– Volume Crashes As S&P 500 Breaks Winning Streak And VIX Plunges To Five Year Lows (ZeroHedge, Aug 13, 2012):

The cash S&P 500 closed very modestly in the red – but tried its best into the end of the day-session to get green to make it seven-in-a-row. After-hours, amid heavier block size, S&P 500 e-mini futures (ES) pushed up to the overnight highs and tried to hold green but failed. NYSE volume plunged – almost unbelievably to be frank – to its lowest non-holiday-trading day volume in over a decade. Intraday ranges remain tiny and average trade size unremarkable as ES is still suffering from the post-Knight slashing in volume.

Credit underperformed once again – though a late-day surge up to Friday’s closing VWAP in HYG (on decent volume) suggested sizable sellers as opposed to buyers (though some arb against intrinsics is likely too). All-in-all, an odd day (again): TSYs unch (though was -3-4bps intra), USD -0.18% (EUR +0.38%), Gold/Silver -1.2%, WTI unch (after a plungefest earlier that recovered about half its loss), Copper -0.7%. VIX clattered down to a 13 handle into the close – the lowest close in over 5 years – but notably unlike March when we were down here – the term-structure is considerably steeper.

Tech and Financials were the only sectors green today as Materials and Energy underperformed. Equities and broad risk-assets remained relatively in sync and correlated but by the close, US stocks had become modestly rich. Are we witnessing Gross’ death of equities?

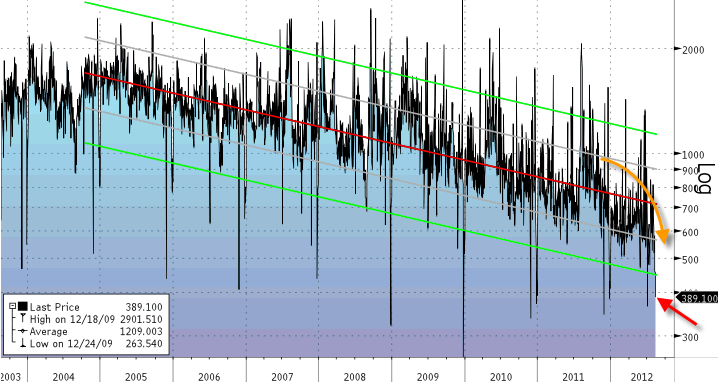

Stunningly – today’s NYSE volume was 3 standard-deviations below its 9 year trend lower on an EXPONENTIAL chart!!! – this is easily the lowest NYSE volume day of trading that is not a holiday!!

Just to be clear – and with no hyperbole – NYSE volume has trended exponentially lower for over 8 years and today’s volume was still a 3-Sigma outlier to the downside!!

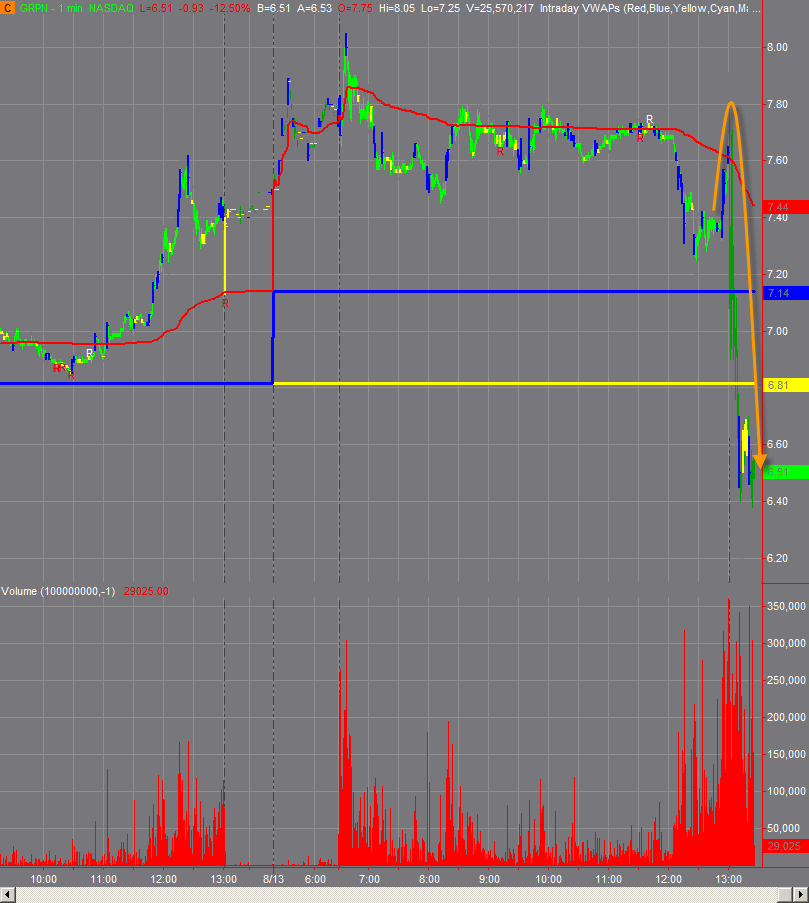

Clearly something broke with Knight’s algo going full-retard! ES volume since has plunged from an average over the last 4 months of 2.2 million contracts to an average over the last few days of only 1.25 million contracts – a 45% plunge instantaneously!!

