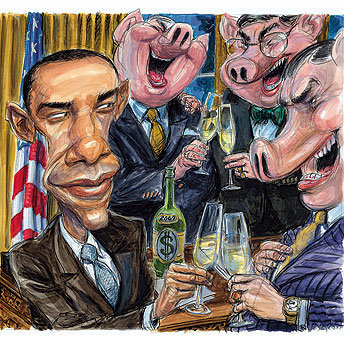

The president has packed his economic team with Wall Street insiders intent on turning the bailout into an all-out giveaway

Barack Obama ran for president as a man of the people, standing up to Wall Street as the global economy melted down in that fateful fall of 2008. He pushed a tax plan to soak the rich, ripped NAFTA for hurting the middle class and tore into John McCain for supporting a bankruptcy bill that sided with wealthy bankers “at the expense of hardworking Americans.” Obama may not have run to the left of Samuel Gompers or Cesar Chavez, but it’s not like you saw him on the campaign trail flanked by bankers from Citigroup and Goldman Sachs. What inspired supporters who pushed him to his historic win was the sense that a genuine outsider was finally breaking into an exclusive club, that walls were being torn down, that things were, for lack of a better or more specific term, changing.

Then he got elected.

What’s taken place in the year since Obama won the presidency has turned out to be one of the most dramatic political about-faces in our history. Elected in the midst of a crushing economic crisis brought on by a decade of orgiastic deregulation and unchecked greed, Obama had a clear mandate to rein in Wall Street and remake the entire structure of the American economy. What he did instead was ship even his most marginally progressive campaign advisers off to various bureaucratic Siberias, while packing the key economic positions in his White House with the very people who caused the crisis in the first place. This new team of bubble-fattened ex-bankers and laissez-faire intellectuals then proceeded to sell us all out, instituting a massive, trickle-up bailout and systematically gutting regulatory reform from the inside.

How could Obama let this happen? Is he just a rookie in the political big leagues, hoodwinked by Beltway old-timers? Or is the vacillating, ineffectual servant of banking interests we’ve been seeing on TV this fall who Obama really is?

Whatever the president’s real motives are, the extensive series of loophole-rich financial “reforms” that the Democrats are currently pushing may ultimately do more harm than good. In fact, some parts of the new reforms border on insanity, threatening to vastly amplify Wall Street’s political power by institutionalizing the taxpayer’s role as a welfare provider for the financial-services industry. At one point in the debate, Obama’s top economic advisers demanded the power to award future bailouts without even going to Congress for approval — and without providing taxpayers a single dime in equity on the deals.

How did we get here? It started just moments after the election — and almost nobody noticed.

‘Just look at the timeline of the Citigroup deal,” says one leading Democratic consultant. “Just look at it. It’s fucking amazing. Amazing! And nobody said a thing about it.”

Barack Obama was still just the president-elect when it happened, but the revolting and inexcusable $306 billion bailout that Citigroup received was the first major act of his presidency. In order to grasp the full horror of what took place, however, one needs to go back a few weeks before the actual bailout — to November 5th, 2008, the day after Obama’s election.

That was the day the jubilant Obama campaign announced its transition team. Though many of the names were familiar — former Bill Clinton chief of staff John Podesta, long-time Obama confidante Valerie Jarrett — the list was most notable for who was not on it, especially on the economic side. Austan Goolsbee, a University of Chicago economist who had served as one of Obama’s chief advisers during the campaign, didn’t make the cut. Neither did Karen Kornbluh, who had served as Obama’s policy director and was instrumental in crafting the Democratic Party’s platform. Both had emphasized populist themes during the campaign: Kornbluh was known for pushing Democrats to focus on the plight of the poor and middle class, while Goolsbee was an aggressive critic of Wall Street, declaring that AIG executives should receive “a Nobel Prize — for evil.”

