– Greece Hints At Default, Russian Pivot:”Will Not Respect IMF Deadline” – What Happens Next (ZeroHedge, April 1, 2015):

Update: GREECE GOVT DENIES PLAN TO DELAY APRIL 9 IMF PAYMENT: REUTERS

For now the algos can’t decide if Greece is joking about making the payment or joking about not making the payment.

* * *

The hints are growing louder that the Troika-Greece standoff will not end well for either side. Spiegel is reporting that Greek Interior Minister Nikos Voutzis has stated:

“If no money is flowing to 9 April, we will first determine the salaries, pensions pay here in Greece and then ask our partners abroad to achieve consensus and understanding that we will pay 450 million euros to the IMF not on time,”

In other words…

- *GREECE DOESN’T WANT TO RESPECT IMF APRIL 9 DEADLINE: SPIEGEL

And adds:

As of June or July, Russia and China are “complementary to an agreement with the European partners” fixed part of a new Greek “Plan A are” as Voutzis calls him.

This plan close “with a debt reduction, the end of the austerity measures and a new agreement with a growth clause”.

“We want Russia is helping us rebuild the Greek economy. Both trade agreements as well as through the purchase of government bonds in the primary bond market. ”

The fact that Russia buys government bonds directly from the Greek State to the country’s creditworthiness rise, credit spreads and spreads will automatically fall. Specifically, it should also go state-wide Russian investment projects, especially in the field of energy and transport.

Open Europe explains the consequences of not paying back The IMF…

It seems likely that Greece can make payments covering pensions and wages for public sector workers in March, but beyond today the picture is far less certain. Even if Greece manages the 9 April payment, it has to roll over €1.4bn of short-term debt (T-bills) on 14 April and a further €1bn on 17 April – a much tougher proposition given the recent ECB decision to legally limit the amount of T-bills that Greek banks can hold. This means they won’t be able to increase their share of the debt to cover for foreign owners who are unlikely to roll it over.

So what happens if Greece does not pay the IMF? How serious would this be?

Are countries often late in paying the IMF?

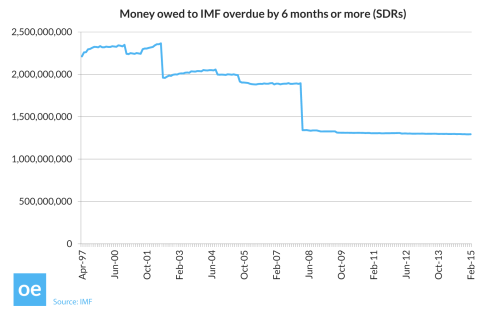

While it is well known that no country has defaulted on the IMF in its 70-year history, it is less well known that there have been a number of late payments. Furthermore, as the chart below shows, there continue to be a sizeable amount of arrears with the IMF outstanding (the chart is in Special Drawing Rights, 1 SDR = $1.38 currently).

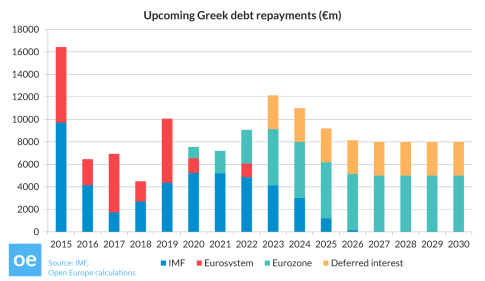

That said, the large majority of these arrears are made up of countries such as Sudan, Zimbabwe and Somalia – not Greece. Furthermore, the total amounts are far below what would amass if Greece stopped making regular payments to the IMF – its total payments this year to the IMF are €9.7bn.

IMF internal reaction

The first step would be the IMF reaction. As detailed in the IMF’s ‘Strategy on Overdue Financial Obligations’, there would actually be little action until 1 month has passed. Before then, the Fund would continue to push the state for prompt payment. After a month, the IMF’s Managing Director Christine Lagarde notifies the IMF Board that an obligation is overdue. This is the point where the country is officially considered to be overdue on the payment, in the sense that this is where the knock-on effects would kick in.

Potential knock-on effects

The real problem may not actually be the IMF reaction – given its presence as senior creditor it is confident of getting paid back in full at some point – but the knock on effects of not making good on payments to the IMF.

IMF stops cooperating with Greece – One of the biggest problems for Greece is that it is still working with the Fund and relies on its sign off (as part of the ‘institutions’) to get its current review completed and therefore funding released. The response of the fund on the ground will therefore be important. Of course, the fund finds itself in a bit of a circular position. It is unlikely to get paid if it does not approve Greece’s review, but how can it approve the review if it is not getting paid?

