– The Last 3 Times This Happened, Markets Turmoiled (ZeroHedge, Dec 22, 2013):

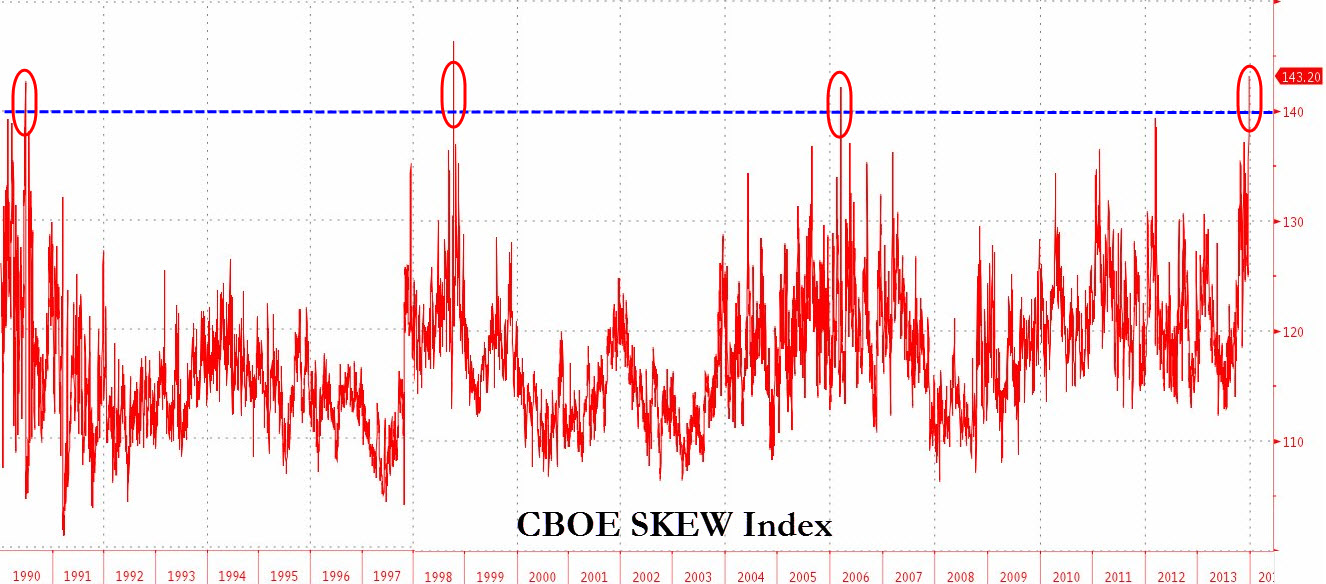

Thanks to Bob “I don’t get out of bed unless it’s over 20” Pisani’s daily diatribes about VIX (the so-called ‘fear’ index), we are supposed to rest assured that all is well in the ever-decreasing horizon world of equity markets. However, while VIX measures the expectations of ‘normal’ day to day moves in stocks, it does not offer any insight into market participants’ perspectives on tail risks (or ‘the big one’). CBOE’s SKEW index does just that, based on the pricing differences between normal and fat-tail risk pricing in the options market, it provides a measure of the market’s belief in extreme events… and for only the 4th time in history, it’s flashing a big red warning signal of volatility ahead.

The last 3 times this happened… markets went a little crazy…

In 24 years of history, SKEW has been above 140 only 4 times (including the current)… the last 3 times were…

- 06/21/1990 – S&L Crisis (Stocks dropped 18% in next 3 months and the US entered recession)

- 10/16/1998 – Russian Default and LTCM (Stocks soared 22% in the next 3 months and the dot-com bubble was born)

- 03/16/2006 – Housing Bubble peak (Stock dropped 6% in next 3 months and the ‘great recession’ started within a year)

And now?

- 12/20/2013… Taper…

Chart: Bloomberg

It no longer matters.

The stock market is so rigged, it makes no sense to anyone but the insiders.

The next bite will be on people who appear to be worth a million or more…..but not more than $10 million. It will hit people who right now think they are fine.

The stock market has few real investors, only 15% of the market involve investments…..85% is high frequency, skim and sell faster than I blink my eye.

As one who followed the market all my life, all I can say is that it is so convoluted, and twisted that nobody with any sense is investing any longer. It is all smoke and mirrors. The corrupt greedy guts, like Jon Corzine, who stole over a billion dollars from his depositors and walks free, now control the market.

All I can say is if there are people invested who would lose if the market crashes…..they need to get out.

Another thing, interest rates are going up as our dollars buy less. This is truly an ugly time for America.

Believe it or not, the biggest danger isn’t a market crash, it is Fukushima. Safe food and water will be far more in demand than gold, stock, or anything……we cannot eat them.

The world is shifting violently, and the media obscures the truth. Even the Guardian now looks like a US media site. We have dark days ahead, far worse than the loss of money.