But come November 5th, both were banished from Obama’s inner circle — and replaced with a group of Wall Street bankers. Leading the search for the president’s new economic team was his close friend and Harvard Law classmate Michael Froman, a high-ranking executive at Citigroup. During the campaign, Froman had emerged as one of Obama’s biggest fundraisers, bundling $200,000 in contributions and introducing the candidate to a host of heavy hitters — chief among them his mentor Bob Rubin, the former co-chairman of Goldman Sachs who served as Treasury secretary under Bill Clinton. Froman had served as chief of staff to Rubin at Treasury, and had followed his boss when Rubin left the Clinton administration to serve as a senior counselor to Citigroup (a massive new financial conglomerate created by deregulatory moves pushed through by Rubin himself).

Incredibly, Froman did not resign from the bank when he went to work for Obama: He remained in the employ of Citigroup for two more months, even as he helped appoint the very people who would shape the future of his own firm. And to help him pick Obama’s economic team, Froman brought in none other than Jamie Rubin, a former Clinton diplomat who happens to be Bob Rubin’s son. At the time, Jamie’s dad was still earning roughly $15 million a year working for Citigroup, which was in the midst of a collapse brought on in part because Rubin had pushed the bank to invest heavily in mortgage-backed CDOs and other risky instruments.

Now here’s where it gets really interesting. It’s three weeks after the election. You have a lame-duck president in George W. Bush — still nominally in charge, but in reality already halfway to the golf-and-O’Doul’s portion of his career and more than happy to vacate the scene. Left to deal with the still-reeling economy are lame-duck Treasury Secretary Henry Paulson, a former head of Goldman Sachs, and New York Fed chief Timothy Geithner, who served under Bob Rubin in the Clinton White House. Running Obama’s economic team are a still-employed Citigroup executive and the son of another Citigroup executive, who himself joined Obama’s transition team that same month.

So on November 23rd, 2008, a deal is announced in which the government will bail out Rubin’s messes at Citigroup with a massive buffet of taxpayer-funded cash and guarantees. It is a terrible deal for the government, almost universally panned by all serious economists, an outrage to anyone who pays taxes. Under the deal, the bank gets $20 billion in cash, on top of the $25 billion it had already received just weeks before as part of the Troubled Asset Relief Program. But that’s just the appetizer. The government also agrees to charge taxpayers for up to $277 billion in losses on troubled Citi assets, many of them those toxic CDOs that Rubin had pushed Citi to invest in. No Citi executives are replaced, and few restrictions are placed on their compensation. It’s the sweetheart deal of the century, putting generations of working-stiff taxpayers on the hook to pay off Bob Rubin’s fuck-up-rich tenure at Citi. “If you had any doubts at all about the primacy of Wall Street over Main Street,” former labor secretary Robert Reich declares when the bailout is announced, “your doubts should be laid to rest.”

It is bad enough that one of Bob Rubin’s former protégés from the Clinton years, the New York Fed chief Geithner, is intimately involved in the negotiations, which unsurprisingly leave the Federal Reserve massively exposed to future Citi losses. But the real stunner comes only hours after the bailout deal is struck, when the Obama transition team makes a cheerful announcement: Timothy Geithner is going to be Barack Obama’s Treasury secretary!

Geithner, in other words, is hired to head the U.S. Treasury by an executive from Citigroup — Michael Froman — before the ink is even dry on a massive government giveaway to Citigroup that Geithner himself was instrumental in delivering. In the annals of brazen political swindles, this one has to go in the all-time Fuck-the-Optics Hall of Fame.

Wall Street loved the Citi bailout and the Geithner nomination so much that the Dow immediately posted its biggest two-day jump since 1987, rising 11.8 percent. Citi shares jumped 58 percent in a single day, and JP Morgan Chase, Merrill Lynch and Morgan Stanley soared more than 20 percent, as Wall Street embraced the news that the government’s bailout generosity would not die with George W. Bush and Hank Paulson. “Geithner assures a smooth transition between the Bush administration and that of Obama, because he’s already co-managing what’s happening now,” observed Stephen Leeb, president of Leeb Capital Management.

Left unnoticed, however, was the fact that Geithner had been hired by a sitting Citigroup executive who still had a big bonus coming despite his proximity to Obama. In January 2009, just over a month after the bailout, Citigroup paid Froman a year-end bonus of $2.25 million. But as outrageous as it was, that payoff would prove to be chump change for the banker crowd, who were about to get everything they wanted — and more — from the new president.

