Related info:

– New Bankster Bailout Disguised As QE3

– QE3: Helicopter Ben Bernanke Unleashes An All-Out Attack On The U.S. Dollar

– Marc Faber: ‘Fed Will Destroy The World’ (Video)

“When a country embarks on deficit financing and inflationism (= QE 3) you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul“The Federal Reserve System is nothing more than legalized counterfeit.”

– Ron Paul

– How QE3 Will Make The Wealthy Even Wealthier While Causing Living Standards To Fall For The Rest Of Us (Economic Collapse, Sep 16, 2012):

The mainstream media is hailing QE3 as a great victory for the U.S. economy. On nearly every news broadcast, the “talking heads” are declaring that Ben Bernanke’s decision to pump 40 billion dollars a month into our financial system is definitely going to help solve our economic problems. The money for QE3 is being created out of thin air and this round of quantitative easing is going to be “open-ended” which means that the Federal Reserve is going to keep doing it for as long as they feel like it. But is this really good for the average American on the street? No way. Despite two previous rounds of quantitative easing, median household income has still fallen for four years in a row, the employment rate has not bounced back since the end of the last recession, and new home sales have remained near record lows. So what have the previous rounds of quantitative easing accomplished? Well, they have driven up the prices of financial assets. Those that own stocks have done very well the past couple of years. So who owns stocks? The wealthy do. In fact, 82 percent of all individually held stocks are owned by the wealthiest 5 percent of all Americans. Those that have invested in commodities have also done very nicely in recent years. We have seen gold, silver, oil and agricultural commodities all do very well. But that also means that average Americans are paying more for basic necessities such as food and gasoline. So the first two rounds of quantitative easing made the wealthy even wealthier while causing living standards to fall for all the rest of us. Is there any reason to believe that QE3 will be any different?

Of course not.

This time the Federal Reserve is focused on buying mortgage-backed securities. Yes, the same financial garbage that helped cause the last crisis. The Fed plans to gobble up tens of billions of dollars of that trash every month from now on.

But will the Fed pay true market value for those mortgage-backed securities? If you believe that, I have a bridge to sell you.

So this is going to be a huge windfall for some people, and that does not include us.

Not a single penny of this 40 billion dollars a month will go directly into our hands. The theory is that it will “filter down” to us eventually.

But that hasn’t happened with previous rounds of quantitative easing.

So where does the money go?

A recent CNBC article discussed a very interesting report from the Bank of England about the effects of quantitative easing….

It said that the Bank of England’s policies of quantitative easing – similar to the Fed’s – had benefited mainly the wealthy.

Specifically, it said that its QE program had boosted the value of stocks and bonds by 26 percent, or about $970 billion. It said that about 40 percent of those gains went to the richest 5 percent of British households.

Many said the BOE’s easing added to social anger and unrest. Dhaval Joshi, of BCA Research wrote that “QE cash ends up overwhelmingly in profits, thereby exacerbating already extreme income inequality and the consequent social tensions that arise from it.”

Wow.

Who benefits from quantitative easing?

According to the Bank of England, it is “mainly the wealthy” who benefit.

As I noted the other day, Donald Trump said essentially the same thing when he told CNBC the following….

“People like me will benefit from this.”

As I already discussed above, a lot of quantitative easing money gets into the financial markets where it pumps up the prices of financial assets.

But not all of it goes there.

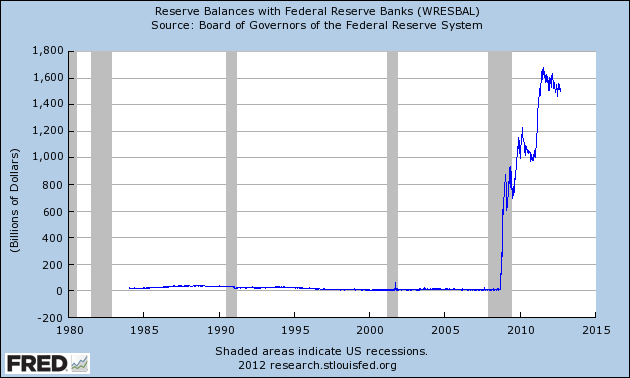

We were told that the whole idea behind quantitative easing was that it was supposed to get banks lending again, but this has not happened. Instead, banks are sitting on unprecedented amounts of money. Just look at how the first two rounds of quantitative easing have caused excess reserves being held by banks to explode from close to zero to over 1.5 trillion dollars….

Of course one of the biggest problems is that the Federal Reserve is still paying banks not to lend money.

Yes, you read that correctly.

The Federal Reserve is paying banks to park money with them. So instead of risking their money by lending it out to us, the banks can just park it at the Fed and make risk-free profits for as long as they want.

Must be nice.

If the Federal Reserve really wanted banks to start lending again, all the Fed has to do is to stop paying banks not to lend money.

But of course if more than 1.5 trillion dollars suddenly started flooding into our economy (especially after you consider the multiplier effect) we would be dealing with nightmarish inflation unlike anything we have ever seen before.

So if you want to know why inflation was not even worse after QE1 and QE2 it is because more than a trillion and a half dollars is being parked with the Fed.

So did QE1 and QE2 do any good for average Americans?

Let’s go to the charts.

