consumer who was supposed to take his “gas tax” savings and spend them. Only that never happened because, drumroll, it snowed, and the result was a first half of retail sales that has been one of the worst 6 month periods for the economic series on record.

The only good news is that soon even more unemployed former energy workers will be allowed to confirm for themselves just how “unambiguously good” it is when the world’s most important and most traded commodity enters its second bear market in under one year.