JPM’s $150 Billion FDIC

Reality Adjustment

Reuters published an exclusive story this morning:

Buried in the final paragraph:

In a presentation in March, JPMorgan Chase said it had a recovery plan in place and said it was ordered by regulators. The presentation was organized by Harvard Law School and was closed to the media at the time, but is now available online.

Here’s the BEST part of the JPM document.

It’s easy to see on the PDF:

http://www.law.harvard.edu/programs/about/pifs/symposia/europe/baer.pdf

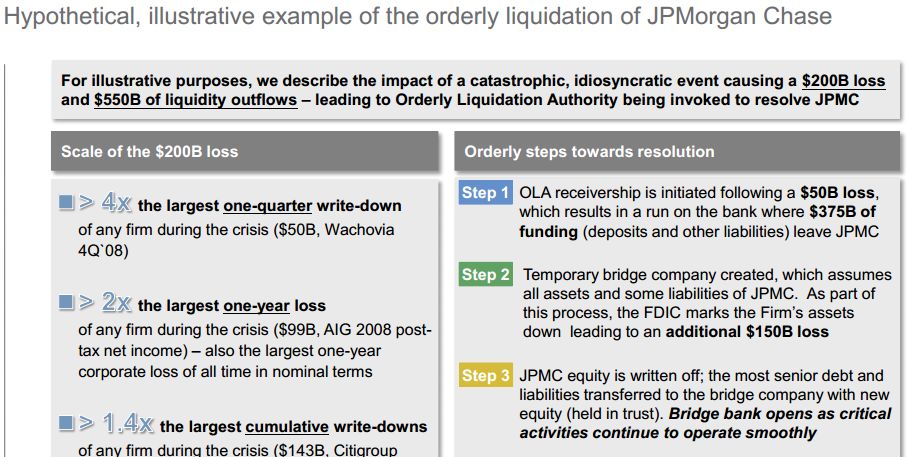

Go to page 9. Under the wipeout scenario JPM describes a $50 billion trading loss turning into a $200 billion loss as soon as the FDIC takes over. Why… ? Because JPM says they would expect the FDIC to immediately writedown JPM’s assets

by an additional $150 billion.

Holy mark to bullshit. Jamie Dimon just admitted to the world that JPM is mis-marking assets to the tune of $150 billion.

It gets better. Go to page 10. The chart shows that they only have $184 billion in equity, minus the $50 billion loss, minus ‘the $150 billion fdic reality adjustment’, which leaves them in a negative equity position of (-$16 billion).

So, we can extrapolate that without this phantom loss of $50 billion, JPM’s real equity position is just $34 billion currently, not the $184 billion on their books.

See STEP 2 in the figure below:

Look at the far right column EQUITY in the figure below: