From the article:

“When I was chairman, more than one legislator accused me and my colleagues on the Fed’s policy-setting Federal Open Market Committee of “throwing seniors under the bus” (to use the words of one senator) by keeping interest rates low. The legislators were concerned about retirees living off their savings and able to obtain only very low rates of return on those savings.”

And the punchline:

“I was concerned about those seniors as well.”

Yes, deeply concerned on how to wipe them (the middle class and the poor) out best.

– Ben Bernanke Pens First Blog Post, Defends Fed, Says He “Was Concerned About Seniors” (ZeroHedge, March 30, 2015):

It would appear the $250,000/hour speaking opportunities for Ben Bernanke have ground to a halt, and as such, the former Chairsatan has decided to dispense his wisdom for free to anyone who cares, by becoming a blogger at Brookings. And, not surprisingly, in his first post, the person who less than a decade ago said the following, in exactly those words…

Well, I guess I don’t buy your premise. It’s a pretty unlikely possibility. We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.

… is out and about defending the Fed and central banks from pushing rates so low, in Europe you are now paid to borrow money, and are charged to save.

So, to those who are too lazy to click on the following link to the Brookings blog where Bernanke is now blogger emeritus, here is the punchline.

In what can only be described as a litany of defensive insecurity, Bernanke launches a full-on assault on all those who accuse the Fed of crushing the economy, which now includes not only tin-foil fringe blogs of the Austrian economics persuasion, but such “very serious people” as Guggenheim’s CIO Scott Minerd who over the weekend said “The long-term consequences of global QE are likely to permanently impair living standards for generations to come while creating a false illusion of reviving prosperity” and rhetorically asks “Why are interest rates so low? Will they remain low? What are the implications for the economy of low interest rates?”

His response to this rhetorical question, is the following: “If you asked the person in the street, “Why are interest rates so low?”, he or she would likely answer that the Fed is keeping them low. That’s true only in a very narrow sense.”

Actually, it is true inn every sense. What is Bernanke’s loophole? He introduces the concept of the equilibrium real interest rate. In Bernanke’s words:

Except in the short run, real interest rates are determined by a wide range of economic factors, including prospects for economic growth—not by the Fed.

To understand why this is so, it helps to introduce the concept of the equilibrium real interest rate (sometimes called the Wicksellian interest rate, after the late-nineteenth- and early twentieth-century Swedish economist Knut Wicksell). The equilibrium interest rate is the real interest rate consistent with full employment of labor and capital resources, perhaps after some period of adjustment. Many factors affect the equilibrium rate, which can and does change over time. In a rapidly growing, dynamic economy, we would expect the equilibrium interest rate to be high, all else equal, reflecting the high prospective return on capital investments. In a slowly growing or recessionary economy, the equilibrium real rate is likely to be low, since investment opportunities are limited and relatively unprofitable. Government spending and taxation policies also affect the equilibrium real rate: Large deficits will tend to increase the equilibrium real rate (again, all else equal), because government borrowing diverts savings away from private investment.

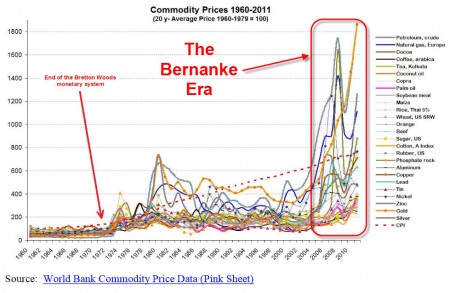

He is absolutely right. What he just fails to notice is that the entire world is gripped in ZIRP, and increasingly NIRP, is that the current bubble implosion aftermath, now 7 years after the Lehman collapse, is merely the 3rd consecutive bubble burst in the past 15 years. In other words, the Fed may spout whatever mumbo jumbo it wants about why its response to the crisis was required, what it has zero defense against is why its only policy under the Greenspan “Great Moderation” paradigm has been to inflate bubbles, and replace a post-bubble vacuum with another bubble, ultimately leading to a complete and global economic halt, and a world in which central banks now have to monetize all net developed world issuance!

In essence there is no Weimar state any more – the entire world has become Weimar, and the only reason why no currency is hyperinflating in isolation is because absolutely everyone is doing the same cardinal monetary sin at the same time.

Of course, none of this will get much exposure.

What will, however, is the former Chairman’s surprisingly defensive pivot in which it is almost as if he sense what is coming over the horizon when he unexpectedly says it wasn’t his fault the entire nation’s senior population was decimated due to his and Greenspan’s ludicrous policies.

When I was chairman, more than one legislator accused me and my colleagues on the Fed’s policy-setting Federal Open Market Committee of “throwing seniors under the bus” (to use the words of one senator) by keeping interest rates low. The legislators were concerned about retirees living off their savings and able to obtain only very low rates of return on those savings.

And the punchline:

I was concerned about those seniors as well.

Perhaps he is referring to seniors such as Omaha Octagenarians who had tens of billions in investments in a financial system that would have gotten insolvent overnight if he hadn’t bailed it out?

But if the goal was for retirees to enjoy sustainably higher real returns, then the Fed’s raising interest rates prematurely would have been exactly the wrong thing to do. In the weak (but recovering) economy of the past few years, all indications are that the equilibrium real interest rate has been exceptionally low, probably negative. A premature increase in interest rates engineered by the Fed would therefore have likely led after a short time to an economic slowdown and, consequently, lower returns on capital investments. The slowing economy in turn would have forced the Fed to capitulate and reduce market interest rates again. This is hardly a hypothetical scenario: In recent years, several major central banks have prematurely raised interest rates, only to be forced by a worsening economy to backpedal and retract the increases. Ultimately, the best way to improve the returns attainable by savers was to do what the Fed actually did: keep rates low (closer to the low equilibrium rate), so that the economy could recover and more quickly reach the point of producing healthier investment returns.

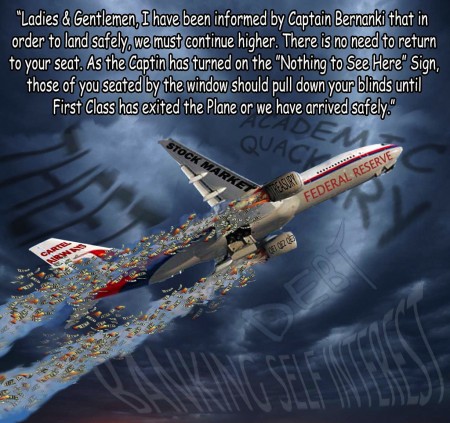

Well thank you for the admission that there really is no getting out of a world in which three consecutive and ever larger bubbles has burst, and now with central banks all-in to support the last one, the final outcome will be a global catastrophe with a good global war thrown in for good measure, unlike any seen before.

Yet the funniest part of Bernanke’s diatribe is when he tacitly shifts away from the Fed as the culprit for all that is wrong, and implicitly blames the government.

A similarly confused criticism often heard is that the Fed is somehow distorting financial markets and investment decisions by keeping interest rates “artificially low.” Contrary to what sometimes seems to be alleged, the Fed cannot somehow withdraw and leave interest rates to be determined by “the markets.” The Fed’s actions determine the money supply and thus short-term interest rates; it has no choice but to set the short-term interest rate somewhere. So where should that be? The best strategy for the Fed I can think of is to set rates at a level consistent with the healthy operation of the economy over the medium term, that is, at the (today, low) equilibrium rate. There is absolutely nothing artificial about that! Of course, it’s legitimate to argue about where the equilibrium rate actually is at a given time, a debate that Fed policymakers engage in at their every meeting. But that doesn’t seem to be the source of the criticism.

The state of the economy, not the Fed, is the ultimate determinant of the sustainable level of real returns. This helps explain why real interest rates are low throughout the industrialized world, not just in the United States. What features of the economic landscape are the ultimate sources of today’s low real rates? I’ll tackle that in later posts.

