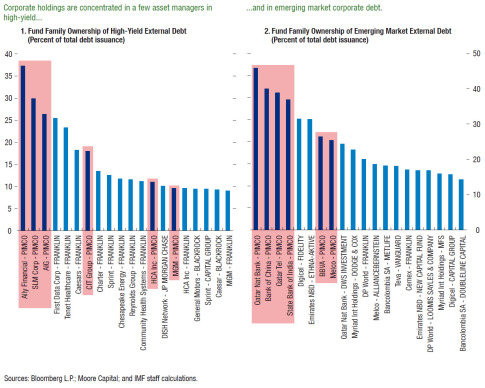

– Why Everyone Should Be Watching PIMCO (In 2 Worrying Charts) (ZeroHedge, Oct 12, 2014):

By now it is clear to everyone that the force-feeding of free-money into financial markets by The Fed et al. has led to a scale of financial repression never before witnessed as bond yields for even the riskiest of risky names collapse to record lows and cheap-financed share buybacks raise leverage to record highs and support an ever more fragile equity wealth creation machine. As Blackrock (and many others) have recently proclaimed, the corporate bond market is “broken” and the risk posed by investors trying to dump bonds is”percolating right under” the noses of regulators; so it is with grave concern we suggest the following two charts – showing the massive out-sized holdings of PIMCO’s funds in the high-yield and emerging market debt markets leave a bond marketplace in fear that forced sales via redemptions are the straw that breaks the ‘central bank omnipotence’ narrative’s back…

PIMCO – simply put – dominates the market for high-yield and emerging market debt…

Source: IMF

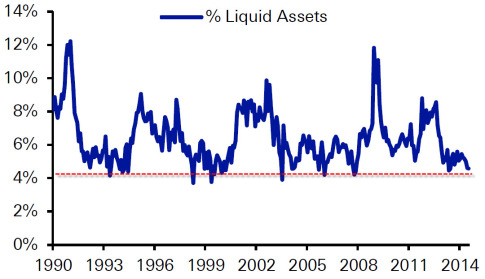

And if you are under some mistaken belief that they can fund redemptions from cash or more liquid assets… think again…

In other words, the massive (and likely levered) positions The Fed has forced the world to take on by its repression face a dramatic liquidity risk cost if they are ever to ‘realize’ any gains from the Fed’s handouts (by actually selling).

That’s what every bond manager ‘knows’…

* * *

To BlackRock, the dangers of price gaps and scant liquidity have been masked in a benign, low interest-rate environment, and need to be addressed before market stress returns.

…

The risk posed by investors trying to dump bonds after the Federal Reserve raises interest rates is “percolating right under” the noses of regulators, he said.