– How The World’s Billionaires Stay Safe In Davos: “It Feels Like Half The Swiss Army Is Here”

With the western world facing high terror alerts, the biggest meeting of top CEOs and world leaders comes at a delicate time. As Bloomberg’s Tom Gibson exclaims in this brief clip, “it feels like half the Swiss army is here,” but officials play down the security presence as ‘business as usual’. With a special no-fly-zone and snipers overhead, Davos is protected by 3,000 military personnel for these few days… no wonder the billionaires aren’t worried about leaving their private jets unlocked on the Davis runways.

…

– Oil Producers Currency Collapse Continues, Nigeria’s Naira Crashes To Record Low Against Dollar:

Having proclaimed it is not Zimbabwe, Nigeria’s currency is starting to look a lot like a hyper-inflating mess. After devaluing to a 168 peg in November, the Naira has crashed to 200 / USD today – smashing above the upper peg band of 176 as it appears Nigeria is losing control. The collapse of Oil Producer currencies had abated for a week or two but the last 2 days have seen the Ruble and Naira tumble (even as The USDollar weakens modestly ahead of the ECB QE tomorrow).

…

Because nothing says ‘stability’ like a Central Bank in charge of things, the

smartestrichest men in the world have proclaimed in Davos this week that “we need a central bank of oil, like the central bank in financial world.” As long as they are not Swiss, of course. Oil has been volatile today amid these calls for stability after Saudi Aramco comments on cutting projects (supply) sent prices higher, and was then talked back by the CEO bringing prices lower. Oman – the largest non-OPEC Middle East oil producer – blasted that “we have created volatility,” noting it was having a “really difficult time,” and that’s “bad for business,” demanding OPEC slow production. But it was The IMF that sparked the greatest concerns as it warned oil producers to treat this oil price drop as permanent noting that they expect these economies to lose $300 billion. only to be contradicted by OPEC’s al-Badri who noted “oil prices will rebound back to normal soon.”…

– €425 MILLION anti-terror plan: France to hire thousands of extra police, spies & investigators:

France will create 2,680 extra anti-terror staff, as over 3,000 radical Islamists require surveillance, Prime Minister Manuel Valls said at a Wednesday meeting, revealing plans to boost terror strategies.

In the next three years, the number of security agency employees involved in counter-terrorism activities, will be increased by 2,680 people. The funding will be boosted by €425 million.

…

– Greece’s Bailout Programs Are Not Working:

Greece’s bailout program is not working. After receiving hundreds of billions of Euros in new loans to stave off a sovereign default, Greeks are on the verge of electing a new government that may throw Eurozone politics into turmoil. How things will play out in Greece and abroad is anybody’s guess. But it is important to consider the factors which have contributed to the current state of affairs.

…

– Kansas Officials Admit “Strong Correlation” Between Quakes & Fracking:

If the government and the Kansas Corporation Commission care about the people of Kansas and the damages, they will order a moratorium,” exclaims Joe Spease, chairman of the Kansas Sierra Club’s fracking committee following a report from Kansas officials, who have been reluctant to link the mysterious earthquakes in south central Kansas to fracking, admitted last week that “we can say there is a strong correlation between the disposal of saltwater and the earthquakes.” As LJWorld reports, it’s the first time state officials have so clearly stated the likely cause of the earthquakes, which are afflicting a region where fracking is widely used.

…

– America’s Ultra Luxury Housing Bubble Has Burst: “Deals Have Slowed To A Trickle”:

As we further showed, the bulk of foreign demand for New York’s most expensive properties, originated in China, Russia and various other oligarch-controlled nations, where the impetus to launder illegally obtained hot money meant an impulse to buy US real estate sight unseen and virtually at any price. And all of it, of course, all cash. No mortgages. That onslaught of foreign oligarch demand is ending, and with it so is the bubble that luxurious New York real estate found itself in on the back of some $12 trillion in central bank liquidity created out of thin air in the past 6 years. Business Week cites Manhattan real estate agent Lisa Gustin who listed a four-bedroom Tribeca loft for $7.45 million in October, expecting a quick sale. Instead, she cut the price this month by $550,000. “I thought for sure a foreign buyer would come in”… They didn’t.

