– Peak Central Banker Hypocrisy: ECB Warns On ELA “Moral Hazard” (ZeroHedge, July 7, 2015):

On Monday, the ECB ratcheted up the pressure on the Greek banking sector.

The bank holiday is now in its second week and Greeks have been living with capital controls for nine days. The unequivocal results of Sunday’s referendum suggest that the ‘inconvenience’ of the daily limit on ATM withdrawals and the supplier credit crunch that threatens to empty the shelves at Greek stores hasn’t yet been sufficient to force the country into submission.

And while the mood may indeed shift once ATM liquidity is exhausted (which by all accounts could happen at any time) and the real shortages of critical imported goods become evident, the ECB decided to act preemptively by raising the haircut on the collateral Greek banks post for emergency cash from the Bank of Greece.

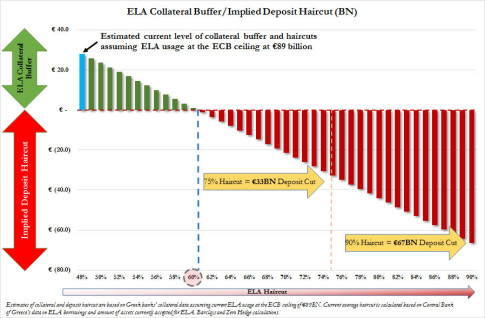

As a reminder, raising the haircut chews through whatever collateral buffer the banks might have had left on their balance sheets and once that buffer is exhausted, a depositor haircut is implied. Here is our full sensitivity analysis which outlines the implications for depositors of a given hike on ELA haircuts:

“Greece has to itself start to think about how they will deal with this situation and little by little, we can see how this bag of money decreases in the future,” Bank of Latvia chief and ECB Governing Council member Ilmars Rimsevics told Latvijas Radio on Tuesday (before going on to note that redenomination was the most “realistic” scenario for Greece), implying that the haircuts would likely increase sooner rather than later if Greece continues to careen towards an EU exit.

Of course some EU officials and policymakers — notably Bundesbank head Jens Weidmann and certain German MPs — likely wouldn’t call Monday’s move “preemptive” at all.

In fact, many believe the ECB should have at least frozen the ELA cap long ago and should now pull emergency funding altogether in light of Sunday’s “no” referendum vote.

Against this backdrop, the ECB figured now was a good time to release a report which discusses its “risk management” practices. Conveniently, there’s an entire section dedicated to ELA. Here is one particularly amusing excerpt:

ELA should not conflict with the objectives and tasks of the ESCB. Interference with the objectives and tasks of the ESCB could, for instance, result from the following: (i) a threat to the singleness of monetary policy, (ii) a threat to the implementation of monetary policy, for example by making the steering of short-term rates more difficult, (iii) a threat to the financial independence of the NCB, for instance if ELA was not provided against sufficient collateral to safeguard such independence, (iv) an obvious concern about a possible breach of the monetary financing prohibition, or (v) provision of ELA at overly generous conditions, which, in turn, could increase the risk of moral hazard on the side of financial institutions or responsible authorities.

Aside from the rather obvious fact that the timing of the release and the addition of the “moral hazard” language is almost certainly aimed at putting further pressure on Greece just one day after the ECB hiked the ELA collateral haircuts for Greek banks, the language highlighted above is glaringly hypocritical, particularly points iv and v.

While there’s little question that allowing Greek banks to pledge government issued bonds as collateral for cash amounts to monetary financing, the ECB seems to have forgotten that PSPP amounts to a massive €1.1 trillion monetary financing operation.

ECB QE has driven sovereign yields on periphery debt to levels that don’t even come close to approximating the risk inherent in those nations’ fiscal situations, meaning the ECB is making it far easier for those countries to borrow money than would be the case if the market were left to price country risk on its own. This ties directly into the idea of moral hazard. Indeed, if ever there were a program that encouraged governments to act fiscally irresponsible due to the fact that they will not likely have to bear the consequences of their actions on their own, then ECB QE is certainly that program. Don’t believe us? Just ask Jens Weidmann who said the following about PSPP in May:

“The political pressure on central banks [can increase] when it comes to future monetary policy decisions, especially as member states’ drive to reform is also being weakened.”

In short, the ECB’s attempt to hold the Greek ELA experience up as an example of what can happen when central banks aren’t careful to avoid moral hazard is hypocritical to the point of absurdity given the central bank’s QE program and indeed, if Mario Draghi is really concerned about “risk management”, he should perhaps consider what happens to a trillion-euro bond portfolio purchased at a premium to par when some unforseen event (like, say, the dissolution of the EMU) causes yields to suddenly spike.

The again, we’re talking about the same central bankers who, at their April policy meeting, apparently convinced themselves that QE “compliments” austerity, so we suppose that because the bank’s willful ignorance apparently knows no bounds, it’s at least possible that the tragic irony strewn across the risk management report’s 50 or so crisply worded pages is entirely lost on them.

(note: Weidmann was “not available” for this group photo)

Financial Risk Management of Eurosystem Monetary Policy Operations 201507.En

Eric Holder gets greedy gut job after failing to prosecute ONE greedy gut who caused the crash of 2008……..

What will it take to wake Americans up?

This is appalling.

http://www.zerohedge.com/news/2015-07-07/cronyism-pays-eric-holder-triumphantly-returns-law-firm-lobbies-banks

Cue another pic of the chameleon…

http://wolfstreet.com/2015/10/22/draghi-speaks-euro-falls-off-chart-stocks-soar-despite-layoffs-shrinking-revenues-and-evil-strong-dollar-that-just-got-a-heck-of-lot-stronger/