The irony of Bob Rubin: He’s an unapologetic arch-capitalist demagogue whose very career is proof that a free-market meritocracy is a myth. Much like Alan Greenspan, a staggeringly incompetent economic forecaster who was worshipped by four decades of politicians because he once dated Barbara Walters, Rubin has been held in awe by the American political elite for nearly 20 years despite having fucked up virtually every project he ever got his hands on. He went from running Goldman Sachs (1990-1992) to the Clinton White House (1993-1999) to Citigroup (1999-2009), leaving behind a trail of historic gaffes that somehow boosted his stature every step of the way.

As Treasury secretary under Clinton, Rubin was the driving force behind two monstrous deregulatory actions that would be primary causes of last year’s financial crisis: the repeal of the Glass-Steagall Act (passed specifically to legalize the Citigroup megamerger) and the deregulation of the derivatives market. Having set that time bomb, Rubin left government to join Citi, which promptly expressed its gratitude by giving him $126 million in compensation over the next eight years (they don’t call it bribery in this country when they give you the money post factum). After urging management to amp up its risky investments in toxic vehicles, a strategy that very nearly destroyed the company, Rubin blamed Citi’s board for his screw-ups and complained that he had been underpaid to boot. “I bet there’s not a single year where I couldn’t have gone somewhere else and made more,” he said.

Despite being perhaps more responsible for last year’s crash than any other single living person — his colossally stupid decisions at both the highest levels of government and the management of a private financial superpower make him unique — Rubin was the man Barack Obama chose to build his White House around.

There are four main ways to be connected to Bob Rubin: through Goldman Sachs, the Clinton administration, Citigroup and, finally, the Hamilton Project, a think tank Rubin spearheaded under the auspices of the Brookings Institute to promote his philosophy of balanced budgets, free trade and financial deregulation. The team Obama put in place to run his economic policy after his inauguration was dominated by people who boasted connections to at least one of these four institutions — so much so that the White House now looks like a backstage party for an episode of Bob Rubin, This Is Your Life!

At Treasury, there is Geithner, who worked under Rubin in the Clinton years. Serving as Geithner’s “counselor” — a made-up post not subject to Senate confirmation — is Lewis Alexander, the former chief economist of Citigroup, who advised Citi back in 2007 that the upcoming housing crash was nothing to worry about. Two other top Geithner “counselors” — Gene Sperling and Lael Brainard — worked under Rubin at the National Economic Council, the key group that coordinates all economic policymaking for the White House.

As director of the NEC, meanwhile, Obama installed economic czar Larry Summers, who had served as Rubin’s protégé at Treasury. Just below Summers is Jason Furman, who worked for Rubin in the Clinton White House and was one of the first directors of Rubin’s Hamilton Project. The appointment of Furman — a persistent advocate of free-trade agreements like NAFTA and the author of droolingly pro-globalization reports with titles like “Walmart: A Progressive Success Story” — provided one of the first clues that Obama had only been posturing when he promised crowds of struggling Midwesterners during the campaign that he would renegotiate NAFTA, which facilitated the flight of blue-collar jobs to other countries. “NAFTA’s shortcomings were evident when signed, and we must now amend the agreement to fix them,” Obama declared. A few months after hiring Furman to help shape its economic policy, however, the White House quietly quashed any talk of renegotiating the trade deal. “The president has said we will look at all of our options, but I think they can be addressed without having to reopen the agreement,” U.S. Trade Representative Ronald Kirk told reporters in a little-publicized conference call last April.

The announcement was not so surprising, given who Obama hired to serve alongside Furman at the NEC: management consultant Diana Farrell, who worked under Rubin at Goldman Sachs. In 2003, Farrell was the author of an infamous paper in which she argued that sending American jobs overseas might be “as beneficial to the U.S. as to the destination country, probably more so.”

Joining Summers, Furman and Farrell at the NEC is Froman, who by then had been formally appointed to a unique position: He is not only Obama’s international finance adviser at the National Economic Council, he simultaneously serves as deputy national security adviser at the National Security Council. The twin posts give Froman a direct line to the president, putting him in a position to coordinate Obama’s international economic policy during a crisis. He’ll have help from David Lipton, another joint appointee to the economics and security councils who worked with Rubin at Treasury and Citigroup, and from Jacob Lew, a former Citi colleague of Rubin’s whom Obama named as deputy director at the State Department to focus on international finance.

