From the article:

As the FT reports, “sales of homes worth more than £2m have dropped by 80 per cent in the past year.”… “It is like the 1970s again, when waves of wealthy people left Britain and it was a disaster.”

– UK Housing Bubble Bursts: Sales Of Luxury Homes Crash By 80%; “Waves Of Wealthy People Are Leaving” (ZeroHedge, April 12, 2015):

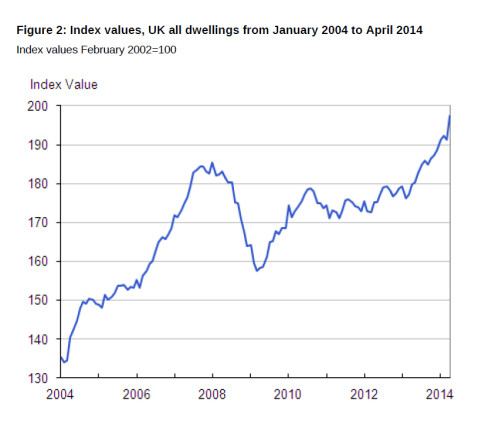

About a year ago, when the Chinese housing bubble had just begun to burst (as a reminder Chinese house prices are now crashing at a faster pace than in the US after Lehman) and forcing the real estate bubble blowers to consider a different venue, namely the stock market, another housing bubble several thousand miles away was in full blown escape velocity mode – that of the UK. In fact, as we showed in the following table from last June, the appreciation in UK home prices had surpassed that of China as recently as 10 months ago.

Back then, this is what UK home prices looked like:

The problem with this relentless scramble into London real-estate, however, is that it was almost entirely driven by the high end, which as we have reported tirelessly over the past 4 years, has become – alongside the US ultra luxury real estate market – the new “Swiss bank account”: a mostly anonymous place (with anonymous LLCs and Corps buying on behalf of uber-rich foreign oligarchs) where tax evaders can park their cash, with the NAR’s, and the government’s, blessing.

And now, the party is over.

As the FT reports, “sales of homes worth more than £2m have dropped by 80 per cent in the past year, according to Douglas & Gordon.”

First the bubble in China popped, and a year later, the UK has followed:

Ed Mead, a director of Douglas & Gordon estate agents, said his company had carried out 37 valuations in the past month for owners of high-end homes who were thinking of selling up, when the normal level is about six.

“It is like the 1970s again, when waves of wealthy people left Britain and it was a disaster,” Mr Mead said.

Why did the UK luxury housing bubble? The same reason we previewed back in December 2013, when we warned that “Foreign UK Homebuyers To Be Subject To Capital Gains Tax” in which we said that “we would not be surprised if the ultra-luxury segment … becomes just a tad wobbly as foreigners seek to quietly but promptly sell now and avoid capital gains.”

Just as predicted:

Wealthy foreigners are shunning London’s luxury housing market following Labour’s announcement that it will end their “non-dom” status if it wins the UK’s general election, according to estate agents. Property deals have begun to fall through in the days since Ed Miliband laid out his plans, they revealed, with some foreign residents also putting their homes up for sale and fleeing the UK.

The announcement, combined with Labour’s plan to introduce a mansion tax on high-value homes, has led many foreigners to conclude that the UK is no longer an attractive and reliable home for the rich, agents said.

During the past two years Conservative chancellor George Osborne has also made tax changes that have increased the burden on the affluent. The introduction of capital gains tax on the proceeds of property sales came into force on April 6 and is believed by agents to have contributed to owners’ jitters.

Of course, rich foreigners know when they are not welcome and have the means to find alternatives. What they don’t know is what happens when, following years of the ultra-wealthy buying up every piece of real estate in London, they all become sellers: a bidless market.

So what to do? Well, start by blaming the government, the same government that everyone loved when it was encouraging speculative gambling in every asset class, and now that the revulsion against foreign oligarchs is a front and center political issue (and the money has dried up) is roundly hated.

Charles McDowell, an independent agent who acts for some of the wealthiest families in London, said that two deals he was involved in had collapsed this week as a result of the non-doms plan, while two families he acts for had asked him to put their homes up for sale.

Mr Osborne is “the most anti-property chancellor Britain has ever had”, Mr McDowell said.

“Britain has gone from being a safe, predictable tax environment to being not predictable and not attractive financially,” he said. “My clients feel under attack, they are not going to invest in London any more.”

What happens next is that thousands of Ultra High Net Worth individuals will pack up and go, in many cases dumping their UK citizenship in the process, and take their spending habits with them, to whatever government has decided not to tax them through the nose. Yet.

Trevor Abrahmsohn, a veteran property agent at Glentree Estates, said the non-doms proposal was “completely mad”. About 50 per cent of the internationally mobile businesspeople among his clients were talking about “establishing citizenship elsewhere”, he said. “It is a very big topic of conversation.”

“The message [the non-dom policy] sends to my clients is that Britain is closed for business,” he said. “Don’t invest in this country, we don’t like foreigners, that is the message.”

Wealthy foreigners are a net economic benefit to the country, Mr Mead said. Research carried out last year found that the average buyer of a £15m home spent £4m-£5m a year on goods and services in Britain. In total the capital’s super-rich add £4bn a year to its economy, the research by Ramidus Consulting, an economic consultancy, found.

As for London real-estate price updates, it hasn’t fully hit yet: “House price growth in London’s priciest areas has flatlined during the past six months, for the first time in five years, according to data from estate agent Knight Frank. Rents are rising strongly as the capital’s wealthy eschew buying and choose instead to rent.”

Expect London house prices to crash in the coming months as those who refuse to hit bids, suddenly realize that he who sells first, sells best, especially with the taxman glancing over the shoulder. And once UK housing tumbles, watch as the entire economy follows suit, and leads to, you guessed it, another episode of QE from the BOE. Because in a world addicted to constant money flow from “outside” sources, if the wealthy refuse to be taxed, then the central bank will have to provide the funding on its own.

As for the world’s billionaires, don’t cry for them. Even without London, they will have plenty of other metropolises to pick from in the coming months, as we showed before…

… at least until every single government follows suit and established the financial asset tax on all assets, the inevitable outcome for the entire insolvent world, precisely as we warned back in 2011.