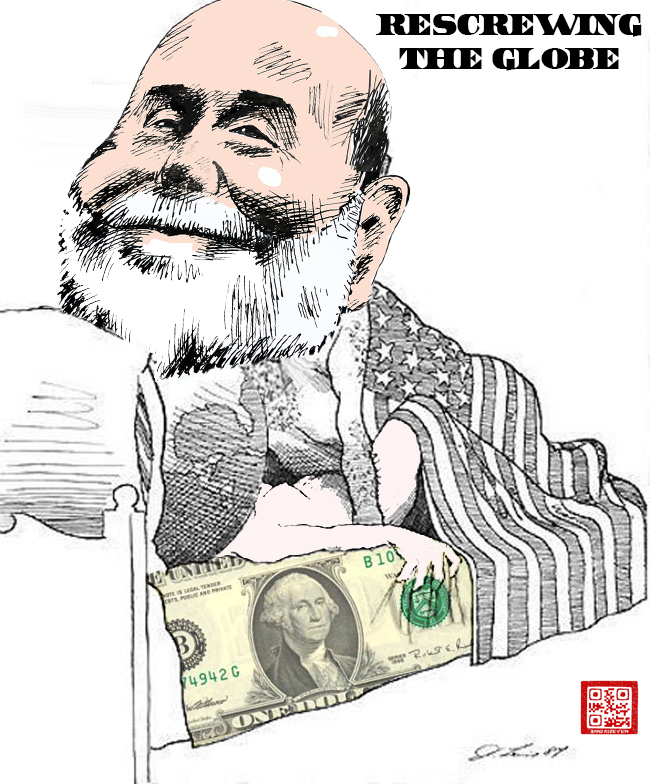

– Fed Finally Admits Frontrunning Of Central Banks Is What Moves Markets (ZeroHedge, Jan 7, 2014):

Something curious appeared in the December minutes – the Fed finally admits that market is no longer a discounting mechanism of a reality in which central bank intervention is irrelevant, but that market, or rather “market” merely discounts what centrals banks (and by “what” we mean will they or won’t they inject a few trillion in liquidity) will do next.

In their discussion of financial market developments, participants observed that movements in asset prices over the intermeeting period appeared to have been importantly influenced by concerns about prospects for foreign economic growth and by associated expectations of monetary policy actions in Europe and Japan.

And now if only the Fed could apply the same logic to itself, it would grasp (publicly, it clearly did so in private some 101 years ago) that the market, or rather “market” merely frontruns how much liquidity it will provide to the market. We would then welcome this biggest enabler of monetary heroin to the 1st step of a long and very painful detox program.

How long can the FED provide unlimited funds when there is nothing behind it? This has been my question since 2008, and they just print more…………this is why 70% of the world has stopped using the dollar, the dollar has nothing behind it but ink.

I no longer understand the world or the economy, none of it makes sense. Weekly jobless claims FALL to 294,000……showing a “firming” of the job market………what lies. For every job lost, seven more are put at risk, putting the number at nearly two million jobs. For 300K jobs, the number is over two million………..a week.

How the real economy got removed from the markets is beyond me, but greedy gut manipulations have taken all life out of the market…..

We are done. How they can keep it going regardless the economy is dying is beyond my understanding. 2008? Why does nobody mention 2001, when the real crash started?