Over at the Commodity Futures Trading Commission, which is supposed to regulate derivatives trading, Obama appointed Gary Gensler, a former Goldman banker who worked under Rubin in the Clinton White House. Gensler had been instrumental in helping to pass the infamous Commodity Futures Modernization Act of 2000, which prevented deregulation of derivative instruments like CDOs and credit-default swaps that played such a big role in cratering the economy last year. And as head of the powerful Office of Management and Budget, Obama named Peter Orszag, who served as the first director of Rubin’s Hamilton Project. Orszag once succinctly summed up the project’s ideology as a sort of liberal spin on trickle-down Reaganomics: “Market competition and globalization generate significant economic benefits.”

Taken together, the rash of appointments with ties to Bob Rubin may well represent the most sweeping influence by a single Wall Street insider in the history of government. “Rather than having a team of rivals, they’ve got a team of Rubins,” says Steven Clemons, director of the American Strategy Program at the New America Foundation. “You see that in policy choices that have resuscitated — but not reformed — Wall Street.”

While Rubin’s allies and acolytes got all the important jobs in the Obama administration, the academics and progressives got banished to semi-meaningless, even comical roles. Kornbluh was rewarded for being the chief policy architect of Obama’s meteoric rise by being outfitted with a pith helmet and booted across the ocean to Paris, where she now serves as America’s never-again-to-be-seen-on-TV ambassador to the Organization for Economic Cooperation and Development. Goolsbee, meanwhile, was appointed as staff director of the President’s Economic Recovery Advisory Board, a kind of dumping ground for Wall Street critics who had assisted Obama during the campaign; one top Democrat calls the panel “Siberia.”

Joining Goolsbee as chairman of the PERAB gulag is former Fed chief Paul Volcker, who back in March 2008 helped candidate Obama write a speech declaring that the deregulatory efforts of the Eighties and Nineties had “excused and even embraced an ethic of greed, corner-cutting, insider dealing, things that have always threatened the long-term stability of our economic system.” That speech met with rapturous applause, but the commission Obama gave Volcker to manage is so toothless that it didn’t even meet for the first time until last May. The lone progressive in the White House, economist Jared Bernstein, holds the impressive-sounding title of chief economist and national policy adviser — except that the man he is advising is Joe Biden, who seems more interested in foreign policy than financial reform.

The significance of all of these appointments isn’t that the Wall Street types are now in a position to provide direct favors to their former employers. It’s that, with one or two exceptions, they collectively offer a microcosm of what the Democratic Party has come to stand for in the 21st century. Virtually all of the Rubinites brought in to manage the economy under Obama share the same fundamental political philosophy carefully articulated for years by the Hamilton Project: Expand the safety net to protect the poor, but let Wall Street do whatever it wants. “Bob Rubin, these guys, they’re classic limousine liberals,” says David Sirota, a former Democratic strategist. “These are basically people who have made shitloads of money in the speculative economy, but they want to call themselves good Democrats because they’re willing to give a little more to the poor. That’s the model for this Democratic Party: Let the rich do their thing, but give a fraction more to everyone else.”

Even the members of Obama’s economic team who have spent most of their lives in public office have managed to make small fortunes on Wall Street. The president’s economic czar, Larry Summers, was paid more than $5.2 million in 2008 alone as a managing director of the hedge fund D.E. Shaw, and pocketed an additional $2.7 million in speaking fees from a smorgasbord of future bailout recipients, including Goldman Sachs and Citigroup. At Treasury, Geithner’s aide Gene Sperling earned a staggering $887,727 from Goldman Sachs last year for performing the punch-line-worthy service of “advice on charitable giving.” Sperling’s fellow Treasury appointee, Mark Patterson, received $637,492 as a full-time lobbyist for Goldman Sachs, and another top Geithner aide, Lee Sachs, made more than $3 million working for a New York hedge fund called Mariner Investment Group. The list goes on and on. Even Obama’s chief of staff, Rahm Emanuel, who has been out of government for only 30 months of his adult life, managed to collect $18 million during his private-sector stint with a Wall Street firm called Wasserstein-Perella.