…

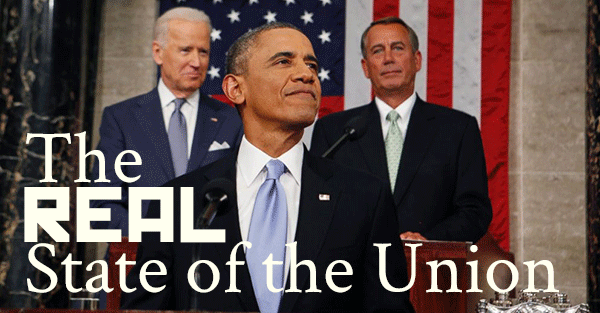

– ‘Everything Is Awesome’ SOTU Post-Mortem: “It’s Not Government’s Job To Make Everybody Rich”:

The only thing we did not get from tonight’s State of The Union speech was a “Mission Accomplished” flag… oddly some of the 6,493 words (the lowest word-count of his Presidency) were not entirely ‘factual’…

…

– Russian spy ship in Havana ahead of US delegation’s historic visit:

The Russian Navy’s intelligence collection ship, the Viktor Leonov, has docked in Havana just a day before the arrival of an American delegation. The Russian warship is moored in open view of a pier usually used for cruise ships.

The ship’s visit, unannounced by the Cuban authorities, comes as the US and Cuba are attempting to restore diplomatic ties broken in 1961.

…

– And Another Shocker: Bank Of Canada Stuns Market With Completely Unexpected Rate Cut:

USDCAD breaks 1.23 – weakest since April 2009

Unexpected to most, The Bank of Canada cut its benchmark interest rate to 0.75% citing financial stability risks and worried about downside inflation risks. The press release is extremely negative… *MAGNITUDE OF OIL SHOCK CREATES EXCEPTIONAL UNCERTAINTY: BOC

…

– The Road To The Welfare State: Why 50% Of “Exceptional” America Gets Checks From Uncle Sam:

Despite tactical, rhetorical opposition to further expansion of the entitlement state by many voices in Washington, and firm resistance by an honorable and principled few, collusive bipartisan support for an ever-larger welfare state is the central fact of politics in our nation’s capital today, as it has been for decades. Until and unless America undergoes some sort of awakening that turns the public against its blandishments, or some sort of forcing financial crisis that suddenly restricts the resources available to it, continued growth of the entitlement state looks very likely in the years immediately ahead. And in at least that respect, America today does not look exceptional at all.

…

– Gotta Keep Dancing – Honda Executive Laments “Stupid” Auto Loans Driving U.S. Sales Higher:

When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. We’re still dancing.

– Chuck Prince, Citigroup CEO, July 2007

We’ve seen this movie before, we know how it ends, and it’s not pretty. But I say that it has longer to run, and we have already paid the price of admission. So we might as well stay to the end. You just keep your eyes on the exit door.

– Tom Webb, Chief Economist at Manheim Consulting, January 2015

…

– For Lulz? PEGIDA leader Lutz Bachmann steps down after Hitler-style pic emerges:

De facto PEGIDA leader Lutz Bachmann is to step down from his post after a Facebook photo of the organizer looking remarkably like Nazi leader Adolf Hitler – toothbrush mustache, pursed lips and side-part included – was printed in a German tabloid.

…

– 11 facts that won’t be in tonight’s State of the Union address:

…

The real issue, however, isn’t where the United States is today. The problem is where it’s going. And quickly.

…

– Record Iraqi oil output adds more downward pressure on prices:

Iraq’s daily oil production reached a record 4 million barrels in December 2014 and the country is planning to increase its share of the global oil market, said Iraqi Oil Minister Adel Abdul Mahdi. The decision is likely to push oil prices even lower.

…

– Toronto under Extreme Cold Weather Alert

– Spain – Up to a meter of snow dumped on mountain communities

– Winter storm warnings for Newfoundland and Labrador

– WORLD WAR III: Anglo-American Axis vs. BRICS Alliance:

Those who called it early on were absolutely right as All Hell Broke Loose In 2014.

Yeah, but what’s really going on? With Russia? With Vladimir Putin? With the plummeting oil price?

Why is the price of gold always gyrating like a jitterbug? And how is it that the stock market is booming in the face of so much economic doom and financial gloom?

Why did the Ukraine become ground zero for this evolving World War III scenario?

…

If it keeps them afloat this time, will they legalise it?

http://www.theguardian.com/global/2009/dec/13/drug-money-banks-saved-un-cfief-claims