– The Elephant In The Room: Deutsche Bank’s $75 Trillion In Derivatives Is 20 Times Greater Than German GDP (ZeroHedge, April 28, 2014):

It is perhaps supremely ironic that the last time we did an in depth analysis of Deutsche Bank’s financial situation was precisely a year ago, when the largest bank in Europe (and according to some, the world), stunned its investors with a 10% equity dilution. Why the capital raise if everything was as peachy as the ECB promised it had been? It turned out, nothing was peachy, and in fact DB would proceed to undergo a massive balance sheet deleveraging campaign over the next year, in which it would quietly dispose of all the ugly stuff on its balance sheet during the relentless Fed and BOJ-inspired “dash for trash” rally in a way not to spook investors about everything else that may be beneath the Deutsche covers.

We note this because moments ago, Deutsche Bank did the same again when it announced that it would issue yet another €1.5 billion in Tier 1 capital.

The issuance will be the third step in a co-ordinated series of measures, announced on 29 April 2013, to further strengthen the Bank’s capital structure and follows a EUR 3 billion equity capital raise in April 2013 and the issuance of USD 1.5 billion CRD4 compliant Tier 2 securities in May 2013. Today’s announced transaction is the first step towards reaching the overall targeted volume of approximately EUR 5 billion of CRD4 compliant Additional Tier 1 capital which the Bank plans to issue by the end of 2015

Ok, so in retrospect nothing is peachy in Frankfurt, and for all the constant lies about improving NPLs and rising cash flows, banks – especially those which not even the ECB can bailout when push comes to shove – Deutsche is as bad as it was a year ago.

So, just like last year when we decided to take a look inside the company’s financials to understand why DB was scrambling to dilute its shareholders and raise a few paltry billion in cash, so this year too, we had the pleasure of perusing the European megabank’s annual report.

What we found, while hardly surprising for those who read out post from also a year ago, “At $72.8 Trillion, Presenting The Bank With The Biggest Derivative Exposure In The World (Hint: Not JPMorgan)“, is just as jarring.

Because while America’s largest bank by assets, and certainly ego of its CEO, that would be JPMorgan of course, had a whopping $70.4 trillion in total notional of derivative holdings (across futures, options, forwards, swaps, CDS, FX, and so on), Deutsche Bank once again put it well in the dust.

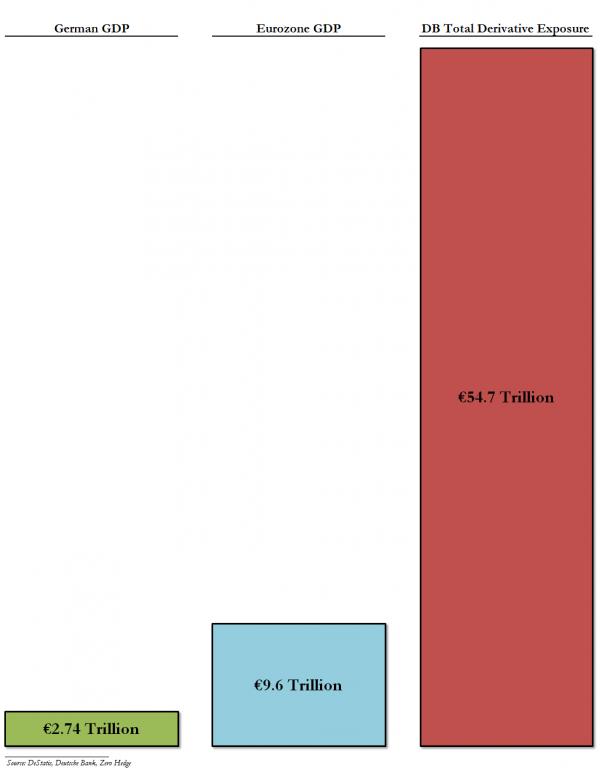

The number in question? €54,652,083,000,000 which, converted into USD at the current exchange rate, amounts to $75,718,274,913,180. Which is over $5 trillion more than JPM’s total derivative holdings.

