What could possibly go wrong?

– Here Is The Reason Why Stocks Just Had Their Best Month Since October 2011 (ZeroHedge, Feb 28, 2015):

Despite ending the month with a whimper, after Fed vice-chairman’s hawkish words spooked the market on Friday afternoon, February was the best month for equities in over three years – since October of 2011 – driven by a 7% Nasdaq surge on the back of a gigantic move higher in Apple. And yet, as we have shown time and again, none of this reflects the “decoupling” US underlying economy, which if anything has rapidly recoupled with the rest of the world following 38 data “misses” and only 6 “beats”- the worst “surprise” index in 12 months…

… a world which as Goldman recently showed is now in outright contraction for the first time since 2012.

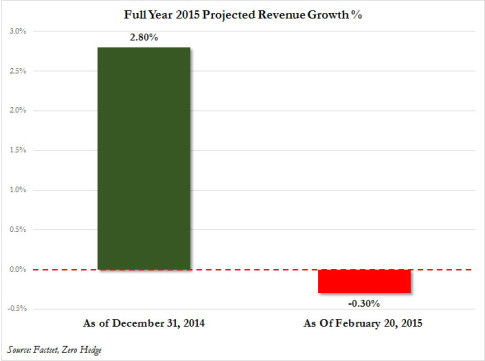

It also certainly wasn’t earnings: February was the first month in which we showed that as a result of plunging revenue and EPS guidance and deteriorating sales and profitability, 2015 will be the first year since Lehman when there will be a full year decline in year-over-year sales.

So if not the economy or fundamentals, and if not the Fed, which as we know is still on sabbatical after its massive QE1-2-Twist-3 $3 trillion liquidity injection, just what has pushed stocks up to jawdropping all time highs?

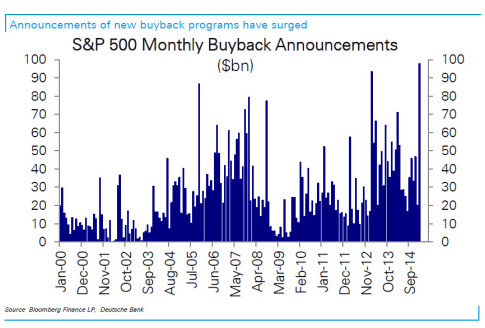

Here, courtesy of Deutsche Bank, is the answer:

In case it is unclear just what the chart above shows, here is DB’s explanation: “buyback announcements have surged with February ($98bn) posting the largest monthly tally on record. The pace of actual buybacks tends to closely follow that of announcements.”

And there you have it: the highest number of monthly buyback announcements in history, which for a market that may be broken but can still discount what companies will do (now that they have committed to buybacks) is merely frontrunning the most cost-insensitive buyer in the world: corporate management teams themselves.

It should thus come as no surprise why the S&P500 soared to record highs at a time when US economic data tumbled at the fastest pace in years. It should also explain the relentless buying of AAPL stock (among others), which pushed the Nasdaq to just why of 5000: recall that it was less than 3 weeks ago that AAPL announced it would proceed with merely its latest debt-funded share buyback.

It also explains why, in the absence of the Fed, stocks continue to rise as if QE was still taking place: simply said, bondholders – starved for any yield in an increasingly NIRP world – have taken the place of the Federal Reserve, and are willing to throw any money at companies who promise even the tiniest of returns over Treasuries, oblivious if all the proceeds will be used immediately to buyback stock, thus pushing equity prices even higher, but benefiting not only shareholders but management teams who equity-linked compensation has likewise never been higher.

To be sure, this theater of financial engineering – because stocks are not going up on any resemblance of fundamental reasons but simply due to expanding balance sheet leverage – will continue only until it can no longer continue.

What do we mean by that? Two things:

…

The baby is Jewish. That is an Elders’ secret hand sign.