The point is that an economic team made up exclusively of callous millionaire-assholes has absolutely zero interest in reforming the gamed system that made them rich in the first place. “You can’t expect these people to do anything other than protect Wall Street,” says Rep. Cliff Stearns, a Republican from Florida. That thinking was clear from Obama’s first address to Congress, when he stressed the importance of getting Americans to borrow like crazy again. “Credit is the lifeblood of the economy,” he declared, pledging “the full force of the federal government to ensure that the major banks that Americans depend on have enough confidence and enough money.” A president elected on a platform of change was announcing, in so many words, that he planned to change nothing fundamental when it came to the economy. Rather than doing what FDR had done during the Great Depression and institute stringent new rules to curb financial abuses, Obama planned to institutionalize the policy, firmly established during the Bush years, of keeping a few megafirms rich at the expense of everyone else.

Obama hasn’t always toed the Rubin line when it comes to economic policy. Despite being surrounded by a team that is powerfully opposed to deficit spending — balanced budgets and deficit reduction have always been central to the Rubin way of thinking — Obama came out of the gate with a huge stimulus plan designed to kick-start the economy and address the job losses brought on by the 2008 crisis. “You have to give him credit there,” says Sen. Bernie Sanders, an advocate of using government resources to address unemployment. “It’s a very significant piece of legislation, and $787 billion is a lot of money.”

But whatever jobs the stimulus has created or preserved so far — 640,329, according to an absurdly precise and already debunked calculation by the White House — the aid that Obama has provided to real people has been dwarfed in size and scope by the taxpayer money that has been handed over to America’s financial giants. “They spent $75 billion on mortgage relief, but come on — look at how much they gave Wall Street,” says a leading Democratic strategist. Neil Barofsky, the inspector general charged with overseeing TARP, estimates that the total cost of the Wall Street bailouts could eventually reach $23.7 trillion. And while the government continues to dole out big money to big banks, Obama and his team of Rubinites have done almost nothing to reform the warped financial system responsible for imploding the global economy in the first place.

The push for reform seemed to get off to a promising start. In the House, the charge was led by Rep. Barney Frank, the outspoken chair of the House Financial Services Committee, who emerged during last year’s Bush bailouts as a sharp-tongued critic of Wall Street. Back when Obama was still a senator, he and Frank even worked together to introduce a populist bill targeting executive compensation. Last spring, with the economy shattered, Frank began to hold hearings on a host of reforms, crafted with significant input from the White House, that initially contained some very good elements. There were measures to curb abusive credit-card lending, prevent banks from charging excessive fees, force publicly traded firms to conduct meaningful risk assessment and allow shareholders to vote on executive compensation. There were even measures to crack down on risky derivatives and to bar firms like AIG from picking their own regulators.

Then the committee went to work — and the loopholes started to appear.

The most notable of these came in the proposal to regulate derivatives like credit-default swaps. Even Gary Gensler, the former Goldmanite whom Obama put in charge of commodities regulation, was pushing to make these normally obscure investments more transparent, enabling regulators and investors to identify speculative bubbles sooner. But in August, a month after Gensler came out in favor of reform, Geithner slapped him down by issuing a 115-page paper called “Improvements to Regulation of Over-the-Counter Derivatives Markets” that called for a series of exemptions for “end users” — i.e., almost all of the clients who buy derivatives from banks like Goldman Sachs and Morgan Stanley. Even more stunning, Frank’s bill included a blanket exception to the rules for currency swaps traded on foreign exchanges — the very instruments that had triggered the Long-Term Capital Management meltdown in the late 1990s.

Given that derivatives were at the heart of the financial meltdown last year, the decision to gut derivatives reform sent some legislators howling with disgust. Sen. Maria Cantwell of Washington, who estimates that as much as 90 percent of all derivatives could remain unregulated under the new rules, went so far as to say the new laws would make things worse. “Current law with its loopholes might actually be better than these loopholes,” she said.

