– The “Big Three” Banks Are Gambling With $860 Billion In Deposits (ZeroHedge, Jan 18, 2013):

A week ago, when Wells Fargo unleashed the so far quite disappointing earnings season for commercial banks (connected hedge funds like Goldman Sachs excluded) we reported that the bank’s deposits had risen to a record $176 billion over loans on its books. Today we conduct the same analysis for the other big two commercial banks: Wells Fargo and JPMorgan (we ignore Citi as it is still a partially nationalized disaster). The results are presented below, together with a rather stunning observation.

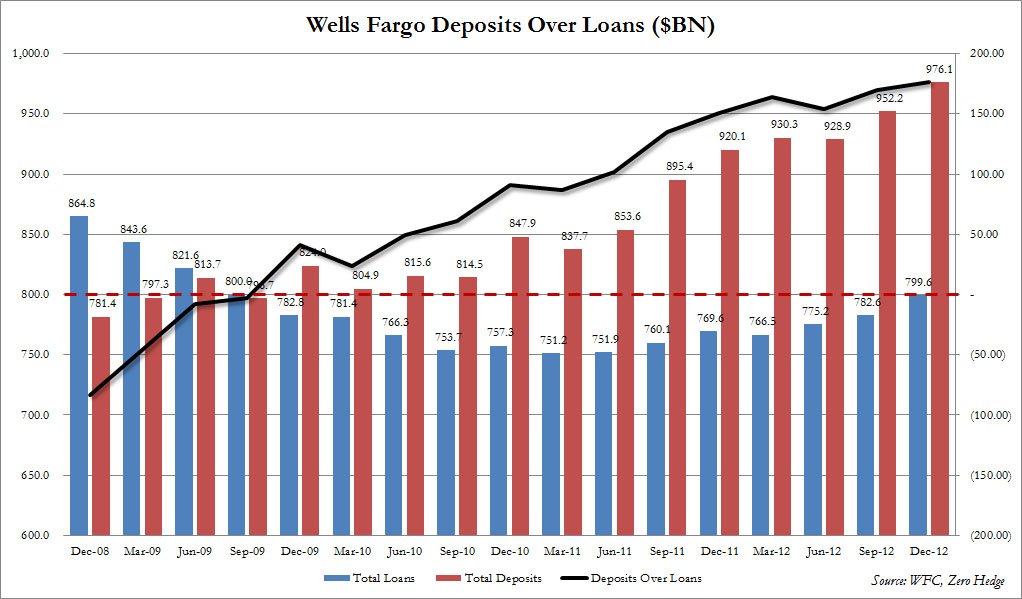

First, Wells again – deposits over loans: record $176 billion.

