– Most People Don’t Believe It, But We Are Right On Schedule For The Next Financial Crash (Economic Collapse, Sep 4, 2014):

People have such short memories. Even though we are repeating so many of the same patterns that we witnessed in 2000-2001 and 2007-2008, most people do not think that another financial crash is coming. In fact, with the stock market setting record high after record high lately, I have been taking quite a bit of criticism for my relentless warnings about the coming financial storm. Many of the comments go something like this: “Snyder you are a moron! Nothing you say ever comes true. The stock market is going to keep on rocking and Obama is going to lead this country back to greatness. I hope that you choke on all of your doom and gloom.” Of course these critics never offer any hard evidence that I have been wrong about anything. They just assume that since the stock market has soared to unprecedented heights that all of us “bears” must have been wrong.

But the truth is that what we are observing right now is classic bubble behavior. The stock market crashes of 1929, 1987 and 2008 were all preceded by irrational market rallies in the spring or summer. The financial markets have become completely divorced from economic reality, and such a state of affairs never lasts forever. It is just a matter of time before a correction comes.

But every time there is a bubble, most people end up getting caught up in all of the euphoria. And it is happening again. In fact, CNBC has just reported that bearishness among market newsletter writers is the lowest that it has been since 1987. But of course we all remember what happened back in 1987…

Professional investors haven’t had this little fear about stocks since Ronald Reagan was president.

It was the same year Michael Jackson told us in a song he was “Bad.” The New York Giants won the Super Bowl.

And oh yeah … by the way … the stock market crashed.

As gauged by the weekly Investors Intelligence report, bearishness among market newsletter writers has fallen to 13.3 percent, a level it has not seen since 1987 as the market continues to set new highs despite a seemingly endless call for a long-overdue correction.

People need to understand that just because something has not happened yet does not mean that it is not going to happen.

In this day and age, we have extremely short attention spans and we do not have the patience to wait for much of anything. But the financial world is not a game of checkers. It is a game of chess where things can take an extended period of time to play out.

Those that are mocking those of us that are bearish should consider where we stand financially in comparison to previous crash cycles. For example, the derivatives bubble is 20 percent larger than it was back in 2008, the “too big to fail banks” are 37 percent larger than they were back in 2008 and global debt levels are 40 percent larger than they were back in 2008.

In other words, many of our long-term economic problems are a lot worse than they were just prior to the last major financial meltdown.

But most people pay such little attention to the fundamentals these days. All they can see is that little stock market ticker going up and up and up.

Other analysts with much stronger credentials than I are issuing similar ominous warnings about what is ahead for the financial markets.

For example, Nobel Prize-winning economist Robert Shiller is warning that market valuations are tremendously bloated right now…

Shiller, a Yale University professor who is often cited as one of the most influential people in economics and finance in the world, created a metric that compares stock prices with corporate profits. The metric recently climbed above 25. That level has only been surpassed three times since 1881: 1929, 1999 and 2007.

Steep market tumbles followed each instance, including the bursting of the dotcom bubble in the early 2000s.

But it doesn’t take a genius to see this.

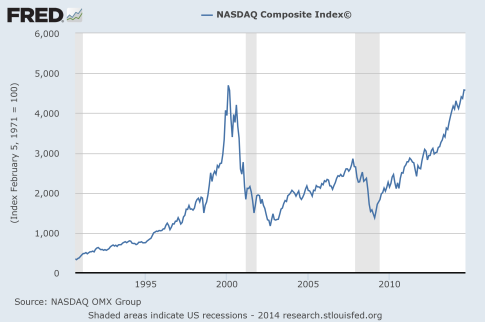

Just look at the chart of the NASDAQ that I have posted below. The “dotcom bubble” in 2000 is really easy to see. So why can’t more people recognize the bubble that is happening now?…

In so many ways this bubble is reminiscent of the “dotcom bubble” of 14 years ago. Consider the following numbers from a recent article by Brett Arends…

When you look at medians, or in other words the typical stock, valuations are higher today than they were at the peak in 1999-2000.

For example, the median stock today is 20 times earnings. In January 2000, it was 16 times.

The median stock today trades at 2.5 times “book” or net asset value. At the start of 2000 it was just 2.2 times.

The median stock today trades for 1.8 times annual per-share revenues. In 2000: just 1.4 times.

What we are experiencing is not normal.

And this is especially true considering the fact that our overall economic performance is tepid at best.

A stock market correction is coming.

But you don’t have to take my word for it. Some of the most prominent names in the financial world are warning about the coming correction. Two of them were recently interviewed by CNBC…

A jolt to international confidence in central banks will lead to a 30 to 60 percent market decline, David Tice, president of Tice Capital and founder of the Prudent Bear Fund, told CNBC’s “Power Lunch.” When this happens, he said, markets will face a “period of extreme turmoil.”

This crash will be precipitated, he said, by a disillusionment with the Federal Reserve’s “confidence game,” which will then see inflation rise, and the Fed scramble to raise rates. At that point, Tice added, “the Fed starts to lose control.”

Another market watcher also called for an impending fall.

The Fed’s low interest rates could bring a “scary” 50-60 percent market correction, said technical analyst Abigail Doolittle.

“Unfortunately, I think it could come on a crash similar to what happened in 2007,” Doolittle, the founder of Peak Theories Research, said on “Squawk Box” a day after the S&P 500 closed above the 2,000 level for the first time ever. “It’s tough to know what the exact catalyst will be. But that’s the very nature of that kind of selloff. They start slowly and then happen very suddenly.”

