– Yuan Tumbles To 11-Month Lows As China Home Price Growth Slows (ZeroHedge, March 17, 2014):

It would appear that the widening of the daily trading bands (we discussed last night) are having a directional effect on USDCNY as the devaluation continues on the back of forced carry-trade unwinds. At 6.19, CNY is its weakest in 11 months (2.5% weaker than its lows in January) and the last 2 months have seen by far the biggest weakening in the currency on record. This ‘implied’ easing is modestly supporting the stock market and copper for now (though we suspect that is more spillover from risk-on squeezes post-Ukraine). While Goldman and BofA are adamant that widening the bands will not mean a change in trend overall, it seems clear that hot money is outflowing and driving a trend change anyway as corporate bond prices are not rising and home-price appreciation is slowing in the major cities.

USDCNY drops 100 pips to 6.19 – lowest in 11 months…

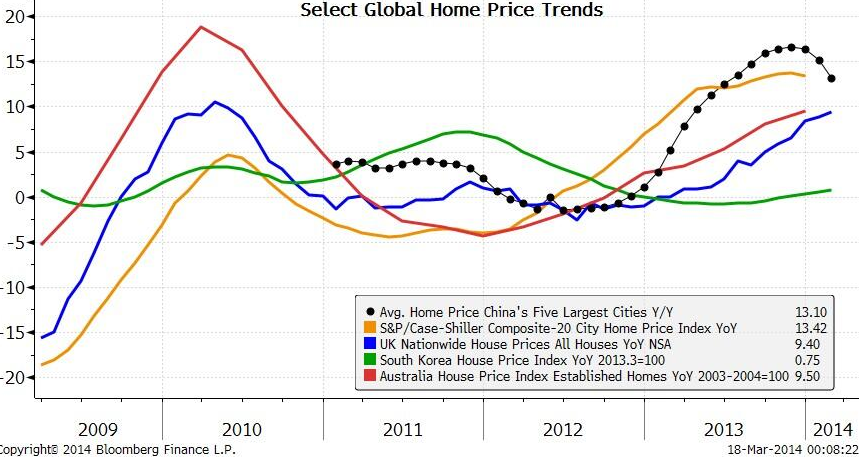

Chinese home price appreciation slows notably… (h/t @M_Mcdonough)

China’s decision to squeeze speculators out of its currency is causing pain for local companies and individual investors.

…

China is attempting to reduce the amount of money flowing into the country from foreign investors looking to profit on a rise in the yuan. The government sees this cash as inflating asset prices and making the economy more vulnerable to financial shocks.

But the currency’s decline is having a broader impact, particularly on Chinese companies that had placed bets on an appreciating yuan, traders and analysts say.

These companies have placed such bets in recent years to guarantee steady revenue from exports as the currency’s value climbed steadily against the dollar.

Many companies borrow money to make these trades, magnifying gains when the yuan rises but opening them up to big losses if the currency falls.

With the yuan down 2% against the dollar this year, more of the bets are losing money, said Geoff Kendrick, head of Asian currencies and rates at Morgan Stanley.

…

He estimates that paper losses on one popular way companies hedge their yuan exposure and individual investors bet on the yuan, through what is known as target redemption-forward products, have hit $2.3 billion, on contracts valued at $150 billion.

…

“In the past, when the [yuan] had a clear one-way trend, it used to be really easy for corporates. But now, with two-way volatility it becomes very tricky for them to manage,” he said. “It’s going to be a very different market from here.”

…

For now, most of the losses remain on paper because investors and companies haven’t yet sold their positions. However, banks are asking both corporate and individual clients with losing bets to pony up more collateral, traders in Hong Kong say. Banks also are advising companies to restructure their investments around weaker levels for the yuan, a cheaper alternative than completely unwinding millions of dollars of the products, which were originally designed to help companies hedge against gains in the yuan.

While the recent declines likely aren’t big enough to trigger a stampede out of the yuan, the added volatility in the exchange rate may give some investors pause.

