??- Bill Gross Sends Out Big Apology To Investors, And Then Declares That The Economy Is Doomed (Business Insider, Oct. 15, 2011):

Funny, just yesterday afternoon we pointed out the irony of nobody caring about the fact that Bill Gross had loaded up the boat on the long end of the yield curve, a gamble that obviously meant one thing: He sees no growth or inflation ahead — essentially an economy that’s doomed.

Well….

Now he might get more attention, because he just put that in writing.

Dealbreaker (via ZeroHedge) put up a special letter from Gross to his investors titled, simply Mea Culpa.

For those not caught up on Gross’ year, he’s ranked 536 out of 584 bond funds this year, mostly due to the fact he predicted (quite loudly in the press) that the end of QE2 this summer would see yields soar. But they didn’t. Instead, the economy started slowing down right then, and the flight to Treasuries was ON, creaming his bet.

Here’s his mea culpa summed up in one sentence from the letter:

The simple fact is that the portfolio at midyear was positioned for what we call a “New Normal” developed world economy – 2% real growth and 2% in?ation. When growth estimates quickly changed it was obvious that I had misjudged the ?y ball: E-CF or for non- baseball a?cionados – error center?eld.

But now, after he’s made his monstrous bet on the long end he no longer believes in the new normal.

So where do we go from here? Our internal growth forecast for developed economies is now 0% over the coming several quarters and the portfolio more accurately re?ects this posture. Yet even so, can the golden glove regain its magic? Well, as I’ve indicated, we’re showing up early every day at the ballpark – in this case for a little ?elding practice. And perhaps importantly, we recognize the majesty of the stadium we’re playing in. This is big league ball, where your ticketholders come to the park expecting not a circus Willie Mays catch but more wins than losses and a yearend performance that places your bond assets near the top of the standings.

He’s really inviting a “swing for the fences analogy”

Baseball metaphors aside, we know why PIMCO Total Return is arguably the largest and hopefully the greatest bond fund in the world. You want consistency, no surprises, but at the same time you want to get back through outperformance more than you pay for in fees. PIMCO, Mohamed El-Erian, and yours truly are working hard to make that happen. Despite the approaching World Series, for us it’s

the beginning of a new season. Play ball!Of course, the depressing thing for Gross here is that his new bet on lower rates and horrible growth is already looking out of step (maybe).

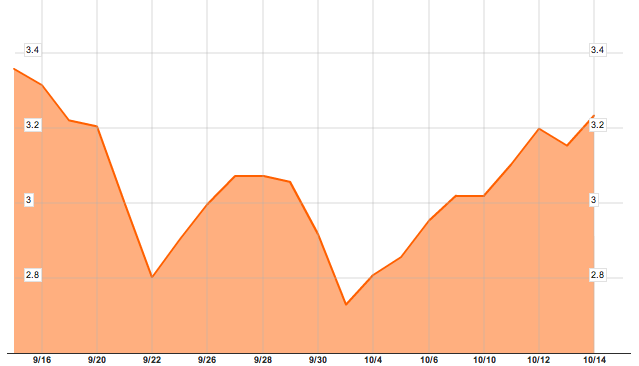

He went long sometime before the end of September, and no doubt you’ve seen the jump in long rates since then, from under 2.8% on the 30-year Treasury (below) to over 3.2%. A similar move is seen in the 10-year.

Of course everything could go off the rails on the turn of a dime, and Gross’s bet on lower rates will look fine, but you can just sense from the letter that it’s all on the line at the fund, and with fundraising shriveling up of late, it’s not hard to understand the pressure.