As we explained last year, the good news for Deutsche Bank’s accountants and shareholders, and for Germany’s spinmasters, is that through the magic of netting, this number collapses to €504.6 billion in positive market value exposure (assets), and €483.4 billion in negative market value exposure (liabilities), both of which are the single largest asset and liability line item in the firm’s €1.6 trillion balance sheet mind you (and down from €2 trillion a year ago: a 20% deleveraging which according to DB “was predominantly driven by interest-rate derivatives and shifts in U.S. dollar, euro and pound sterling yield curves during the year, foreign exchange rate movements as well as trade restructuring to reduce mark-to-market, improved netting and increased clearing”), and subsequently collapses even further into a “tidy little package” number of just €21.2 in titak derivative “assets.”

And as we further explained both last year and every other time we have the displeasure of having to explain the reality of gross vs net, this accounting gimmick works in theory, however in practice the theory falls apart the second there is discontinuity in the collateral chain as we have shown repeatedly in the past (and certainly when shadow funding conduits freeze up), and not only does the €21.2 billion number promptly cease to represent anything real, but the netted derivative exposure even promptlier become the gross number, somewhere north of $75 trillion.

The conclusion of this story has not changed one bit from last year: this epic derivative exposure is the primary reason why Germany, theatrically kicking and screaming for the past five years, has done everything in its power, even “yielding” to the ECB, to make sure there is no domino-like collapse of European banks, which would most certainly precipitate just the kind of collateral chain breakage and net-to-gross conversion that is what causes Anshu Jain, and every other bank CEO, to wake up drenched in sweat every night.

Finally, just to keep it all in perspective, below is a chart showing the GDP of both Germany and Europe compared to Deutsche Bank’s total derivative exposure. If nothing else, it should make clear, once and for all, just who is truly calling the Mutually Assured Destruction shots in Europe.

As always, there is nothing to worry about: this €55 trillion in derivative exposure, should everything go really, really bad is backed by the more than equitable €522 billion in deposits, or just over 100 times less.

As a trained Accountant, can I ask how the hell this situation arose.

Nobody in their right mind could allow this gambling sickness to develop like this.

It is incompetence and greed on a massive scale…and by the country currently dictating the terms of bail outs.

Have heads rolled? I think not.

It’s another sub-prime repeat, but the implications for all the small EU bailed out/austerity mug countries is ominous…the only answers are either default or bail in.

To my favorite poster, Squodgy: You have summed it up beautifully. The same story is true here in the US, and as a result, the world has moved their money out of our markets, the banks are empty shells of debt, and our dollar is falling like a stone as much of the world has stopped using it…

Three years ago, the IMF proposed all banks have five cents on deposit for every dollar they claimed as an asset. The banks would have had to borrow the five cents……..

This, my friend, is the state of the world economy, not just Germany. This is why we are facing a global economic collapse, worse than anything we have ever seen or read about.

As Ross Perot warned us back in the early 1990s, when you take an economy global, all nations become vulnerable to the craven thievery of others……..and since Clinton removed all the regulations in our financial markets during his disastrous administration, the entire world followed suit. China……. the EU……The UK was smart enough to retain its own currency, I hope it kept the financial regulations in place. As an accountant, you can tell me. I don’t know, but I do know you were smart to keep your own currency.

The world, at least much of the west, made the mistake of following the US lead. Until Clinton, the US had a sterling reputation in the financial field, but he let the greedy bankers take over. The world didn’t really catch on until the 2nd level of the crash (2000-01 was the real one, but covered up by a real estate bubble financed by the same greedy bankers) in 2007-08. Bush did nothing to clean up the banks, or the players. None of the crooks who caused the ruin of hundreds of thousands of workers were punished, or even tried.

Ken Lay was tried for his part in Enron, the accounting model that Moody’s exported to the rest of the world, and he conveniently died just before sentencing, so his family could keep all the stolen billions. I don’t believe he died, I think he got some plastic surgery, and is living someplace…….bastard. Jeff Skilling, his CFO, got 14 years, but was out of a federal penitentiary (where there are never early paroles) in 4 years for the payment of a few hundred thousand dollars. A pittance.

The banks have taken over, they are in fact, empty shells full of paper profits that are actually debt, and no real money. As people start asking for their money, this will be made clear very quickly as the debacle with the IMF should prove. As interest rates and prices continue to climb, it will start very soon based on need.