Let us guess: features such a Congress which is now completely and utterly incapable of passing even one law perhaps because the passage of any real reforms is vastly unpopular for any politician (just look at Greece), and after all why bother: “get to work, Mr. Chairman” has been the operative principle of the US Congress since 2009, a Congress which has had some $4 trillion in deficit funding to keep America going, monetized by Bernanke’s own Fed.

But don’t expect any mention of that in Bernanke’s blog. And likewise, don’t expect your comment to appear on the Brookings blog.

Comments are welcome, but because of the volume, we only post selected comments.

By selected they of course mean only those which praise the man who threw America’s seniors under the bus, er pardon, didn’t.

And certainly not any comments which remind the broader public of all previous Ben Bernanke greatest hits of whicht he following is a small sampling:

7/1/05 – Interview on CNBC

INTERVIEWER: Tell me, what is the worst-case scenario? We have so many economists coming on our air saying ‘Oh, this is a bubble, and it’s going to burst, and this is going to be a real issue for the economy.’ Some say it could even cause a recession at some point. What is the worst-case scenario if in fact we were to see prices come down substantially across the country?

BERNANKE: Well, I guess I don’t buy your premise. It’s a pretty unlikely possibility. We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.

10/20/05 – Testimony before the Joint Economic Committee, Congress

House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals.

11/15/05 – Confirmation Hearing before Senate Banking Committee

SEN. SARBANES: Warren Buffet has warned us that derivatives are time bombs, both for the parties that deal in them and the economic system. The Financial Times has said so far, there has been no explosion, but the risks of this fast growing market remain real. How do you respond to these concerns?

BERNANKE: I am more sanguine about derivatives than the position you have just suggested. I think, generally speaking, they are very valuable… With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly. The Federal Reserve’s responsibility is to make sure that the institutions it regulates have good systems and good procedures for ensuring that their derivatives portfolios are well-managed and do not create excessive risk in their institutions.

3/6/07 – At bankers’ conference in Honolulu, Hawaii… as delinquencies in the subprime mortgage sector rise

The credit risks associated with an affordable-housing portfolio need not be any greater than mortgage portfolios generally.

3/28/07 – Testimony before the Joint Economic Committee, Congress

Although the turmoil in the subprime mortgage market has created severe financial problems for many individuals and families, the implications of these developments for the housing market as a whole are less clear…At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.

5/17/07 – Remarks before the Federal Reserve Board of Chicago

…we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well.

8/31/07 – Remarks at the Fed Economic Symposium in Jackson Hole

It is not the responsibility of the Federal Reserve–nor would it be appropriate–to protect lenders and investors from the consequences of their financial decisions

1/10/08 – Response to a Question after Speech in Washington, D.C.

The Federal Reserve is not currently forecasting a recession.

2/27/08 – Testimony before the Senate Banking Committee

I expect there will be some failures [among smaller regional banks]… Among the largest banks, the capital ratios remain good and I don’t anticipate any serious problems of that sort among the large, internationally active banks that make up a very substantial part of our banking system.

4/2/08 – New York Times article after the collapse of Bear Stearns

“In separate comments, Mr. Bernanke went further than he had in the past, suggesting that the Fed would remain aggressive and vigilant to prevent a repetition of a collapse like that of Bear Stearns, though he said he saw no such problems on the horizon.”

6/10/08 – Remarks before a bankers’ conference in Chatham, Massachusetts

The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.

7/16/08 – Testimony before House Financial Services Committee

[Fannie Mae and Freddie Mac are] adequately capitalized. They are in no danger of failing… [However,] the weakness in market confidence is having real effects as their stock prices fall, and it’s difficult for them to raise capital.

Full Bernanke blog post HERE.

And I saw this somewhere on the web:

Ironically, this clown was introduced to the world as an expert on the Great Depression of the 1930s. What was not said he would take us back into one even worse………….in 1930, our currency was backed with gold, today, all it has behind it is ink.

This guy sat and did nothing but serve greedy guts. He is one more example of a not working part of the US economy.

What a clown. I am glad he isn’t being paid to speak, he never had a thing to say.