– “I’m Not Crazy, I’m Scared” – Why For One Trader, This Time It Is Different (ZeroHedge, April 24, 2015):

Bloomberg’s Richard Breslow, author of “Trader’s Notes” is painfully accurate with his latest take on the “markets.”

I’m Not Crazy, I’m Scared

The SPX flirted with all-time highs. The Nasdaq Index made 15 year highs; Chinese equities, and so many other equity indices are flying. Bonds sold off this week, but the German 10-year yield is still ~17bps, the U.S. 10-year yield unable to get beyond 2%, and Greek bonds had a two-day rally that would be truly impressive if it wasn’t on volume that made it just an exercise moving wide bid/offer spreads, representing sentiment not trading.

The USD is selling off on the view that Greece is saved, the Fed is scared, and a “we can’t sit with positions because it never works” mentality. The only really new thing the market needs to digest is that commodities may be nearing a bottom

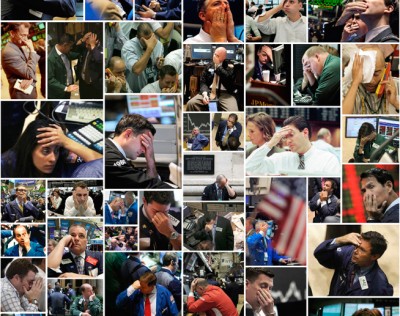

Happy days seemingly, but there have been some very discordant and troubling comments from the creme de la creme of smart – and big – investors.

Over the last three days, we have reported that some of the most important investment voices in the world are more than a little scared about the ravenous appetite for risk playing out in the market, and the fact that they have been ignored is beyond unnerving. Central banks are driving all investment decisions, and what this implies is that they are in this trade so deeply that there is no obvious or practical exit.

Over the course of this week we have heard Larry Fink of Blackrock talking about the severe risks of investing in Europe; Bill Gross of Janus saying German bonds are the short trader’s dream; Pimco warning that markets have not addressed the potential of a Fed tightening (I remember 1994); the incoming CEO of Allianz, that TWO trillion dollar asset manager, saying, “We see generally meager growth prospects, political dangers and risks of a stock market crash.” Even Abby Cohen thinks it is a stock pickers world, not a buy anything and kick back world. And yet, the market didn’t even blink.

What is different this time?

Central Banks and their sovereign wealth funds have become the major players dominating market activity. One central banker after another has admitted they are fixated on market reaction to their comments and actions. They are relying on markets blessing their actions even though it was market dysfunction (and regulatory malfeasance) that brought us here. This is a dangerous situation. The focus must return to the REAL economy; we cannot trade our way out of past mistakes.

And we must look at commodities. One thing central bankers do, because forward curves drive all their forecasts, is extrapolate ad infinitum current trends into the future. No central bank in the world got oil right, and that is arguably the most important commodity in the world. Well, oil has made new YTD highs. Why do you think TIPs auctions have been blowing off the shelves? If central bankers have this wrong, their forecasts are wrong, and the Fed, for one, will be way behind the curve. I posit that a lot of central bankers will be tacking right if Brent holds above $63.

So the big question to ponder is why all these very smart people who control trillions of dollars of assets don’t seem to be voting with their money. If the biggest fund managers and thought leaders of the world were radically changing their asset allocations, wouldn’t we see it? Not if central banks are all on the other side of the trade. Maybe they think they can just hold to maturity. A wise central banker told me I should learn to live with central banks being the dominant force in the market, whether I like it or not. I, unhappily, think he is right. Oh, how I wish Louis Rukeyser could get them on his couch.