Douglas Borthwick, Managing Director of Trading at Faros:

“The significance of the US dollar losing its ‘flight to quality’ status is significant. We believe the US dollar continues to hold 8% of its strength as a result of ‘flight to quality’ inflows following Lehman’s demise and European peripheral concerns. The US dollar is already the funding currency of choice, and now, as it loses its ‘flight to quality’ moniker and interest rate differentials move in the Euro’s favor, we expect further EUR/USD gains going forward, despite the resounding loss of confidence in Chancellor Merkel as indicated by the people of Hamburg this past weekend.”

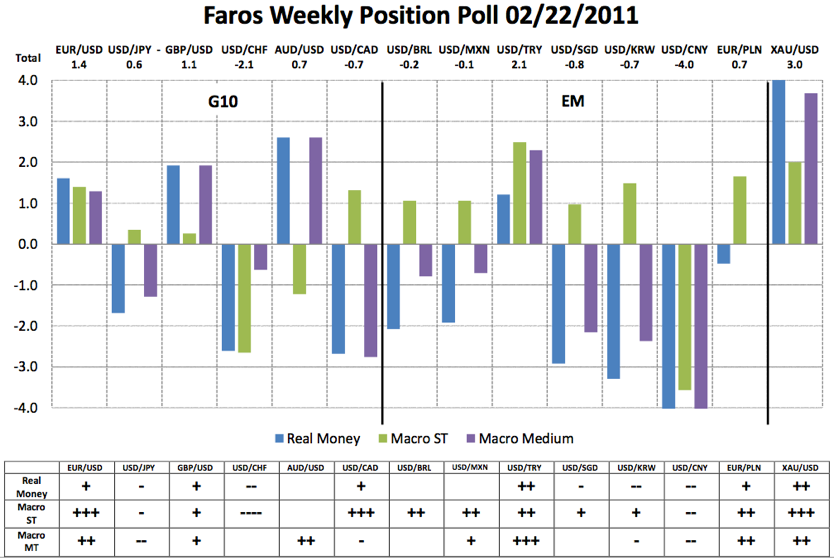

Here is a more detailed explanation from Faros to better understand the chart above:

The Faros Weekly Position Poll reflects the current market position for three primary categories of asset managers; Macro funds with a short term focus, Macro funds with a medium term focus and Real Money funds that are traditional long only equity or bond fund managers with an active FX overlay program. Macro short term funds are traditional systematic Commodity Trading Advisors (CTAs) who trade the market very technically and very actively. Macro medium term funds trade the market with a technical backdrop and with consideration to fundamental analysis and hold their positions longer. Real Money managers take a longer term view with a purchasing power parity based approach backed up by sound fundamental analysis.

The Faros Weekly Position Poll is the only volume-weighted bank poll of how the market is positioned in a selection of currency pairs. A significant number of both U.S. and international banks participate in the poll. In order for the poll to more accurately reflect the market, each bank’s answers are weighted according to its share of global daily volume, based on the 2010 Euromoney FX survey. The poll is on a scale of -5 to +5, with -5 being very short, +5 very long. The total is weighted 50% macro short term, 25% macro medium term, and 25% real money. The table below reflects the week over week change. One ‘+’ is a change of 0.5 – 1 point, ‘++’ is a

change of 1 – 2 points, ‘+++’ is a change of 2 – 3 points, etc.

Full article here: King World News