– “Magic” Collateral: A Frank Look At The Sheer Credit Horror About To Be Unleashed In China (ZeroHedge, March 11, 2014):

While the world is terrified about what China – where corporate bond defaults are now permitted – may be about to unleash on the world, most are all too happy to remain in a state of delightful ignorance. We decided to take a peek behind the scenes.

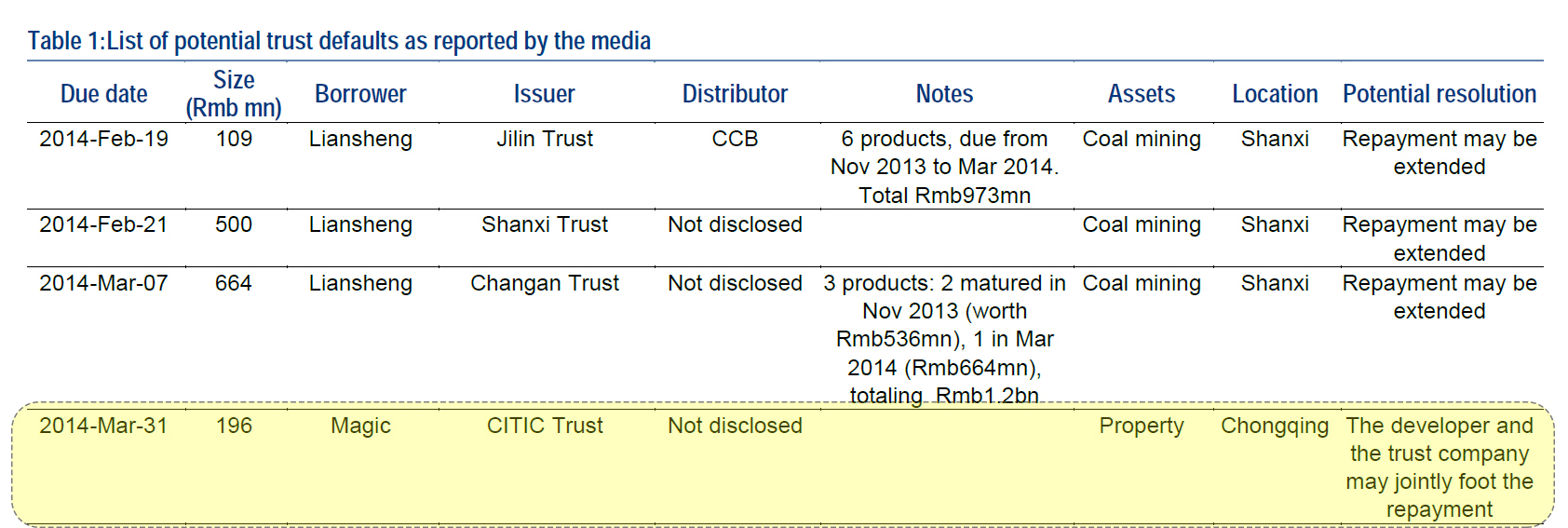

Recall that as we have repeatedly shown in the calendar of coming Chinese bond default, on March 31, a borrower named “Magic” (no comment) is set to default on a CNY196 million Trust.

The default may or may not happen, as there is always a high likelihood it will simply be bailed out as has happened frequently in the past, but regardless of the final outcome, here is what is really going on behind the scenes.

From Bank of America:

31 Mar 2014, Rmb196mn borrowed by Magic Property & arranged by CITIC Trust

Details: invested in an office building in Chongqing. The Chongqing developer ran into financial problems in mid-2013. CITIC Trust tried to auction the collateral but failed to do so because the developer has sold the collateral and also mortgaged it to a few other lenders.

Potential outcome: The developer and the trust company may share the repayment.

Reasons: 1) When CITIC Trust sold the product, it did not specify the underlying investment project. 2) The local government has intervened, fearing social unrest. A local buyer of a unit in the office building committed suicide as he/she could not obtain the title to the property due to the title dispute between the trust and the developer.

Please re-read that first part again:

CITIC Trust tried to auction the collateral but failed to do so because the developer has sold the collateral and also mortgaged it to a few other lenders.

So, “Magic” not only sold the collateral… but also mortgaged it to a few other lenders: lenders who count its as a perfectly performing asset when in reality they have zero claims to it. Did they steal that straight from the MF Global instruction manual?

Now add this:

“The local government has intervened, fearing social unrest. A local buyer of a unit in the office building committed suicide as he/she could not obtain the title to the property due to the title dispute between the trust and the developer.”

… and multiply by a few thousand for all the other shadow (and not so shadow) players who have engaged in precisely this kind of gross abuse of underlying collateral, which also happens to be the main reason why China can magically create trillions in debt out of thin air with zero collateral constraints, each and every year, no questions asked.

Well, the time to ask a question or two has finally arrived.

China lies about everything. They base their GDP on what they build, not what they produce and earn.

They lie about their exports. Regardless they have been busted several times for overstating how much they are selling to various nations, they continue to lie.

They build cities their people cannot afford.

They built the world’s biggest building, complete with false sea shore……..but it is nearly empty because nobody can afford it. They seem to think if they show something, that makes it so. Magic thinking is fine for children, but not for nations.

Their real estate debt/investment has grown from $10 trillion in 2009, to $25 Trillion in 2013……..as much growth as the US banking system in the last 100 years…….in five.

Their lies are beyond belief. They are going to crash. Their environment is as filthy as was London in 1850 from coal dust……they cannot see the sun. As a result, the fat cat greedy guts are moving away……..to places like Sydney, Australia.

Russia is the growing soon to be #1 empire, not China. Five years ago, we all thought it would be China…..but no longer. Their system is so full of holes……….