“Greece was warned by a group of European Union officials in Brussels it had less than 24 hours to come up with a serious counter-proposal,” Bloomberg says. Meanwhile, Reuters reports that Germany is “holding ‘concrete consultations’ on what to do in the case of a bankruptcy of the Greek state.”

– Europe Gives Greece 24 Hours To Comply; Germany Draws Up Capital Control Plans (ZeroHedge, June 11, 2015):

EU officials turned up the heat on Athens Thursday after the IMF withdrew its team and sent its lead negotiators back to Washington.

In what can only be described as a half-hearted effort, Greek PM Alexis Tsipras submitted two three-page proposals earlier this week that were dismissed by creditors as “not serious.” We suggested that perhaps that was intentional as Tsipras, having bought Greece some time by opting for the “Zambian” IMF payment bundle, is simply keeping up appearances while the real negotiating is going on behind the scenes with Syriza party hardliners who Tsipras desperately needs to support any proposal before it goes to parliament in order to avoid what could quickly deteriorate into a political and social crisis.

One has to believe that Brussels understands this, but it could very well be that between Tsipras’ scathing op-ed (published two Sundays ago) and the PM’s fiery speech to parliament last Friday, creditors are becoming concerned that Tsipras might actually be starting to believe that he can effectively blackmail the EMU by threatening to prove, once and for all, that the currency bloc is in fact dissoluble no matter what manner of protestations one might hear in polite company.

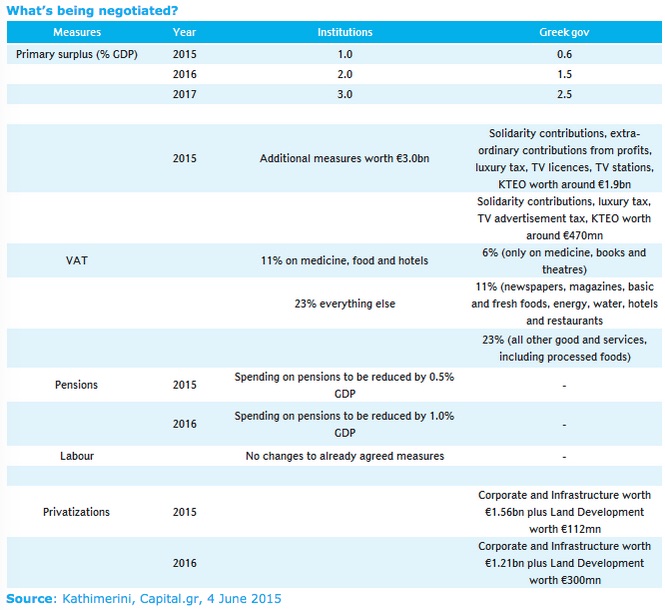

So, with the IMF having thrown in the towel, and with German lawmakers set to rally behind the incorrigible FinMin Wolfgang Schaeuble in what amounts to a mutiny on the SS Merkel, Europe appears to have finally had enough because by Thursday evening, reports indicated that EU officials have given Greece 24 hours to come back with a proposal that includes pension reform and VAT increases.

Via Bloomberg:

Greece was warned by a group of European Union officials in Brussels it had less than 24 hours to come up with a serious counter-proposal, according to a person familiar with the discussion.

Greek delegate told by EU officials that a list must includes reform on pension and VAT.

Greece told by the officials that they are taking seriously all scenarios.

EU official didn’t specifically say what would happen to Greece if there was no plan presented tomorrow.

And meanwhile, Reuters (citing Bild) says Germany is now engaged in “concrete” discussions over how to handle a Greek bankruptcy :

The German government is holding “concrete consultations” on what to do in the case of a bankruptcy of the Greek state, German newspaper Bild said, citing several people familiar with the matter.

This includes discussions about introducing capital controls in Greece if the crisis-stricken country goes bankrupt, Bild said in an advance copy of an article due to be published on Friday.

It said a debt haircut for Greece was also being discussed, adding that government officials were in close contact with the European Central Bank on that.

The German government did not, however, have a concrete plan of how it would react if Greece goes bankrupt and much would have to be decided on an ad-hoc basis, Bild cited the sources as saying.

The takeaway here is that come hell, high water, or “Grimbo,” the EU is going to extract its pension cuts and VAT hikes from Tsipras, and not because anyone seriously thinks it will make a difference in terms of putting the country on a ‘sustainable’ path, but because the EU simply cannot afford for Syriza sympathizers in more economically consequential countries like Spain to get any ideas about rolling back austerity (of ‘fauxsterity‘ as it were) and using EMU membership as a bargaining chip.

The only question now is whether Tsipras has been successful at convincing party hardliners to support further concessions, because if this turns into a protracted political battle, it’s entirely possible that the country will descend into chaos, if only for a few weeks.

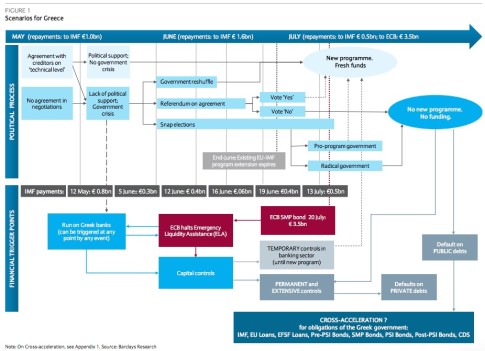

Stay tuned, and as a reminder, here’s a flowchart that outlines various political and economic ramifications as well as a guide to what’s being negotiated:

Why is no reference being made to Russia, and the jobs and money it will bring to Greece’s ports and economy? The bankers don’t have a total monopoly on this game…………

It’s still a lot of bluff poker and barking dogs that don’t bite.

One can only admire and at the same time feel compassion with the Greek negotiators, who by now must feel the enormous pressure of these giant money-hungry organizations. Let alone that they must resist attempts to bribe them and betray their own people, which is otherwise so easily achieved with standard politicians.

I don’t see what the big deal is. Tell them to fuck off, stop stealing the working man’s money to pay the banks and let the house of cards crumble! Yeah it might be rough roads ahead as a result, but in the long run it will be the best thing for all of us. When bankers go belly up they get tax payer bailouts, when everyone else does it we are strangled to the point of no return…….