Related info:

– Haunted By The Last Housing Bubble, Fitch Warns “Gains Are Outpacing Fundamentals” (ZeroHedge, May 28, 2013):

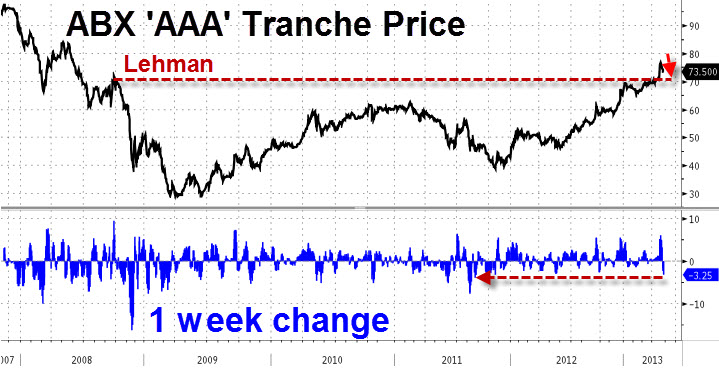

The last week has seen quite dramatic drops in the prices of a little-discussed but oh-so-critical asset-class in the last housing bubble’s ‘pop’. Having just crossed above ‘Lehman’ levels, ABX (residential) and CMBX (commercial) credit indices have seen their biggest weekly drop in 20 months as both rates and credit concerns appear to be on the rise. Perhaps it is this price action that has spooked Fitch’s structured products team, or simply the un-sustainability (as we discussed here, here and here most recently) that has the ratings agency on the defensive, noting that, “the recent home price gains recorded in several residential markets are outpacing improvements in fundamentals and could stall or possibly reverse.” Simply put, “demand is artificially high… and supply is artificially low.”

FITCH: US RESIDENTIAL RECOVERY TOO FAST IN SOME LOCAL ECONOMIES

Fitch Ratings believes the recent home price gains recorded in several residential markets are outpacing improvements in fundamentals and could stall or possibly reverse. Many of these areas are in California, which has seen price increases of 13% over the last year.

In many markets, fundamentals are improving as unemployment rates continue declining, while low prices and low interest rates have kept affordability high. However, especially in cities that never fully unwound the mid-2000s bubble, rapidly increasing price levels are a potential cause for concern. For example, in Los Angeles, prices are up more than 10% in the past year despite a stubborn unemployment rate that remains above 10% and real incomes that have declined over the past two years. Prices are now more than 75% above pre-2000 levels.

Several factors are combining to form an environment supportive of brisk home price growth, but few are capable of providing long-term support to sustain the recent pace of improvement. Primarily, restricted supply and bolstered demand factors are bidding prices up.

The demand is artificially high as borrowers remain on the side lines waiting for prices to stabilize. We believe this level of housing demand is likely to abate once the pent-up demand is satisfied.

The supply is also artificially low, as recent regulations have limited the pace of foreclosure sales and the large percentage of underwater borrowers continues to hope for further price increases to be able to sell their homes at a profit.

The supply-demand imbalance is even more pronounced in regional markets that are seeing strong institutional and retail bids for rental properties. The low rate and steep drop in prices, coupled with the decline in homeownership, have attracted an estimated $8-$10 billion of new capital to this sector. Many markets have a large number of buyers vying for a limited number of homes.