– Russell Napier Explains What’s In Store For Gold If Cash Is Outlawed (ZeroHedge, May 9, 2015):

Why we didn’t have negative nominal yields in the Depression and the end of QE

Oh the time will come up

When the winds will stop

And the breeze will cease to be breathin’,

Like the stillness in the wind

’Fore the hurricane begins —

The hour when the ship comes in.And the words that are used

For to get the ship confused

Will not be understood as they’re spoken,

For the chains of the sea

Will have busted in the night

And will be buried at the bottom of the ocean.– When The Ship Comes In (Bob Dylan 1963)

The Napier Euro High Yield Capital Guarantee Fund (discussed in the November 12th edition of The Solid Ground) is almost ready for launch. It offers a unique combination of attributes to investors. It has significantly better risk/reward characteristics than both deposits and government debt securities. In short, it is a room full of Euro banknotes.

The launch of the fund will clearly mark the limits to monetary policy and thus the end to QE in Europe. The fund’s many attractive features include:

- a small negative yield (my fee), but it yields more than Euro bank deposits and most Euro denominated government debt securities.

- the assets are a liability of the central bank and not the commercial banks. While bank deposits, above the level guaranteed by governments, can be bailed-in and frozen during any bank reconstruction, the banknotes nominal value is assured by the central bank. The fund thus offers significant capital protection and enhanced liquidity to any bank deposit.

- unlike longer-dated debt securities of the government, the banknote will not suffer a loss in value should fears of inflation rear their ugly head. While the markets will begin to price future inflation into longer-dated fixed interest securities, the banknote holder suffers no loss at such apprehension. The fund would seek to move from banknotes should recorded inflation appear, as this would impact the real value of investments. The nominal value of the fund cannot decline if inflation expectations rise, ensuring significant protection compared to government debt securities.

- banknotes could be bid up, relative to deposits, as the authorities seek to restrict access. Last week Schweizer Radio und Fernsehen reported that a Swiss bank had refused to transform the deposits of a Swiss pension fund into banknotes and that the Swiss National Bank confirmed that they were against the hoarding of banknotes to avoid negative deposit rates. The ECB is just as likely to be against such bank runs as the SNB. Any move to restrict access to central bank liabilities (banknotes) and enforce the holding of commercial bank liabilities (bank deposits) is likely to lead to a premium of one over the other. Given the capital risk and lower yield on bank money, Gresham’s Law is likely to see banknotes becoming a store of value, while people seek to use the inferior bank deposit as a means of transaction. Banknotes traded at premiums to bank deposits, albeit in closed banks, in the US in the 1930s. A premium for banknotes would provide a rising nominal value for the fund.

- the fund would hold only Euro notes with a serial number beginning with X, the X denoting that these notes have been printed by Germany. Such notes could also be bid up relative to deposits and even other notes, should investors fear the demise of the Euro and the re-birth of the DM or a northern European ‘NEuro’. Should this occur, the nominal value of the fund would once more rise.

- a banknote owner will be able to shift capital to any jurisdiction where the Euro remains fungible. Restrictions on banknote withdrawals and transfers of deposits were imposed in Cyprus, as part of the plan to prevent the funding base of the Cypriot banks moving to other banks in the European Union. The ability to shift capital across borders, should such movement be outlawed, would likely lead to a premium developing for banknotes. Should this occur, the nominal value of the fund would, yet again, rise.

- notes would be held in denominations of 50 Euros. The authorities are already minded to ban the Euro 500 note (known by some as the ‘Bin Laden’ because it is known to exist but is rarely seen). It is rarely seen because the ‘Bin Laden’ is prized by criminals and those seeking to avoid taxation, meaning it’s increasingly likely to be recalled and abolished. Any ban on large denomination notes to combat illegal activity is unlikely, however, to affect the 50 Euro note given its key role in everyday transactions in Europe. Those bent on illegal activity may just have to get themselves bigger suitcases to stash their smaller denomination notes. A premium may develop for such notes, and such suitcases, and should this occur the nominal value of the fund would, you’ve guessed it, rise.

The fund produces an enhanced yield over bank deposits and most government debt securities, and cannot be subject to a decline in nominal value unlike bank deposits or government debt securities. In some fairly extreme cases it may even produce a capital gain relative to most money (bank deposits). The only likelihood of loss is in the case of an instant and material rise in inflation that would undermine the real value of the fund. However, unless such inflation developed virtually overnight the fund could be liquidated, without capital loss unlike government securities subjected to an inflationary shock.

The inflation protection offered by banknotes is thus significant given the current yield on government bonds. While government bond prices may rise somewhat further in a deflation, the banknote arbitrage opportunity suggests that the upside for government bond prices in a deflation is very limited. Government debt securities did not have negative nominal yields in the Great Depression despite gross deflation so why should they they have them now? Thus, those speculating on government bonds to see negative nominal yields go ever lower may not get the capital gains they think are coming their way. Banknotes may even perform as well in a deflation as government debt securities and offer much better protection should an inflationary future appear more likely.

Given this combination of risk characteristics, why would you want to own a government bond or a bank deposit when the Napier Euro High Yield Capital Guarantee Fund is available? (Before I am inundated with e-mails looking for a prospectus, I should point out that I am independent financial consultant and, am not regulated to look after client monies. Also, I don’t have a basement or a machine gun.)