…

“If the currency appreciation is no slam dunk anymore…part of the attraction of owning Chinese equities and bonds is being erased,” said Greg Anderson, global head of foreign-exchange strategy for BMO Capital Markets, a subsidiary of BMO Financial Group. “The result will probably be less foreign portfolio investment in China.”

…

“Some hedge funds are closing up positions,”… Even a small drop in the yuan could trigger big losses. Many investors are vulnerable if the yuan weakens to 6.20 to the dollar

And with home price appreciation slowing, perhaps things are moving a little too fast for the PBOC to manage?

As we warned before, Simply put, if the CNY keeps going (whether by PBOC hand or a break of the virtuous cycle above), then things get ugly fast…

How Much Is at Stake?

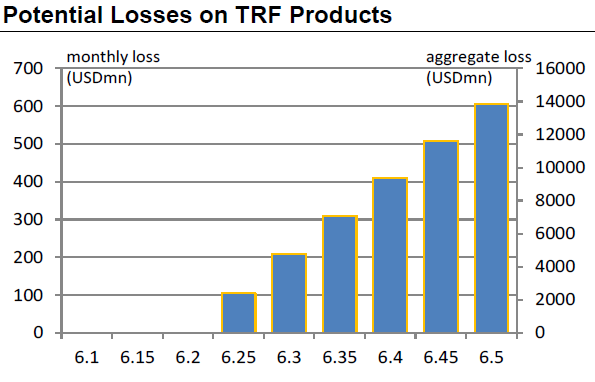

In their previous note, MS estimated that US$350 billion of TRF have been sold since the beginning of 2013. When we dig deeper, we think it is reasonable to assume that most of what was sold in 2013 has been knocked out (at the lower knock-outs), given the price action seen in 2013.Given that, and given what business we’ve done in 2014 calendar year to date, we think a reasonable estimate is that US$150 billion of product remains.

Taking that as a base case, we can then estimate the size of potential losses to holders of these products if USD/CNH keeps trading higher.

In round numbers, we estimate that for every 0.1 move in USD/CNH above the average EKI (which we have assumed here is 6.20), corporates will lose US$200 million a month. The real pain comes if USD/CNH stays above this level, as these losses will accrue every month until the contract expires. Given contracts are 24 months in tenor, this implies around US$4.8 billion in total losses for every 0.1 above the average EKI.

As Morgan Stanley warns however, this has much broader implications for China…

The potential for US$4.8 billion in losses for every 0.1 above the average EKI could have significant implications for corporate China in its own right, as could the need to post collateral on positions even if the EKI level is not breached.

However, the real concern for corporate China is linked to broader credit issues. On that, it’s worth reiterating that the corporate sector in China is the most leveraged in the world. Further loss due to structured products would add further stress to corporates and potentially some of those might get funding from the shadow banking sector. Investment loss would weaken their balance sheets further and increase repayment risk of their debt.

In this regard, it would potentially cause investors to become more concerned about trust products if any of these corporates get involved in borrowing through trust products. In this regard, this would raise concerns among investors, given that there is already significant risk of credit defaults to happen in 2014.

Remember, as we noted previously, these potential losses are pure levered derivative losses… not some “well we are losing so let’s greatly rotate this bet to US equities” which means it has a real tightening impact on both collateral and liquidity around the world… yet again, as we noted previously, it appears the PBOC is trying to break the world’s most profitable and easy carry trade – which has created a massive real estate bubble in their nation (and that will have consequences).

+++++++++++++++

The bottom line is the question of whether the PBOC’s engineering this CNY weakness is merely a strategy to increase volatility and thus deter carry-trade malevolence (in line with reform policies to tamp down bubbles) OR is it a more aggressive entry into the currency wars as China focuses on its trade (exports) and keeping the dream alive? (Or, one more thing, the former morphs into the latter as a vicious unwind ensues OR the market tests the PBOC’s willingness to break their momentum spirit).

Slows? Nobody can afford them…..and this has been true for years.

The world looked to China to rescue it after Wall Street caused the world economic collapse. What they didn’t know is that China adopted the same policies of Enron accounting……they have nothing but smoke, mirrors and far too many people.