– Turkmenistan Devalues Currency By 18%, Armstrong Warns Of “Economic Collapse On A Global Scale” (ZeroHedge, Jan 2, 2015):

The energy-rich former Soviet republic of Turkmenistan Thursday devalued its currency against the US dollar by 18%,as AFP notes, in the latest sign of contagion among Russia’s neighbors from the plunging ruble (following Krgyzstan’s 17% plunge in 2014 and Kazakhstan’s 14% tumble). However, as Martin Armstrong warns, this is symptomatic of a deflationary contagion that “will contribute to now force the dollar higher… We are in a major economic collapse on a global scale. Most people do not understand that this is the real threat we face.”

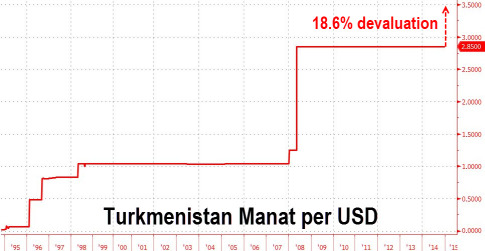

On Thursday, the website of Turkmenistan’s central bank published the rate of 3.50 manats to the US dollar, from 2.85 manats, a depreciation of 18.6 percent.

The devaluation came as the plunge in value of the Russian ruble, linked to Western sanctions over Ukraine and falling oil prices, sent shockwaves through former Soviet republics.

All Turkmenistan’s currency exchange offices and banks were closed Thursday, officially due to the public holiday.

The official exchange rate set by the central bank for the manat had been set at 2.85 to the US dollar since 2009. Earlier in 2009, Turkmenistan had knocked zeroes off the manat in a redenomination after the official exchange rate reached 14,250 to the dollar.

Turkmenistan has been led by President Gurbanguly Berdymukhamedov since 2006, following the death of the eccentric dictator Saparmurat Niyazov, who erected a golden statue of himself that revolved to face the sun.

But that’s not the only pain…

Earlier Thursday, Turkmenistan’s oil and gas ministry announced petrol prices had risen by 60 percent. The rising price did not immediately lead to long queues at petrol pumps.

A litre of one type of petrol on Thursday cost one manat, while previously it cost 62 tenge (22 US cents under the previous exchange rate). No immediate explanation was given for the sudden price rise.

Martin Armstrong’s perspective on this…

Turkmenistan, the former Soviet republic, devalued its currency against the US dollar by 18% for the new year. Turkmenistan is energy-rich and this is the latest sign of seriousness of the collapse in oil.

This will contribute to now force the dollar higher as commodities decline, the energy producing nations will be compelled to devalue their currencies in an effort to try to make ends-meet.

Devaluations will result in an attempt to create inflation to offset the deflation.

We are in a major economic collapse on a global scale.

Most people do not understand that this is the real threat we face.

We know, we know, “too small to matter”… “contained”… etc etc etc… nothing matters until it all matters remember… and the number of straws on this camel’s back are starting to get very heavy.

He is spot on about deflation, that is the real danger, and it is present everywhere. I was shocked to see how prices have dropped for new consumer items over the past year. I have mentioned the huge growth of thrift shops in areas of my city that were high rent only a couple of years ago…….but a thrift shop is better than a vacant store front……people are afraid to spend because jobs continue to evaporate at the hundreds of thousands each week here in the US. In the EU, our only remaining financial partner, the losses are even worse.

Both the US and EU are riding on what is left of their credit.

He is correct when he says it is a global disaster facing us, and deflation is far harder to fight than inflation because inflation gives the hope your prices can go up, your property values can go up…………..as it is, everything is stagnant or dropping.

I loved what Mr Eckles, the FED chairman under FDR said in 1952 when asked what caused the crash of 1929: “As in a poker game, the chips get concentrated in fewer and fewer hands, and the other fellows can only stay in the game by borrowing. When their credit ran out, the game stopped.”

We are very close to our credit running out.

Earlier tonight, I listed some nations and their debt level…….and regardless of what is happening to this country, the money is going east, and leaving the west in droves.