– US Economy Shrank By 1% In The First Quarter: First Contraction Since 2011(ZeroHedge, May 29, 2014):

Weather 1 – Quantitative Easing 0.

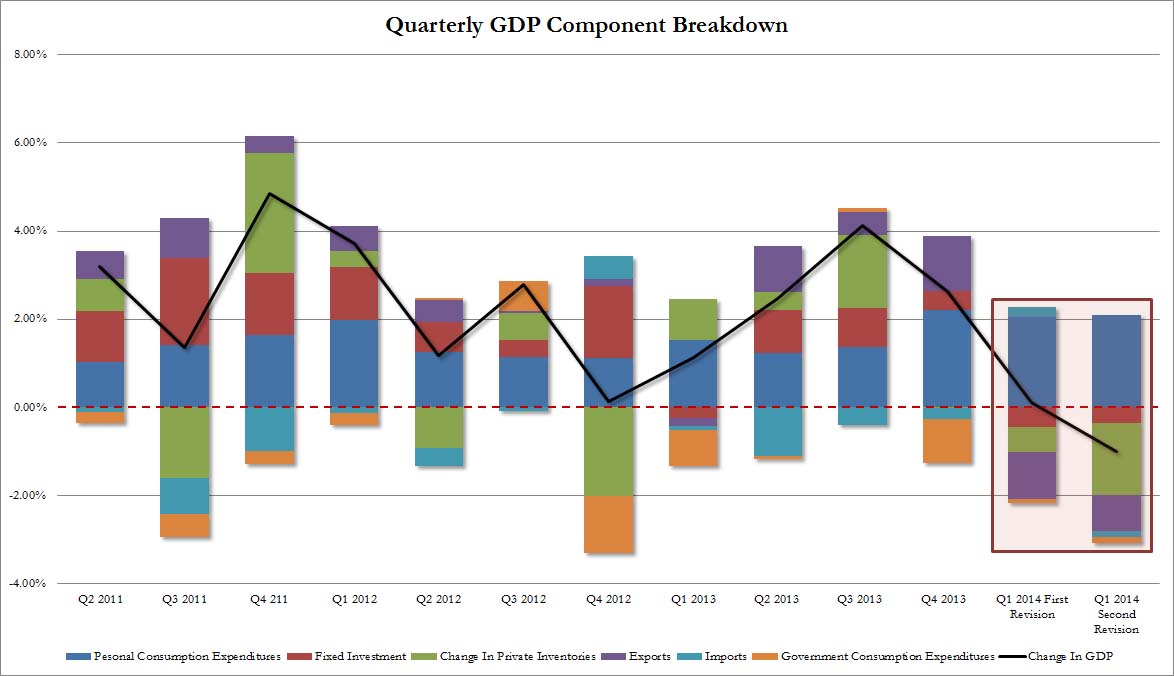

Spot on the chart below just how high the culmination of over $1 trillion in QE3 proceeds “pushed” the US economy.

Joking aside, while the realization that nobody can fight the Fed except a cold weather front, is quite profound, in the first quarter GDP “grew” by a revised -1.0%, down from the +0.1% first estimate, and well below the -0.5% expected, confirming that while economists may suck as economists, they are absolutely horrible as weathermen. This was the worst print since the -1.3% recorded in Q1 2011.

Bottom line: for whatever reason, in Q1 the US economy contracted not only for the first time in three years, but at the fastest pace since Q1 of 2011. It probably snowed then too.

The breakdown by components is as follows:

Some highlights:

- Personal consumption was largely unchanged at 2.09% from 2.04% in the first estimate and down from 2.22% in Q4. Considering the US consumer savings rate has tumbled to post crisis lows at the end of Q1, don’t expect much upside from this number.

- Fixed investment also was largely unchanged, subtracting another 0.36% from growth, a little less than the -0.44% in the first estimate and well below the 0.43% contribution in Q4.

- Net trade, or the combination of exports and imports, declined from

-0.83% to -0.95%, far below the positive boost of 0.99% in Q4.- The biggest hit was in the change in private inventories, which tumbled from -0.57% in the first revision to a whopping -1.62%: the biggest contraction in the series since the revised -2.0% print recorded in Q4 2012.

- Finally, government subtracted another -0.15% from Q1 growth, more than the -0.09% initially expected.

So there you have the priced to perfection New Normal growth (inclusive of “harsh weather”, which obviously has to be excluded for non-GAAP GDP purposes), which also now means that in the rest of the year quarterly GDP miraculously has to grow at just shy of 5% in the second half for the Fed to hit the “central tendency” target of 2.8%-3.0%.

And now we await for stocks to soar on this latest empirical proof that central planning does not work for anyone but the 1%.

The US is sinking.

Less than half the world now accepts the dollar.

No money is coming into this country.

The market is being kept afloat in face of the QE easing from $85-45 billion by corporations buying back their own stock……putting NOTHING into the economy, simply moving money from one pocket to another……just like the FED keeps the national debt current by printing and paying it up…….nothing is coming in to fuel the economy, all is put in to keep the status quo, nothing more.

The status quo has been the same since bush was president……..cost all on the people, the few on top get richer while the rest pay for it.

There has been NO GROWTH in this economy since the era when Obama put up cash for Klunkers ($2 million) and stopped it before it could really help the economy. Starve the people…..that has been the plan since the coup of 2000.

No growth in nearly 15 years.

Roads broken.

Hospitals closing for lack of funds……..

Schools closing for lack of funds………

Everything of value has been defunded.

It just sucks……..