Now, they are raising interest rates here in the states to get all the fools holding mortgages with ARMs…..which are most of them. They are going after the next level of Americans, the wannabe greedy guts. They are folks who have multiple properties with ARM mortgages on them awaiting the return of Happy Days that will never happen.

For years, they have coasted on 1-3% interest rates, many have more than one mortgage per property because they borrowed money to buy these properties. They have used money from one property to make payments on others…….and most of them have not rented out enough to meet the true costs of mortgages, taxes and insurance. They have been “betting on the come”, and I have no sympathy for them, they are fools.

They listen to US media that assures them happy days are back, they can flip their properties as soon as this Summer……..except interest rates are going up, they have doubled over the past few months. Jumbo rates are now nearly 6%, and the rates shown on CNBC website, are for those with sterling credit, those who have never been late on a payment anywhere. They now punish you if you were late on a Nordstrom bill, regardless it was a different company………the use of credit has become user unfriendly, and I avoid it like the plague.

I just sold my last interest in a house, and the buyers took months to get the funding, almost didn’t get it, but they finally did. I hope they can keep the house, they even put money into it before buying it to meet the increasing demands of greedy bankers……unbelievable. All the rules have changed, and buyers have no rights.

Yes, you are right. It is fraud on a global scale, and most countries are in it up to their ears. I hope the UK stayed out, the rest of the EU is in as deep a trouble as Germany and the US.

Good to see your thoughts.

Marilyn,

The UK is bankrupt & insolvent.

The only reason the rug hasn’t been pulled is because that is part of the plan, when it hits the fan, the pound will end up as the only currency with status.

The currency was retained because the Bank of England is merely an arm of the Rothschild empire, having acquired it by default, cunning & insider trading back in 1815.

The Rothschilds ALSO control the world’s international financial transactions through the Bank of International Settlement, the main fulcrum to all Central Banks.

So, as Cathererine Austin-Fitts said, “They were only doing as they were told”

Thus, Britain’s decision to not join the Euro, was, logically, a Rothschild decision.

Really, the only thing going for Britain is the indisputable fact that most of the Rothschild Dynasty are domiciled here.

I believe that is the plan.

Squodgy: You could be right, but according to my research on currencies that has been going on since 2009, electronic currencies, such as The Sucre, have replaced the dollar in better than half the world, including, but not limited to, South American Trade Alliance that established it under Hugo Chavez in 2010, Russia and China, who followed the SATA lead, establishing their own trade agreement, using their own currencies, leaving the dollar out. They went on to recruit Turkey, Iran, much of the South and Central American nations, emerging African nations, India, Japan, New Zealand and Australia have all dumped the dollar. Electronic currencies modeled on the Sucre, allow all of them to trade with each other, using their own currencies, leaving the dollar out. The electronic currency translates the value of each currency during the transaction, making trade much easier.

The Rothschild’s have an amazing history. When the Nazis got the old man in captivity, his cell was filled with his own possessions, rugs, bed, own chef and servant. They simply kept him until ransom demands could be met, then they let him go. The Nazis were just as corrupt as the clowns in power today.

The Pound sterling has not been a world reserve currency since it represented $5.50 to every dollar, and I question if it will be again a world reserve currency. There is no longer a need for one unless there is a huge breakdown in our electronic system.

I don’t know, time will tell, Squodgy. You might be right, we know it won’t be the dollar, or the Yuan……the Chinese are in terrible shape…………

Very good reasoning.

In view of the trend for internet based currencies, and the deep involvement in Chinese activities by Evelyn & his beautiful daughter, it might be reasonable to assume some serious, behind the scenes shenanigans.

As you say, China seems to be in a mess having expanded through borrowing (from whom I wonder!?!?), Europe is dependent on the Deutsche Bank’s soundness, the Dollar has diminished worth, yet, mysteriously, all these currencies have diminished by roughly 10% over the last year against the pound, despite the fact Britain, is bankrupt, has real unemployment of 12%, has no Gold collateral and has had a Balance of Trade deficit for almost 20 years.

Signed

Flummoxed from England