– “Chinese Economic Activity Has Probably Slowed To Less Than 3%” (ZeroHedge, March 5, 2015):

In a world in which sell-side research (and even that of independent third-parties) is not only meaningless – because as we first said in 2010 the only thing that matters in the New Paranormal is ‘the Fed’s H.4.1 statement’ – there are few sources of insightful, non-conflicted analysis. One place which stands out is Cornerstone Macro – yes, it costs a lot of money, but it’s worth it.

Cornerstone is the one place which actually turned bearish a little over a month ago, purely on fundamental factors (FX, oil, global recession), and has been pointing out many of the discrepancies in the narrative (then again, as we showed before, in a world in which central banks are set to have the greatest amount of nominal “intervention” surpassing even the post-Lehman period…

… one doesn’t have to be a rocket surgeon to realize that things are not only not good, but have rarely been worse even with the benefit of $13 trillion in central bank liquidity).

We bring it up because Cornerstone’s analysis of recent developments in China bears keeping a very dose eye on. We won’t spoil it, especially for those who are paying subscribers to the paid (and quite expensive) service, but we will present what they have chosen to broadcast publicly on their research section, which in light of last night’s official news of yet another confirmation the slowdown in China is getting worse (not only on the unprecedented debt build up which we have covered extensively in the past, and where monetary ‘austerity’ is suddenly a very hot topic, but where capital outflows have become the number one focal issue) has released several key research reports.

Here are the key publicly-available excerpts from some of their salient recent reports (accessible here and here):

From Hello Beijing, We Have a Problem:

China is likely to continue to ease, for 3 reasons:

1. Chinese economic activity has probably slowed to less than 3%.

2. China is likely to experience broad-based deflation.

3. China is Nicely to continue to experience net capital outflows. That last bullet, net capital outflows, is the focus of the report today.Bullets 1 and 2 are already widely discussed/debated. In the video and slide deck, we focus on this net capital outflows and how they are basically tightening financial conditions. That is what the PBoC is battling right now. Will growth reaccelerate?

From 3 Updates, China, Eurozone, And The U.S.

In China, based on the composite PMI (HSBC & CFLP), employment is weakening, helping explain the declining trend in consumer confidence. In addition, company earnings, as reported by IBES, declined 0.7% y/y in February. So, although the composite PMI ticked up slightly, it’s still at a sluggish 51.5%. That’s apparently weak enough to keep downward pressure on company earnings and therefore, employment

And finally from Another Dark Day For The CRaBs

Chinese govt has acknowledged growth is slowing, and is now forecasting 7% real GDP growth for 2015, the slowest pace in 25 years. We still believe underlying economic activity is growing closer to 2% – 3%.

There is much more in the actual notes, with extensive supporting documentation, which we leave to readers to uncover, but the bottom line is clear: on one hand we have China’s premier warning China will slow to “only” 7%, on the other we have a reputable research boutique using fact-based research and evidence, to determine that actual China’s growth is not even half this number!

What does this mean? Well, in a world in which the US is now very rapidly recoupling with what until recently was an ex-US global contraction (as Goldman confirmed), a China which is growing at a well below stall-speed pace, and in fact is at what even Deutsche Bank said is on pace for a mini hard landing, to think that the ECB’s monetization (of bonds which nobody really knows who will sell) will make up for China’s furious pace of credit creation (which is really what in a Keynesian world is what “growth” really is) is beyond naive.

If and when the reality of China’s predicament (recall that it was China’s creation of over $3 trillion in credit during the post-Lehman depression that was instrumental in the global rebound) spills over to the entire world, then all bets are off.

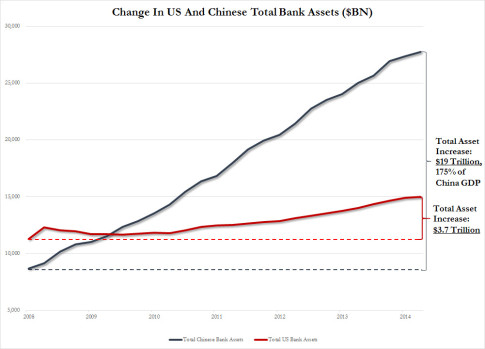

And just so readers have a sense of the Chinese credit/asset creation juggernaut, here is the chart of the day from our November 2013 post (update for the latest data below) showing “How China’s Stunning $15 Trillion In New Liquidity Blew Bernanke’s QE Out Of The Water.”

If the blue line plateaus, or – inconceivably – starts declining, that will be the time to panic.