Gap with creditors grows, reputation harmed – Linked to the above, given that not paying the IMF is usually a course of action reserved only for war torn countries or those on the fringes of the international system, not to mention severly underdeveloped economies, Greece could see its reputation severely dented. Furthermore, it is possible that Greece’s creditors will see that Greece has decided to pay wages and pensions first rather than meet its commitments to them. Whether or not this is a fair assessment, this could drive further animosity between the two sides.

Market funding becomes even harder – At this point in time this might be largely irrelevant given that Greece is locked out of the markets for the foreseeable future in any case, but not paying the IMF would likely be the final nail in the coffin, ending hopes of returning to the markets soon even if some agreement is found with Eurozone partners. Usually, the move would also be expected to raise the cost of short term debt, but given that these go almost entirely to Greek banks who have little choice but to buy them the impact could be limited.

Possible default on Eurozone loans – Greece’s Master Financial Assistance Facility Agreement with the European Financial Stability Facility (EFSF) notes that it could be considered to be in default on the loans from the Eurozone if it

has overdue charges on outstanding purchases and the Managing Director of the IMF has notified the Executive Board of IMF that such repurchases or such payment of charges have become overdue.

Essentially, after one month, when Lagarde notifies the IMF Board about the overdue payments Greece can be considered in default on its EFSF loans as well. However, this is all carefully worded and qualified – it explicitly says the EFSF is “not obliged to” take such action. In the end, it seems to ultimately depend on the decision of the EFSF. It seems unlikely that it would declare the full loan to be in default. That said, pressure would rise within certain member states and national parliaments for some decisive action. Eurozone partners could also use this to further extract concessions from the Greek government. (The original bilateral Eurozone loans also include similar clauses).

Potential cross default on private sector bonds – Under the 2012 debt restructuring, the new Greek bonds which investors were given were issued under English law and included both ‘cross default clauses’ (meaning if they are considered to have defaulted on other obligations they also default on these bonds) and ‘co-financing clauses’ (money for repayments is to an extent pooled between the bonds and the EFSF). However, these look to only apply to the EFSF loans rather than the IMF loans. As such, default would have to be triggered on the EFSF as well for these to be activated. It is worth noting that the rating agency Fitch said in a recent statement that arrears to the IMF alone “would not in and of themselves constitute a rating default” but would be “credit negative” and lead to a further downgrade.

Potential cross default on ECB – The exact terms of the bonds held by the ECB (purchased under its Securities Markets Programme) is less clear since the swap was done in a much more secretive way to ensure the bonds were not captured by the 2012 restructuring. The ECB was issued new bonds under exactly the same terms and maturities. Reports suggest that the bonds remained issued under Greek law. It’s not clear if they include cross default clauses at all and, if they do, whether they would be applicable to bonds issued under English law and/or the loans.

ECB limits or cuts off ELA – It is uncertain then whether default clauses on any loans or bonds would be triggered. Even if they are not, the ECB may reconsider its provision of Emergency Liquidity Assistance (ELA) to Greek banks and would likely refuse to raise the limit further. As noted before, this is likely because of the huge reliance of Greek banks on the state – which would clearly be struggling for cash. Given that the very public act of not paying the IMF may further increase uncertainty and deposit outflows, the impact of limiting ELA could be exacerbated and cause a serious funding crunch for Greek banks and indirectly the economy and the state.

Overall, the short term impact of not paying the IMF may not immediately be dire in economic and financial terms, though of course it would involve serious reputational damage and further widen the already mammoth gap between Greece and its creditors. It may take a month before cross default clauses could be triggered and even then it rests with decisions of highly political institutions such as the EFSF. Such decisions would likely be managed to achieve the least controversial ends, but equally could quickly spiral out of control. Less certain is the response of the ECB, which would once again be the key player.

In the end, it would still not be advisable for the Greek government to test this course of action. We still expect a deal to be found, and largely on Eurozone terms.

* * *

The market appears less sure…

Related info:

– Europe blocks desperate Greek attempt to stay afloat

– George Soros Warns Greece ‘Is Going Down The Drain’ (Video)

– ECB Prepares For Grexit, Anticipates 95% Loss On Greek Debt

– Greece Passes Law To Plunder Pension Funds

– Greece Folds (AGAIN); Ready To Propose “New” Reforms Immediately

– Greece Said To Tap Social Security Capital To Fund T-Bill Rollover

– AND NOW: Greek Government Considers “BORROWING” From Pension Funds To Repay IMF

– The Reason Why The Eurogroup Rushed To Approve The Greek Reform Package? (You can’t make this stuff up!)

– Troika ‘Happy’ With Revised List Of Greek Reform Promises: Full Varoufakis Letter

– Greece’s Syriza Capitulates To The EU

– How Greece Folded To Germany: The Complete Breakdown

– Full Eurogroup Statement On Greece – Bottom Line: Greece Caves On Pretty Much Everything

– George Soros “Trojan Horse” Inside The New Greek Government?

‘Change’ has finally arrived in Greece …