An even bigger loophole could do far worse damage to the economy. Under the original bill, the Securities and Exchange Commission and the Commodity Futures Trading Commission were granted the power to ban any credit swaps deemed to be “detrimental to the stability of a financial market or of participants in a financial market.” By the time Frank’s committee was done with the bill, however, the SEC and the CFTC were left with no authority to do anything about abusive derivatives other than to send a report to Congress. The move, in effect, would leave the kind of credit-default swaps that brought down AIG largely unregulated.

Why would leading congressional Democrats, working closely with the Obama administration, agree to leave one of the riskiest of all financial instruments unregulated, even before the issue could be debated by the House? “There was concern that a broad grant to ban abusive swaps would be unsettling,” Frank explained.

Unsettling to whom? Certainly not to you and me — but then again, actual people are not really part of the calculus when it comes to finance reform. According to those close to the markup process, Frank’s committee inserted loopholes under pressure from “constituents” — by which they mean anyone “who can afford a lobbyist,” says Michael Greenberger, the former head of trading at the CFTC under Clinton.

This pattern would repeat itself over and over again throughout the fall. Take the centerpiece of Obama’s reform proposal: the much-ballyhooed creation of a Consumer Finance Protection Agency to protect the little guy from abusive bank practices. Like the derivatives bill, the debate over the CFPA ended up being dominated by horse-trading for loopholes. In the end, Frank not only agreed to exempt some 8,000 of the nation’s 8,200 banks from oversight by the castrated-in-advance agency, leaving most consumers unprotected, he allowed the committee to pass the exemption by voice vote, meaning that congressmen could side with the banks without actually attaching their name to their “Aye.”

To win the support of conservative Democrats, Frank also backed down on another issue that seemed like a slam-dunk: a requirement that all banks offer so-called “plain vanilla” products, such as no-frills mortgages, to give consumers an alternative to deceptive, “fully loaded” deals like adjustable-rate loans. Frank’s last-minute reversal — made in consultation with Geithner — was such a transparent giveaway to the banks that even an economics writer for Reuters, hardly a far-left source, called it “the beginning of the end of meaningful regulatory reform.”

But the real kicker came when Frank’s committee took up what is known as “resolution authority” — government-speak for “Who the hell is in charge the next time somebody at AIG or Lehman Brothers decides to vaporize the economy?” What the committee initially introduced bore a striking resemblance to a proposal written by Geithner earlier in the summer. A masterpiece of legislative chicanery, the measure would have given the White House permanent and unlimited authority to execute future bailouts of megaconglomerates like Citigroup and Bear Stearns.

Democrats pushed the move as politically uncontroversial, claiming that the bill will force Wall Street to pay for any future bailouts and “doesn’t use taxpayer money.” In reality, that was complete bullshit. The way the bill was written, the FDIC would basically borrow money from the Treasury — i.e., from ordinary taxpayers — to bail out any of the nation’s two dozen or so largest financial companies that the president deems in need of government assistance. After the bailout is executed, the president would then levy a tax on financial firms with assets of more than $10 billion to repay the Treasury within 60 months — unless, that is, the president decides he doesn’t want to! “They can wait indefinitely to repay,” says Rep. Brad Sherman of California, who dubbed the early version of the bill “TARP on steroids.”

The new bailout authority also mandated that future bailouts would not include an exchange of equity “in any form” — meaning that taxpayers would get nothing in return for underwriting Wall Street’s mistakes. Even more outrageous, it specifically prohibited Congress from rejecting tax giveaways to Wall Street, as it did last year, by removing all congressional oversight of future bailouts. In fact, the resolution authority proposed by Frank was such a slurpingly obvious blow job of Wall Street that it provoked a revolt among his own committee members, with junior Democrats waging a spirited fight that restored congressional oversight to future bailouts, requires equity for taxpayer money and caps assistance to troubled firms at $150 billion. Another amendment to force companies with more than $50 billion in assets to pay into a rainy-day fund for bailouts passed by a resounding vote of 52 to 17 — with the “Nays” all coming from Frank and other senior Democrats loyal to the administration.

