– Japan Enters The Keynesian Twilight Zone As Total Debt Crosses ¥1,000,000,000,000,000.00. (ZeroHedge, Aug 9, 2013):

Back in May 2011, together with forecasting Japan’s most epic case of quantitative easing ever unleashed, we presented the absurd, if inevitable, thought experiment of a country that would soon cross into the twilight zone of total sovereign debt numbers that no longer even fit on a simple pocket calculator. The country of course is Japan, and the debt number is one quadrillion. As of last night, the absurd has become real as Japan has officially announced its total government debt rose by 1.7% to ¥1,008,600,000,000,000.00.

This represents about $10.5 trillion, is an amount larger than the economies of Germany, France and the U.K. combined, and is about 230% of Japan’s GDP although at this point who cares: Japan will never repay its debt and the best it can hope for is to inflate it away, which ties in with the first forecast of ever greater “easing” by the BOJ until fiat after fiat loses all meaning in a world that is so hopelessly in debt that destroying the very concept of modern money will ultimately be the only recourse.

Some more from AFP on this theater of the Keynesian absurd:

Japan’s eye-watering national debt has topped one quadrillion yen, official data showed Friday, a record figure that underlines Tokyo’s struggle to curb its huge borrowing.

The figure supplied by the finance ministry of 1.008 quadrillion yen by the end of June amounts to about $10.42 trillion at current exchange rates.

A quadrillion is one thousand trillion.

Tokyo has the dubious distinction of having, proportionately, the biggest debt pile among industrialised nations, more than twice the size of its economy.

The lion’s share of that debt is from long- and short-term Japanese government bonds, as well as other borrowing.

The staggering figure, about 1.7 percent higher than the previous quarter, comes a day after Japan pledged to slash its budget and get spending under control.

Japan has not faced a public debt crisis like the kind seen across the debt-riddled eurozone, largely because most of its low-interest debt is held domestically rather than by international creditors.

But the International Monetary Fund and others have issued warnings about Tokyo’s ever-increasing borrowing, after a series of sovereign credit rating downgrades in recent years.

This week, the IMF called on Japan to adopt a “credible” fiscal plan to repair its books, including raising sales taxes to generate new revenue.

Prime Minister Shinzo Abe’s government is mulling whether to go ahead with a series of sales tax rises that would double the rate to 10 percent by 2015, a key source of new income but one that some fear would stall his economy-boosting plan dubbed “Abenomics”.

Yes, we too think that it is very charming that Japan believes it can “manage” its public debt, especially now that interest rates are once again rising because after all – the “great rotation.”

As a reminder, this is what the Privateer’s Bill Buckler said about Japan’s debt back in April 2011:

The latest projections from the Japanese Finance Ministry regarding the fiscal year which started on April 1 make for sobering reading. They say that Japan’s “public” (funded) debt will probably rise by 5.8 percent this year – to 997.7 TRILLION Yen ($US 12.2 TRILLION at current exchange rates). Should these projections be even slightly on the optimistic side – and government financial projections always are – then Japan could easily be looking at a public debt of 1,000 TRILLION Yen by March 31, 2012.

There is another way of expressing 1,000 TRILLION. It is the same as ONE QUADRILLION.

The sheer magnitude of these numbers has long been a talking point for the watchers of international finance. Now, they are becoming very nervous indeed. The OECD has recently “urged” the Japanese government to “do something” about their deficits, especially in the wake of the earthquake disaster. Noting that Japanese sovereign debt is about to hit 204 percent of GDP, they suggested that Japan’s current sales tax be “at least” doubled from its present 5 percent to 10 percent. The Japanese Foreign Ministry politely declined to comment on this suggestion, contenting themselves with assuring the OECD that – “We will continue to work to maintain and secure trust in Japanese government bonds.”

Ironically, since then, with Japan becoming the marginal QE dynamo in the world as the Fed is set to taper its own bond buying if only briefly, the OECD has been urging Japan to incur more debt in order to provide the BOJ with more monetization material in order to push global markets ever higher, and to assure Goldman partners yet another year of record Christmas bonuses.

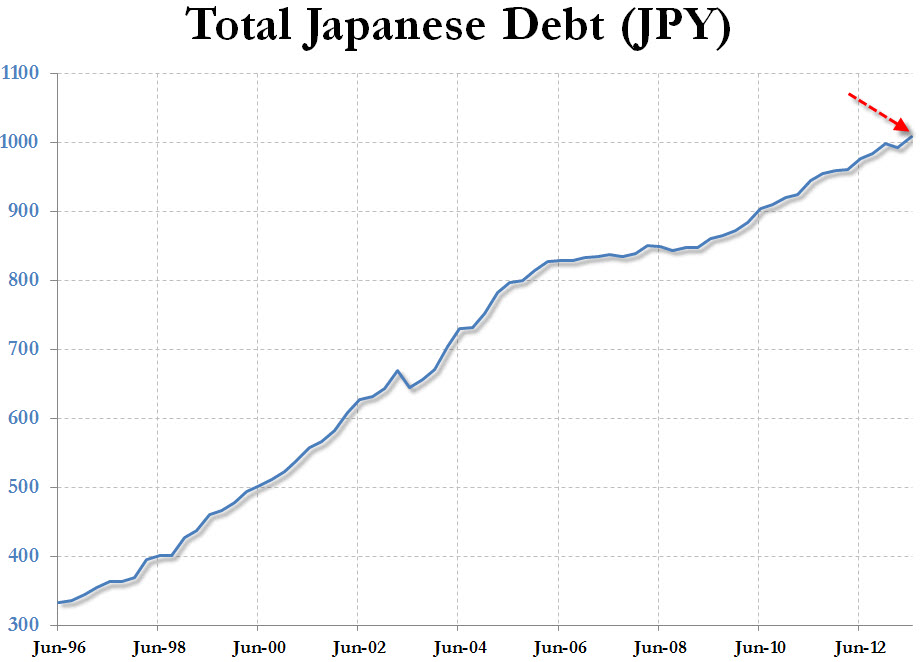

Finally, those curious how that number looks across time, here it is: