– Venezuela Bolivar Devalues 89% in Start of New FX Market (ZeroHedge, March 24, 2014):

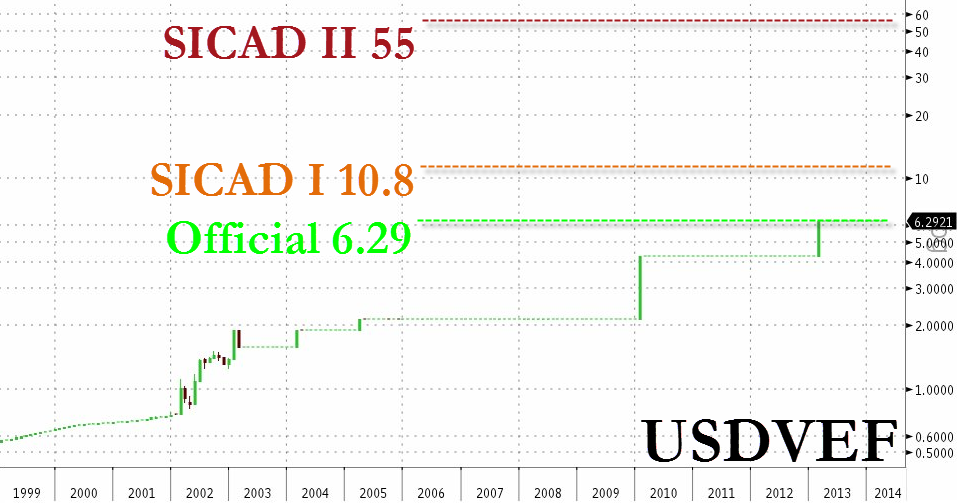

Venezuela’s exchange rate is a Gordian Knot of rules and regulations meant to baffle onlookers with bullshit and, we suspect, hide the hyperinflation from prying eyes just a little longer.Today’s launch of SICAD II, a new currency market which allows the free-market to bid for USD (in Bolivars), appears to be an effort to provide liquidity to a black-market for dollars. SICAD II priced at 55 Bolivars today – an 88% devaluation from the official rate of 6.29 (and another auction-based rate SICAD I – applicable to some firms – of 10.8).

This new SICAD II rate will replace SICAD I as the official tourist rate.

Confused? You should be – the bottom line is that Maduro and his cronies continue to suppress the reality of a hyperinflating currency as student marches grow ever more popular and outspoken.

The positive ‘spin’ is that SICAD II has lowered the black market rate but simply due to the additional liquidity and transparency that the platform provides – an 88% devaluation is nothing to be too excited about!!

“It is going to cover 7, 8 percent of real (dollar) demands, seeking equilibrium as regards the flow of foreign currency necessary for the functioning of the economy,” Maduro said in a speech on Friday.

Sicad 2 essentially revives a previous system, known locally as the “permuta” or “swap” market, which Chavez shuttered in 2010 after accusing speculators of manipulating it.

Opposition politicians have long criticized the government’s currency controls. Still, they are lambasting Maduro for what they call a “stealth devaluation” via the new system.

“Today will be ‘black Monday’. Sicad 2 is another devaluation for our currency,” Tweeted opposition leader Henrique Capriles. “Nicolas has also finished off the bolivar. Another blow to the poor.”

Venezuela’s annual inflation rate, currently at more than 56 percent, is the highest in the Americas.

As Bloomberg adds,

“This is a devaluation any way you look at this,” Tamara Herrera, chief economist at financial research firm Sintesis Financiera, said by phone. “The government is trying to bring down the black market rate with this new market, with the consensus that the dollar should be trading for about 50 bolivars.”

The problem is that all nations are now tied together financially in a sick system called globalism. There is no way the rest of us will not be affected. VZ admits a 56% inflation level, the highest in the Americas.

I wonder what the real inflation level is here in America. If you look at food prices, they have gone up 300-400% over the past 4 years since the rest of the world started dropping the dollar usage in international trading. The US dollar is no longer involved in better than half of the world’s international trades, down 50% from Jan, 2010.

Food prices have gone up 3-4X in 4 years. Gas prices have nearly tripled since Bush left office…..well over $4.00 a gallon here in CA. Rentals, insurance, medical care, all have gone through the roof. Dental care has gone up 800% or more.

Drug prices continue to rise, and Obama Care is causing medical insurance rates to double……..isn’t that about 50% inflation in that area alone?

Housing and rentals are through the roof, homelessness and poverty is exploding. Yet, the US government claims inflation rate of 6%? It is all lies, like everything else they say, and nobody believes them.

As Americans, Northern and Southern, continue to earn less for working more (if they have a job at all), prices continue to climb.

I just looked at the debt to GDP. VZ was lying, just like China. The US has 99% debt to GDP noted on usdebtclock.org, but it looks like all the nations have been fudging…..and the debt level for all nations is much higher.

This is just one more indication the world economy is close to implosion…….and it is happening now.

Interest rates for mortgages (if you can get one) now exceeds 5% for the consumer with perfect credit. Loan rates are difficult to find, the lies are kept up until you personally apply. If you want a fixed rate mortgage, good luck, the ARM is going to break the back of the next level of the crumbling upper middle class……the wannabe greedy guts. They are sitting on properties with loans far exceeding current value, but cannot get fixed rates regardless of their credit. Just one or two percentage points cuts the heart out of any budget……..

The whole system is collapsing, yet people won’t look until it is too late.