– And You Thought The Fed Was Bad (ZeroHedge, April 3, 2012)

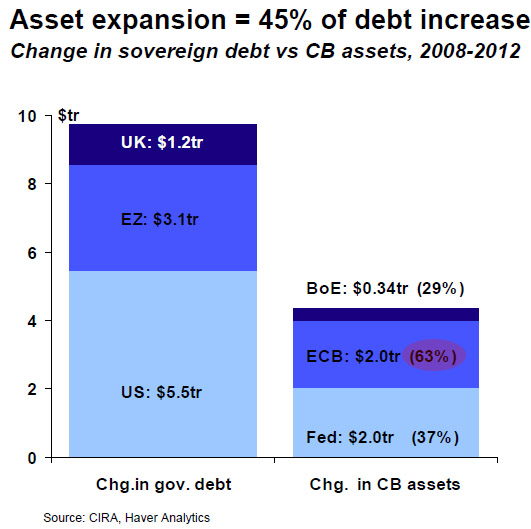

When one cuts out all the noise, the only true purpose of aggressive (or not) central bank asset expansion, is to be a “buyer” of last resort of sovereign debt funding. Think of it as the source of credit money demand (and hence supply) when every other sector is deleveraging, and when a given Treasury authority needs to pump trillions in debt into the market but when nobody can afford to lever up and buy said incremental debt. Call it monetization, call it funding the deficit, call it whatever: that’s what it is. And when people think of monetization, they think, first and foremost of the Chairman, who recently was caught praising the fiat system at a university named for a person who said the following prophetic line: “Paper money has had the effect… it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” Irony aside, when one cuts to the chase, and ignores even further noise about monetization being direct, indirect, sterilized, shadow, etc, there are just two metrics that are relevant: change in sovereign debt and change in Central Bank Assets. In this regard, of the US’ $5.5 trillion in sovereign debt increase, the Fed matched Geithner for $2.0 trillion of the total, or 37%. An admirable number and certainly better than the BoE’s 29%. Yet who gets the absolute top prize? Why none other than the ECB, which with $2 trillion in expansion (of which about 60% took place under Goldman apparatchik Mario Draghi in just the past 6 months) represents a whopping 63% of total Eurozone sovereign debt expansion of $3.1 trillion!

And yes, the fact that the EURUSD is not trading sub parity is for one simple reason: the market expects that Bernanke will, quite soon, match Draghi dollar for euro, in this sheer madness.

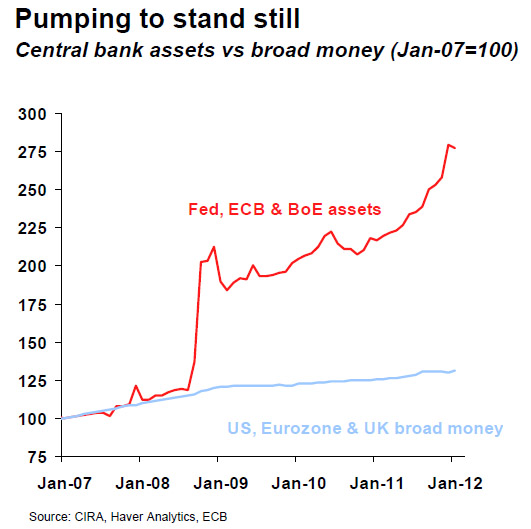

And just to not lose sight of the big centrally-planned picture…

source: citi