The plunge in realized volatility given the extremely low ranges of the last few days has dragged VIX to five-year lows – though the term-structure is at its steepest in years also now…

and credit remains a notable underperformer (despite HYG’s cheapness relative to NAV)…

across asset classes, risk remained relative well-behaved – with VXX/TLT/HYG all staying closely in sync with SPY (despite some early exuberance by SPY -upper left). CONTEXT, our broad risk aset proxy – remained highly correlated, drove risk-off into the European close – but then US equities reovered notably more into the close…

Charts: Bloomberg and Capital Context

Bonus Chart: Group-OFF!

The cash S&P 500 closed very modestly in the red – but tried its best into the end of the day-session to get green to make it seven-in-a-row. After-hours, amid heavier block size, S&P 500 e-mini futures (ES) pushed up to the overnight highs and tried to hold green but failed. NYSE volume plunged – almost unbelievably to be frank – to its lowest non-holiday-trading day volume in over a decade. Intraday ranges remain tiny and average trade size unremarkable as ES is still suffering from the post-Knight slashing in volume.

Credit underperformed once again – though a late-day surge up to Friday’s closing VWAP in HYG (on decent volume) suggested sizable sellers as opposed to buyers (though some arb against intrinsics is likely too). All-in-all, an odd day (again): TSYs unch (though was -3-4bps intra), USD -0.18% (EUR +0.38%), Gold/Silver -1.2%, WTI unch (after a plungefest earlier that recovered about half its loss), Copper -0.7%. VIX clattered down to a 13 handle into the close – the lowest close in over 5 years – but notably unlike March when we were down here – the term-structure is considerably steeper.

Tech and Financials were the only sectors green today as Materials and Energy underperformed. Equities and broad risk-assets remained relatively in sync and correlated but by the close, US stocks had become modestly rich. Are we witnessing Gross’ death of equities?

Stunningly – today’s NYSE volume was 3 standard-deviations below its 9 year trend lower on an EXPONENTIAL chart!!! – this is easily the lowest NYSE volume day of trading that is not a holiday!!

Just to be clear – and with no hyperbole – NYSE volume has trended exponentially lower for over 8 years and today’s volume was still a 3-Sigma outlier to the downside!!

Clearly something broke with Knight’s algo going full-retard! ES volume since has plunged from an average over the last 4 months of 2.2 million contracts to an average over the last few days of only 1.25 million contracts – a 45% plunge instantaneously!!

The plunge in realized volatility given the extremely low ranges of the last few days has dragged VIX to five-year lows – though the term-structure is at its steepest in years also now…

and credit remains a notable underperformer (despite HYG’s cheapness relative to NAV)…

across asset classes, risk remained relative well-behaved – with VXX/TLT/HYG all staying closely in sync with SPY (despite some early exuberance by SPY -upper left). CONTEXT, our broad risk aset proxy – remained highly correlated, drove risk-off into the European close – but then US equities reovered notably more into the close…

Charts: Bloomberg and Capital Context

Bonus Chart: Group-OFF!

There is a lot of coverup going on, especially in our markets. Our markets have become so rigged, nobody abroad or domestic will invest here. Volume has been dropping for years along with our credibility.

Looking at your chart, it fits in with what I have already discovered in my research. 2010 was the beginning of the end. That is the year it became apparent to the rest of the world nothing would be done to repair the damage from the 2008-09 crash, no regulations will be set into place to prevent it happening again, and none of the crooks will face investigations, trial or punishment. As a result, the rest of the world started moving away from us, we are no longer considered safe or credible.

Since 2010, volume on the NYSE has dropped 50%. Also, in 2010, the first electronic currency, the Sucre, went live under the South American Trade Alliance. For the first time, the need for a world reserve currency was rendered obsolete. The Sucre translates the value of each currency of member nations, making conversion to the dollar unnecessary.

Russia and China quickly followed suit the same year, they established trade agreements using their own currencies, leaving the US dollar out. China went on to establish similar agreements with other nations all over the globe. India and Japan recently joined with them, and many emerging African nations don’t use the dollar in international trade either.

Over 40% of world GDP contributors no longer use the dollar, and the percentage is growing rapidly. Soon, we will be sitting on piles of paper currency nobody else wants or needs……we are facing total economic collapse thanks to our lack of responsible behavior with Wall Street or the banks. The rest of the world has washed it’s hands of our currency, we have abused our position as world reserve currency standard, and now, they no longer need us.