– BitCoin Drama Continues After Hours (ZeroHedge, April 10, 2013):

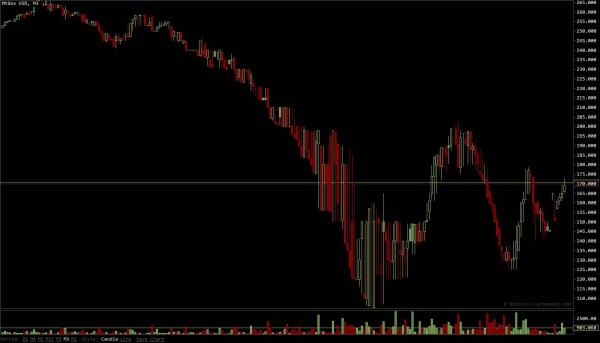

Think the great BitCoin drama is over? After plunging by over 60% intraday, touching $100 from an all time high of $265 earlier, BitCoin was just getting started, posting a just as epic rebound to $200 in mere hours… before tumbling once more to $125… before rebounding again to $180… before sliding to $140… and so on. As the vomit-inducing sequence above hints, merely following every twist and turn of the real time tragicomedy that is the minute chart of BTC is a full-time job. And with the bulk of assorted BTC price charts DDoSed into oblivion, or merely down due to record traffic, the only remaining real-time chart may be the following from Clark Moody: we suggest using 1 Minute resolution. Perhaps what is most fascinating, is that unlike regular stock, FX or commodity charts which are largely dominated by robots, algos and other electronic traders, the trading in BTC is purely carbon-form based. So for those who enjoy some seriously hypnotic after hours undulations, this chart’s for you.

– Bitcoin crashes over 50% just one day after bold public prediction by Mike Adams of Natural News:

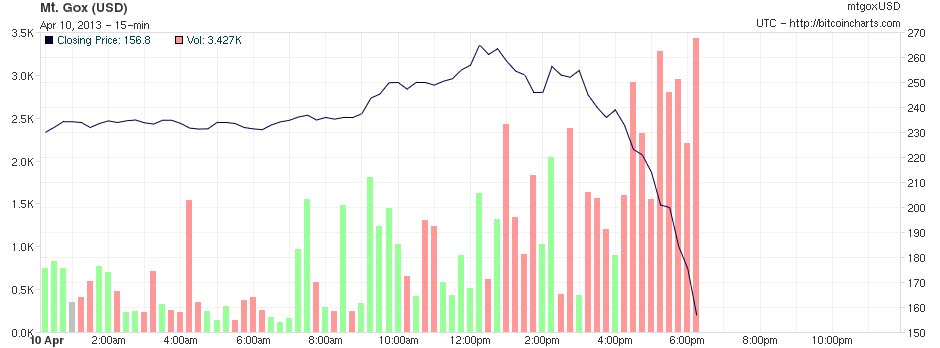

In what has to be the most accurate currency crash prediction ever made, bitcoin crashed today from $266 to a low of $105 in a rapid “free fall” market crash pattern, erasing $1 billion in currency valuation in a matter of hours. I openly and publicly predicted all this would occur yesterday, in both a Natural News article as well as national radio via the Alex Jones Show broadcast aired on over 120 am stations.

But the real story here isn’t that I accurately made this dire prediction less than 24 hours before it took place; the real story is that this crash was almost certainly caused by a covert central bank “stress test” of the pliability of the bitcoin market. That’s all explained below. (This is a Natural News exclusive. Nobody else has realized this yet…)

…

– BitCrash Continues: Down 40% And Dumping (ZeroHedge, April 10, 2013):

Time to rename it BitCrash… or will it stage an amazing recovery? Alas, for this particular bubble, there are no NYSE circuit breakers nor is there a Federal Reserve-mandated “plunge protection team.” And why should there be? The central banks hate all currency alternatives. Firehats: on, especially since the volume is still relatively lite.

Update: -50%

More from Tech Chrunch:

Bitcoin is undergoing a classic correction after quintupling in price over the past 30 days. The currency, which was trading as high as $265 earlier today on Mt. Gox, plummeted and is now trading at around $150.

We’ve reached out to one of the biggest exchanges, Mt. Gox, to see what happened. But another San Francisco-based exchange called TradeHill is saying that the crypto-currency is falling because of apparent distributed denial of service attacks on Mt. Gox and Bitstamp. A denial of service attack happens when an attacker overwhelms a target with external requests, so that it can’t honor regular requests from legitimate users.

This also happened last week when Mt. Gox when Bitcoin reached $142 and hackers attacked the exchange. At that point, Mt. Gox said it had suffered ”its worst trading lag ever.”

The Tokyo-based exchange said last week that hackers are engaging in a strategy to manipulate the price of the currency: “Attackers wait until the price of Bitcoins reaches a certain value, sell, destabilize the exchange, wait for everybody to panic-sell their Bitcoins, wait for the price to drop to a certain amount, then stop the attack and start buying as much as they can. Repeat this two or three times like we saw over the past few days and they profit.”

It looks like this may be happening again. Aside from that, any kind of 400% increase over 30 days is probably unsustainable from a technical point of view. A correction at this point would be healthy and natural.

Gee, what a surprise!