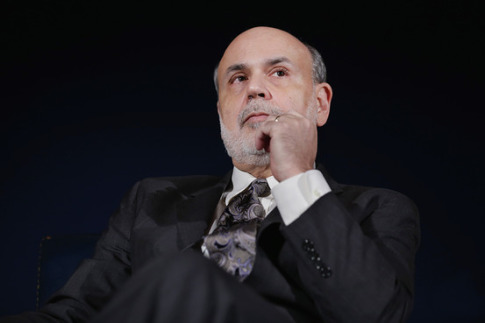

Former Fed Chairman Edward Quince. Or is it Ben Bernanke?

– Meet Edward Quince, the Secret Federal Reserve Chairman in 2008 (Wall Street Journal, Oct 9, 2014):

Edward Quince was arguably the most powerful person in the world in the fall of 2008, with the fate of financial markets resting on his high-stakes decisions.

It turns out he didn’t actually exist.

Mr. Quince was the pseudonym then-Federal Reserve Chairman Ben Bernanke used on emails when he was conferring with colleagues during the financial crisis. The false name was revealed as evidence as part of a class-action lawsuit against the government by shareholders of American International Group Inc., which received a giant Fed-backed bailout as it teetered toward collapse.

A Fed spokeswoman, who confirmed Mr. Bernanke’s use of the pseudonym, said the name didn’t have any particular significance.

The trial has blown the cover on the world’s perhaps first undercover, super-secret central banker. Last week, Fed general counsel Scott Alvarez testified that Mr. Bernanke had used the email pseudonym while at the central bank “to make sure that he didn’t get extraneous emails.”

A Justice Department lawyer, Kenneth Dintzer, introduced emails to and from Mr. Quince as evidence in the case on Wednesday.

On Saturday, Sept. 13, 2008, then-Fed vice chairman Donald Kohn sent an email to then-Fed governor Kevin Warsh, then-New York Fed president Timothy Geithner and the mysterious Mr. Quince, relaying a conversation Fed officials had with AIG. The insurance giant at the time was running out of access to short-term funding, a problem government officials feared could have a calamitous global impact. AIG officials wanted Fed assistance–fast.

“They were vague as to what they expected from us but it sounded like an open-ended liquidity factility,” Mr. Kohn wrote. “‘A bridge to nowhere’ at this point.”

Later in the email, Mr. Kohn went on: “At the end we could blink if they are too connected to fail, but that will open up an unknown can of worms in terms of access to discount-window credit.”

Mr. Quince replied shortly thereafter: “We think they are days from failure. They think it is a temporary problem. This disconnect is dangerous.”

Mr. Dintzer, the Justice Department attorney, told everyone in the courtroom that Mr. Quince was in fact Ben Bernanke, which Mr. Geithner confirmed on the witness stand.

It’s not clear why Mr. Bernanke used a false name for emails during the crisis or when the practice started.

A search of other records shows at least one public reference to Mr. Quince before now. In a hearing of the House Oversight and Government Reform Committee in January 2010, Rep. Spencer Bachus (R., Ala.) read a piece of an email dated March 2009, citing Mr. Geithner (by then the U.S. Treasury Secretary) and William Dudley of the New York Fed: “Secretary Geithner e-mailed William Dudley and Edward Quince, and he said, ‘Where are you on the AIG counterparty disclosure issue?’ You know, are you for disclosing or not?”

The email apparently went on a screen at the hearing, a transcript of the event suggests, but there was no other mention of Mr. Quince after that.

Edward Quince doesn’t exactly seem like the type of name you pull out of a hat, but it’s hard to tell what the significance might have been. There is at least one Edward Quince with a Facebook account, though, based on the profile picture of two adolescents on scooters, it doesn’t appear to have anything to do with Mr. Bernanke.

There also appears to have been an Edward Quince who lived during the 19th century and moved from England to Australia as a “bounty immigrant” with his wife.

Mr. Bernanke’s alias conjures memories of Montagu Norman, the eccentric late Bank of England governor who in the 1920s and 1930s traveled under the name of “Professor Skinner.”

The Shadow man……..perfect for Halloween…….pity he really exists…….