And as Zero Hedge has pointed out, billionaires such as Sam Zell, George Soros, Stan Druckenmiller and Carl Icahn all seem to be “quietly preparing” for the next crash.

Yes, the next financial crash has taken longer to come to fruition than many had anticipated. But as I have discussed so many times before, this is a very good thing. We should want this period of relative stability to last for as long as possible. The longer that things remain relatively stable, the longer that all of us have to prepare and to position ourselves for the financial chaos that is coming.

At this point, the fact that we are in the midst of a massive financial bubble has become so obvious that even the Bank for International Settlements is publicly talking about it…

Financial markets have been exuberant over the past year, […] dancing mainly to the tune of central bank decisions. Volatility in equity, fixed income and foreign exchange markets has sagged to historical lows. Obviously, market participants are pricing in hardly any risks.

Many have expected me to “change my tune” about the coming collapse because of how well the stock market has been performing.

Well, that simply is not going to happen.

Our economic fundamentals have continued to deteriorate, and our financial system is in far worse shape than it was just prior to the financial crash of 2008.

The truth is that we are right on schedule for the next great financial crash.

You can choose to ignore the warnings if you would like, but ultimately time will reveal who was right and who was wrong.

there is a great difference between 2001 and now, look at the charts. the first one grows exponenetially, nowadays not, a correction will come soon probaly this month but after that it is up as saving money is spending money, bonds aren’t trustworthy and so on so what remains are stocks

To Henk:

The differences between 2001 and 2014 are manifold.

Millions upon millions of good paying jobs are gone forever. We have shuttered nearly 60,000 MFG plants. Millions more have lost homes, jobs, portfolios, retirement funds…….the US economy has been gutted thanks to the criminals who took power in 2000, while US citizens slept through it. Our wealth is gone, while greedy gut corporations show profits. The market goes up regardless of the real economy.

When I first invested in the US stock market, I was a girl of fourteen. My father took me down to buy my first block of stock. In those days, you could not buy stock unless you paid for at least one block of 100 shares. You could not sell for a year unless you were willing to pay long term capital gains taxes. After a year, you could sell and pay short term capital gains. Stocks were something we invested in for the long term, and investors were putting their money into the market, not playing on margin or derivatives.

Back then, our markets were the best in the world, our credibility was #1 in the world. All of that is gone, the foreign investment we used to enjoy has nearly ceased completely. Our markets are so crooked, nobody will invest here. Currently, the FED carries more than 86% of the interest on our national debt, paying the interest to keep the debt current.

Now might be a time to remind folks the FED is a private bank, not part of the US government. At what point will they choose to cut their losses?

Thank the leadership we have suffered with after the coup of 2000 and since, our markets are now, like our economy…..a shell. 85% of all investments are High Frequency, where one individual controlling massive amounts of money in big funds, buys and sells large amounts of securities in less time than we blink an eye. Note the word sell…..all of them are buy, skim and sell. Every time a High Frequency trade happens, more money leaves the market. Nothing remains to build the market.

That leaves 15% of the market made up of investors. Of that percentage, we don’t know how many buy on margin.

Todays stock market is completely divorced from the real economy……there is no relation to it at all. It is totally rigged, no matter what happens, the market goes up.

The market used to be a good indicator of our economy and its future. If printer stock went up, one would consider buying paper stock…..the logic is simple, and it used to work when the market was related to the real economy. No longer.

Every time more people lose jobs, the market goes up. Every MFG plant moved offshore means more profit. No thought is given to the jobs lost. For every job that is lost, seven more are put in danger. When people work, they spend money on gas for their cars, food for their lunches, dry cleaners for their clothes, buy new clothes and shoes for their jobs, take classes to improve their work skills, pay insurance for their cars, pay to park……..it is easy to see if you look.

In 2000, a corrupt court put the losing candidate into the White House, a silent coup, and nobody said a word. 911 happened, and the gutless congress handed over their constitutional duties, such as declaring war, spinelessly over to the president.

Those who protested the inauguration were never given coverage on corporate TV. 911 happened, and all the reasons for a strong republic were sidelined.

The Patriot Act was enacted. Those of us opposed to it’s draconian policies could get no voice, no coverage, no traction. Next came NSA spying, some of us even drew up petitions opposing it, we were ignored.

NSA Spying allowed government to use military spy equipment to look through our roofs into our bedrooms and basements to spy on us. The same equipment devised for our enemies, was turned on us. Information from these tools were to be “shared with local law enforcement”. The totalitarian government was established.

Next, Bush invaded Iraq. Not one person in Iraq had a thing to do with 911, 17 of those bastards were Saudis…..but Bush wanted the oil for his buddies. They went in, and the first night, they secured the oil fields.

They destroyed a nation that had not done a thing to deserve it. After setting up a puppet government, they gave all 63 of the major oil outlets to their corporate buddies using long term, low paying leases. The US used its military might to steal their oil. Not one cent of revenue went into the US treasury, all the profits went to corporations, the costs to the people. Today, there are over 50,000 mercenaries there, Obama left them there to protect the oil for the oil companies, living in the embassy they built. Their six figure salaries are paid by the US taxpayer.

I could go on, but the differences between 2001 and today are far too many to list.

Essentially, the middle class, all new businesses have been eliminated. All profits go to the few on top while millions wander the streets homeless and hopeless.

There is no recovery in sight.

When a country gets a government that works against the best interests of its people, it has lost all. That has happened to the US. The fools in power have taken us over the cliff, all that is left is the fall.