– Betting On The ‘Other’ Oil Black Swan (ZeroHedge, Dec 8, 2014):

With oil prices plunging to 5-year lows, perhaps it is time to consider the cheapness of betting on the other oil black swan…

Via BofA’s Jake Greenberg,

In my base case, I remain structurally bearish oil. The world is making huge productivity and efficiency gains (lighter vehicles, new technology, etc.), and we are starting to see real substitution (e.g. to LNG and CNG). On the supply side, oil is not resource constrained (i.e. at the right price, you get more shale coming to market + Libya + KRG + North Sea’s Buzzard + Arctic, etc) and OPEC is a dysfunctional oligopoly. Francisco Blanch thinks we could see Brent drop below $60/bbl in the next six months.

Interestingly, lower oil prices may not incentive increased demand as both China and India are taking advantage of the drop to raise taxes on fuel consumption. Lower crude prices are not being passed on to the end consumers in the markets that matter most for demand growth. See the WSJ here: India raises taxes on fuels. And the Australian here: China lifts fuel tax

Oil’s black swan…

That said, if oil prices go “too low”, there are some very powerful State actors who could become incentivized to precipitate a geopolitical crisis in order to get oil prices back up. E.g. a Saudi Arabian spring, or an attack on a major pipeline? The ISIS-sponsored attack in November in Saudi Arabia’s oil-rich Al Ahsa region did not get a lot of air time, but this is definitely an article worth reading…again from the WSJ: ISIS urging attacks on Saudi

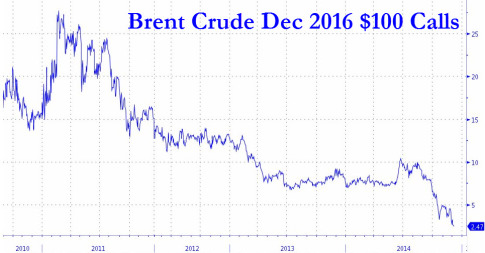

Given this tail risk, I would want to own some long-dated, out of the money call options on Brent within my portfolio.You can buy the DEC 16 $100/bbl call options (COZ6) for ~$2.50, ~21.5vol.

That doesn’t seem expensive for two years of insurance against a supply side shock. Plus, assuming we see a curtailment of investment, oil could just rise naturally to this price level over the next two years…