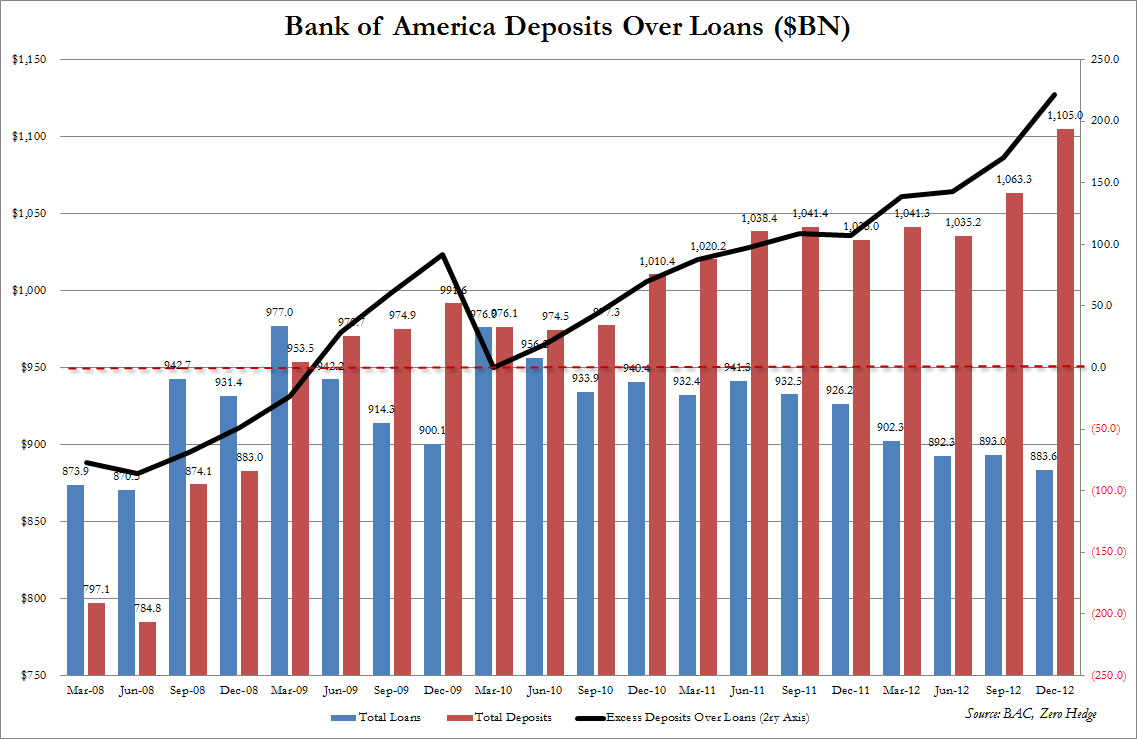

Next: Bank of America: unlike Wells, BofA is not even trying as its deposits are soaring while the loans have been declining for 6 quarters in a row. Deposits over Loans: record $221 billion.

Finally: JP Morgan, or the bank that started it all when the CIO blew up and made it all too clear what happens with the “Excess deposit over loans” cash. December 31 Deposits over Loans: record $460 billion.

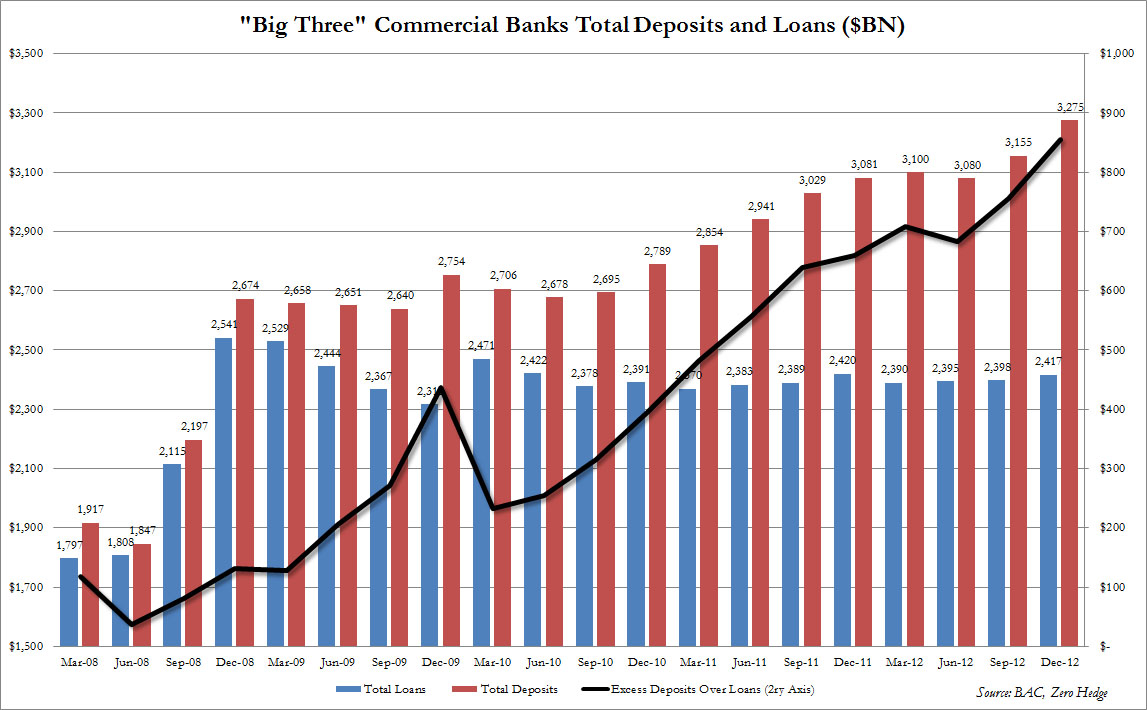

And this is how the consolidated deposit and loan data for the Big Three banks looks: some $858 billion, or nearly half of the $2 trillion in total excess deposits over loans in the entire US commercial banking system (speaking of Too Big To Fail).