The attraction of a banknote fund arises due to an arbitrage which creates a limit to monetary policy. It is that limit which contains the key information about financial market reactions for investors. QE cannot force the price of government debt securities much higher and yields much lower, as increasingly banknotes and even bank deposits become attractive to investors compared to government debt. A limit to QE is a big story.

Such an arbitrage opportunity would limit the profits one makes in such bonds during a deflation and both notes and deposits offer major protection from capital losses should there be a major change in inflationary expectations. This would be a world of deflation where the scale of negative nominal rates would have a floor. Indeed, bond yields could overshoot into negative territory and then rise into a deflation as the limits to negative nominal yields became increasingly clear. Thus the recent rise in the yields of Euroland government securities may not be a signal of inflation at all, but rather a realization that we have reached the arbitrage limits of how far yields can fall.

A world of less growth and deflation, but one where interest rates are clearly stuck in nominal terms, is a very dangerous world for equity investors with surprisingly few gains for bond investors.

Historically the shift from deposits to banknotes was associated with the fear of commercial bank insolvency or illiquidity. That was called a bank run. Today a bank run is the natural consequence of forcing too much central bank liquidity (bank reserves) onto a system which simply does not want them. A banker does not want to accept this short-term funding if he cannot lend the proceeds at a profit.

The only way for the banking system in aggregate to repel such funding is to offer interest rates on deposits (bank liabilities) which force investors into banknotes (someone else’s liability). Tighter regulation and collapsing long-term interest rates mean that profits from lending for Euroland bankers are increasingly illusory. Banks are keen to repel deposits given the lack of opportunity to use them. If QE reduces the banks’ ability to lend money and also creates an arbitrage from bank deposits into banknotes, will it reflate the economy?

If you think the answer is ‘no’ then European QE will have to stop with fairly negative consequences for the equity market and positive implications for the Euro exchange rate. Evidence of selling of government debt securities with negative yields is thus not necessarily a sign of inflation. A move to bank deposits or banknotes from government debt securities can instead indicate that the limits for QE have been reached.

The more investors focus on the limits to the scale of negative nominal rates, the more they focus on the failure of QE or on Ken Rogoff’s paper on killing cash: “Costs and benefits to phasing out paper currency By Kenneth Rogoff, Harvard University.”

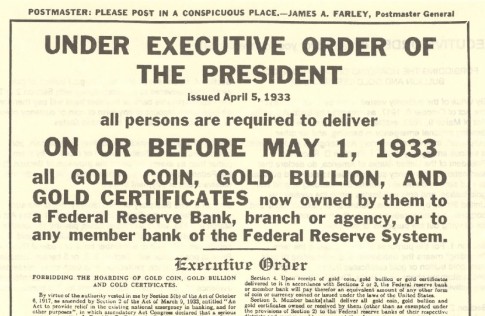

While he doesn’t quite label banknotes a ‘barbarous relic’, he comes pretty close. The direction of travel in seeking to ban the use of cash is the same as those who railed against gold as a form of money. Once gold was considered too hard a money for society but now paper may be too hard for us to bear. It seems we need the digital money of deposits that shrink when subjected by central bankers to the hot light of negative nominal interest rates!

If banknotes are outlawed you will be forced to hold money that is a liability of a commercial bank (deposits) and refused access to money that is the liability of the central bank (bank notes). You will be forced to accept the risk of losses on a bank failure and banned from an instrument which promises no adjustment in nominal value. Any such ban would have to be a decision of government and not of the central bank. This means we’ll all have plenty of warning that it is on its way! We will be forced by law to liquidate the Napier Euro High Yield Capital Guarantee Fund and return capital or watch the fund’s value fall to zero as it holds something which has been stripped of legal tender status.

Euroland is not the only place where the limits to monetary policy are becoming more apparent. In the JPMorgan Chase annual report President and CEO Jamie Dimon warned that banks are having to turn away even USD deposits. This analyst has now spoken with three investment managers who have been asked to close their deposit accounts with JPM. At this stage other bankers still offer positive nominal yields on bank deposits, but how long will that last as orphaned deposits roam the streets of Manhattan, like Oliver Twist, in search of somewhere they can call home? These orphaned deposits will put downward pressure on interest rates for large-scale depositors and eventually, even in the US, the much reviled greenback may be seen as a store of value relative to bank deposits or Treasuries.

So, should we reach the limits to monetary policy, what’s in store for that ‘barbarous relic’ sometimes known as gold? It would be a period of rapidly rising real interest rates, as a floor on negative nominal interest rates had been set in a period of accelerating deflation. This should be bad for gold. As The Solid Ground has argued before, the de-leveraging which always comes with deflation and falling cashflows would be very positive for the USD. This would also be bad for gold.

However, in such a world, zero-yielding gold would be a high-yielding instrument. If the authorities ever sought to restrict access to banknotes, then gold would suddenly find itself enfranchised as money for the first time in many decades. So, given the scale of these competing forces, it is just too early to say what might happen to the gold price, but the allure of gold will grow the more it becomes clear that central bank fiat has failed and the age of government fiat is dawning.

The time is ever nearer when the price of gold will rise in an era of deflation. In due course, though no time soon, the full force of government fiat will engineer a reflation, albeit one replete with the misallocations of savings and capital so beloved by the bureaucrat. Then the PhD standard, in which the value of money is linked only to the words of the over-educated, will have ended. The gold price will rise even further, ‘And the words that are used for to get the ship confused will not be understood as they’re spoken, for the chains of the sea will have busted in the night’. And that’s ‘The hour when the ship comes in.’