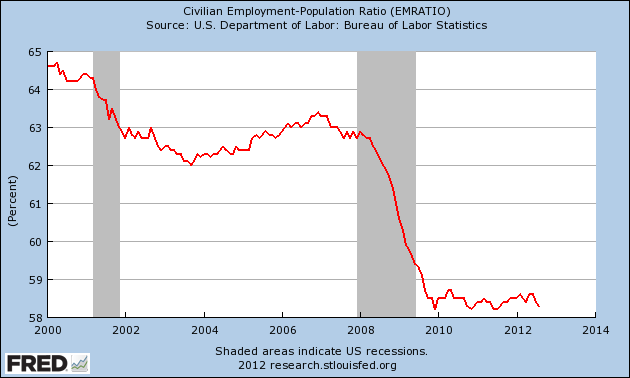

This first chart shows that the percentage of working age Americans with a job has stayed extremely flat since the end of the last recession.

Does it look like QE1 and QE2 made a difference to you? I don’t see any difference….

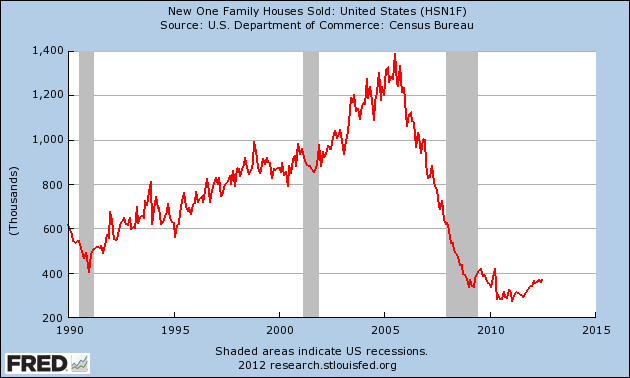

Okay, but what about new home sales?

Did QE1 and QE2 help them?

Nope….

But the mainstream media is still buying the baloney the Fed is pushing.

The mainstream media is promising us that home sales will soon rise and that lots of new jobs are on the way.

Sadly, the truth is that things have steadily gotten worse for average Americans over the past 4 years despite all of the money printing the Fed has been doing. If you doubt this, just read this article.

But this is all that Ben Bernanke seems to have left. When printing money doesn’t work, his answer is to print even more money.

QE3 is likely to cause agricultural commodities and the price of oil to rise even further.

So unless you can convince your employer to give you a corresponding raise, this is going to mean that your paychecks are not going to go as far as they did before.

And so that means a lower standard of living.

In a recent article, Bruce Krasting issued an ominous warning….

Higher inflation expectations in the US will filter around the globe. Post the extraordinary steps Ben took yesterday, people will be stocking up on “stuff”. Things like rice, flour, cooking oil, soy, wheat and sugar. If you can eat it, buy it now. It will be more expensive in a month. While your at it, fill up the gas tank, the price is going up next week and every week for the next few months.

In addition, the policy of the Federal Reserve of keeping interest rates as low as possible is absolutely crippling the finances of many retirees. Even the former president of the Federal Reserve Bank of Atlanta, William F. Ford, recognizes this….

One of the overlooked consequences of the Federal Reserve’s recent rounds of monetary stimulus is the adverse impact those policies have had on the interest income of savers. The prolonged and abnormally low interest-rate structure put in place by the Fed has made life particularly difficult for retirees and others who depend on conservative interest-sensitive investments. But the negative effects do not stop there. They spillover into the overall performance of the economy.

Just about everything that the Federal Reserve does these days is bad for ordinary Americans.

But the Fed is not going to stop. The Fed is addicted to money printing now, and as a recent article by Peter Schiff explained, the Fed is just going to “up the dosage” until it gets what it wants….

The Fed will try to conjure a recovery on the backs of currency debasement. It will not stop or alter from this course. If the economy fails to respond to the drugs, Bernanke will simply up the dosage. In fact, he is so convinced we will remain dependent on quantitative easing that he explicitly said he won’t turn off the spigots even if things noticeably improve.

This is complete and total incompetence by Ben Bernanke and his cohorts over at the Fed.

Economist Marc Faber believes that Ben Bernanke should resign, and I agree with him….

“If I had messed up as badly as Bernanke I would for sure resign. The mandate of the Fed to boost asset prices and thereby create wealth is ludicrous — it doesn’t work that way. It’s a temporary boost followed by a crash.”

And yes, a crash is coming.

Bernanke can try to put it off for a while, but every action he takes is just making the eventual crash even worse.

And some in the financial community clearly recognize this. For example, credit rating agency Egan-Jones downgraded the credit rating of the United States to AA- on Friday.

The primary reason they gave for the downgrade was QE3.

Ben Bernanke and the Federal Reserve are destroying the U.S. dollar and destroying our financial system for a short-term economic sugar high.

It is utter insanity.

That is why we desperately need to get the American people educated about the Federal Reserve system. It is at the very heart of our economic problems and yet neither major political party is willing to blame the Fed for the problems that it is causing.

A bunch of unelected bankers that are not accountable to the American people are running our economy into the ground and the American people do not even realize what is happening.

Please share this article with as many people as you can. Hopefully we can get the American people to understand that more money printing is definitely not the solution to our problems.