Why is all of the above important? Because as we have explained repeatedly in the past several weeks, the “excess deposit cash over loans” is nothing more or less than additional prop trading capital, that banks can use as they see fit. The traditional regulatory explanation is that the cash is to be used for safe, responsible investment. Alas, as the JPM CIO debacle taught us, said cash is used for anything but, and is in fact used to fund prop trading operations deep inside these commercial banks.

But don’t take our word for it. Take the word of the Task Force charged with explaining away the 2012 CIO Losses, released yesterday.

JPMorgan’s businesses take in more in deposits than they make in loans and, as a result, the Firm has excess cash that must be invested to meet future liquidity needs and provide a reasonable return. The primary responsibility of CIO, working with JPMorgan’s Treasury, is to manage this excess cash. CIO is part of the Corporate sector at JPMorgan and, as of December 31, 2011, it had 428 employees, consisting of 140 traders and 288 middle and back office employees. Ms. Drew ran CIO from 2005 until May 2012 and had significant experience in CIO’s core functions.19 Until the end of her tenure, she was viewed by senior Firm management as a highly skilled manager and executive with a strong and detailed command of her business, and someone in whom they had a great deal of confidence.

CIO invests the bulk of JPMorgan’s excess cash in high credit quality, fixed-income securities, such as municipal bonds, whole loans, and asset-backed securities, mortgage-backed securities, corporate securities, sovereign securities, and collateralized loan obligations. The bulk of these assets are accounted for on an available-for-sale basis (“AFS”), although CIO also holds certain other assets that are accounted for on a mark-to-market basis.

Beginning in 2007, CIO launched the Synthetic Credit Portfolio, which was generally intended to protect the Firm against adverse credit scenarios. The Firm, like other lenders, is structurally “long” credit, including in its AFS portfolio, which means that the Firm tends to perform well when credit markets perform well and to suffer a decline in performance during a credit downturn. Through the Synthetic Credit Portfolio, CIO generally sought to establish positions that would generate revenue during adverse credit scenarios (e.g., widening of credit spreads and corporate defaults) – in short, to provide protection against structural risks inherent in the Firm’s and CIO’s long credit profile.

The positions in the Synthetic Credit Portfolio consisted of standardized indices (and related tranches) based on baskets of credit default swaps (“CDS”) tied to corporate debt issuers. CIO bought, among other things, credit protection on these instruments, which means that it would be entitled to payment from its counterparties whenever any company in the basket defaulted on certain payment obligations, filed for bankruptcy, or in some instances restructured its debt. In exchange for the right to receive these payments, CIO would make regular payments to its counterparties, similar to premiums on insurance policies. As described in greater detail below, the actual trading strategies employed by CIO did not involve exclusively buying protection or always maintaining a net credit short position (under CSW 10%); rather, CIO traded in an array of these products, with long and short positions in different instruments.

In other words, JPM’s own task force admitted the CIO was using excess cash for prop trading purposes (there is much more in the full 132 page document). This is when JPM had roughly $400 billion in excess cash over loans. JPM now has a record $460 billion and it most likely continues to invest this cash in any way it sees fit. Sadly, when asked to provide details about what the CIO is doing these days, Jamie Dimon provided no additional information.

Because if JPM was/is doing it, everyone else was/is doing it.

And you, dear savers, are the ones who money is being used by the banks to fund precisely this prop trading, which, among other factors (Fed) is what is causing the relentless stock market melt up.

The only growth in the world economy over the past 12 plus years has been debt. This is just more of the same. The entire global economy is imploding. These crooks are destroying the stability of the globe.