– It Begins: ECB Hikes Greek ELA Haircuts; Full “Depositor Bail-In” Sensitivity Analysis (ZeroHedge, July 6, 2015):

Earlier today we reported that as Bloomberg correctly leaked, the ECB would keep its ELA frozen for Greek banks at its ?89 billion ceiling level last increased two weeks ago. However we did not know what the ECB would do with Greek ELA haircuts, assuming that the ECB would not dare risk contagion and the collapse of the Greek banking system by triggering a waterfall solvency rush in Greek banks if and when it boosts ELA haircuts. Turns out we were wrong, and as the ECB just announced “the Governing Council decided today to adjust the haircuts on collateral accepted by the Bank of Greece for ELA.”

Full Press Release:

ELA to Greek banks maintained

- Emergency liquidity assistance maintained at 26 June 2015 level

- Haircuts on collateral for ELA adjusted

- Governing Council closely monitoring situation in financial markets

The Governing Council of the European Central Bank decided today to maintain the provision of emergency liquidity assistance (ELA) to Greek banks at the level decided on 26 June 2015 after discussing a proposal from the Bank of Greece.

ELA can only be provided against sufficient collateral.

The financial situation of the Hellenic Republic has an impact on Greek banks since the collateral they use in ELA relies to a significant extent on government-linked assets.

In this context, the Governing Council decided today to adjust the haircuts on collateral accepted by the Bank of Greece for ELA.

The Governing Council is closely monitoring the situation in financial markets and the potential implications for the monetary policy stance and for the balance of risks to price stability in the euro area. The Governing Council is determined to use all the instruments available within its mandate.

What does this mean? Since it is almost certain that the haircut is being increased (as decreasing the ELA haircut makes no sense since Greek banks still have about €20 billion in ELA collateral buffer and instead the ECB would have simply raised the total ELA amount), it means that the ECB just took its first practove step toward launching a Greek bank bail in. [ZH: it has since been confirmed that haircuts are being raised].

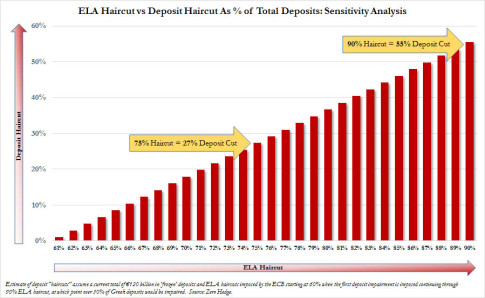

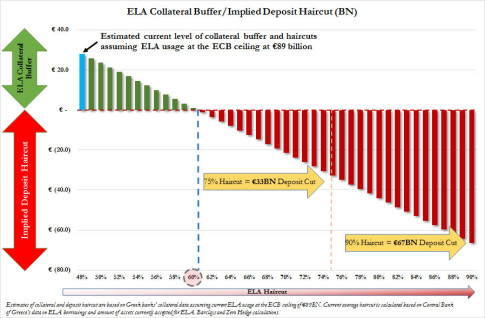

And for the convenience of our readers, previously we prepared precisely the sensitivity analysis showing what ELA haircut results in what depositor bail-in.

Here is the summary sensitivity analysis indicating what a specific ELA haircut translates to in terms of deposit haircut. Basically what the ECB just did is to increase the haircut from the existing level of about 50% which was unusable anyway due to the freezing of total amount of ELA at €89 billion, to 60% at which point the collateral buffer – unusable as it may be – was entirely eliminated from €24 billion to virtually nothing.

Another way of showing this dynamic is presenting the ELA haircut on the X-axis and the corresponding deposit haircut on the Y-axis once the critical “haircut” threshold of 60% in ELA haircuts is crossed.

Further confirmation that this was a haircut increase comes from Reuters reporting that the ECB will hike the haircut just enough to reduce the collateral on Greek banks to slighly above the current level of use which is about €90 billion. In other words, the ECB increased its haircut from roughly 50% to just about 60% above which level depositor bail ins begin.

Needless to say, this decision makes it quite clear that it was not Greece, but the ECB pushing all along for “burning the Greek bridges” – just as we warned in “Goldman’s “Conspiracy Theory” Stunner: A Greek Default Is Precisely What The ECB Wants” – and as a result any chance of a compromise resolution with Greece may have just been, well, burned

This is insanity. This will force a Greek default to the ECB on July 20th, the fallout from the E3.5Billion losses will affect citizen bondholders all over the Euro, including the UK. This will guarantee the contagion they claimed they wanted to avoid will spread like wildfire. Strangling Emergency Liquidity Assistance is bad enough, but raising the deposit haircuts to over 60% will cause riots.

How would any of us like to find 60% of our bank accounts confiscated by greedy guts? This guarantees more defaults……the people of Greece will be so angry, it will become a patriotic cry to screw the bastards, don’t give them a penny! Stupid. So easy to avoid……..

Sure, the IMF will jump right in with funds after a multi billion dollar Euro loss from the June 30th default…….What claptrap. They are not going to give them a cent, it is all smoke and mirrors. The banks are all empty shells in any case, all their loans and deals are packaged and sold on the stock market. The banks no longer carry any debt, they are broke.

What is wrong with these greedy bastards? This is beyond any reasoning that computes to me…….The fact they are broke will become more obvious over the next few weeks……My guess is that they have no money to loan because nobody will be interested in buying any securities or bonds they offer for sale, either the IMF or the ECB after Greece defaults on them come July 20th.

This will spread all over the Euro, and eventually to the US. Add in the Chinese stock market panic that no financial website will cover right now, and I see a global financial tsunami forming.

These bank leaders are idiots. They need to be fired ASAP.

Just days for the Greeks?

Just days for the German cow and her French cohort….both, along with the head of the IMF are on life support……..all will need new jobs. Good riddance.

But, it is Greece that is down to hours?????

http://www.theguardian.com/world/live/2015/jul/07/greek-debt-crisis-alex-tsipras-seeks-last-chance-deal-live#block-559bec8de4b032a39a3bb036