Even as amended, however, resolution authority still has the potential to be truly revolutionary legislation. The Senate version still grants the president unlimited power over equity-free bailouts, and the amended House bill still institutionalizes a system of taxpayer support for the 20 to 25 biggest banks in the country. It would essentially grant economic immortality to those top few megafirms, who will continually gobble up greater and greater slices of market share as money becomes cheaper and cheaper for them to borrow (after all, who wouldn’t lend to a company permanently backstopped by the federal government?). It would also formalize the government’s role in the global economy and turn the presidential-appointment process into an important part of every big firm’s business strategy. “If this passes, the very first thing these companies are going to do in the future is ask themselves, ‘How do we make sure that one of our executives becomes assistant Treasury secretary?'” says Sherman.

On the Senate side, finance reform has yet to make it through the markup process, but there’s every reason to believe that its final bill will be as watered down as the House version by the time it comes to a vote. The original measure, drafted by chairman Christopher Dodd of the Senate Banking Committee, is surprisingly tough on Wall Street — a fact that almost everyone in town chalks up to Dodd’s desperation to shake the bad publicity he incurred by accepting a sweetheart mortgage from the notorious lender Countrywide. “He’s got to do the shake-his-fist-at-Wall Street thing because of his, you know, problems,” says a Democratic Senate aide. “So that’s why the bill is starting out kind of tough.”

The aide pauses. “The question is, though, what will it end up looking like?”

He’s right — that is the question. Because the way it works is that all of these great-sounding reforms get whittled down bit by bit as they move through the committee markup process, until finally there’s nothing left but the exceptions. In one example, a measure that would have forced financial companies to be more accountable to shareholders by holding elections for their entire boards every year has already been watered down to preserve the current system of staggered votes. In other cases, this being the Senate, loopholes were inserted before the debate even began: The Dodd bill included the exemption for foreign-currency swaps — a gift to Wall Street that only appeared in the Frank bill during the course of hearings — from the very outset.

The White House’s refusal to push for real reform stands in stark contrast to what it should be doing. It was left to Rep. Pete Kanjorski in the House and Bernie Sanders in the Senate to propose bills to break up the so-called “too big to fail” banks. Both measures would give Congress the power to dismantle those pseudomonopolies controlling almost the entire derivatives market (Goldman, Citi, Chase, Morgan Stanley and Bank of America control 95 percent of the $290 trillion over-the-counter market) and the consumer-lending market (Citi, Chase, Bank of America and Wells Fargo issue one of every two mortgages, and two of every three credit cards). On November 18th, in a move that demonstrates just how nervous Democrats are getting about the growing outrage over taxpayer giveaways, Barney Frank’s committee actually passed Kanjorski’s measure. “It’s a beginning,” Kanjorski says hopefully. “We’re on our way.” But even if the Senate follows suit, big banks could well survive — depending on whom the president appoints to sit on the new regulatory board mandated by the measure. An oversight body filled with executives of the type Obama has favored to date from Citi and Goldman Sachs hardly seems like a strong bet to start taking an ax to concentrated wealth. And given the new bailout provisions that provide these megafirms a market advantage over smaller banks (those Paul Volcker calls “too small to save”), the failure to break them up qualifies as a major policy decision with potentially disastrous consequences.

“They should be doing what Teddy Roosevelt did,” says Sanders. “They should be busting the trusts.”

That probably won’t happen anytime soon. But at a minimum, Obama should start on the road back to sanity by making a long-overdue move: firing Geithner. Not only are the mop-headed weenie of a Treasury secretary’s fingerprints on virtually all the gross giveaways in the new reform legislation, he’s a living symbol of the Rubinite gangrene crawling up the leg of this administration. Putting Geithner against the wall and replacing him with an actual human being not recently employed by a Wall Street megabank would do a lot to prove that Obama was listening this past Election Day. And while there are some who think Geithner is about to go — “he almost has to,” says one Democratic strategist — at the moment, the president is still letting Wall Street do his talking.

Morning, the National Mall, November 5th. A year to the day after Obama named Michael Froman to his transition team, his political “opposition” has descended upon the city. Republican teabaggers from all 50 states have showed up, a vast horde of frowning, pissed-off middle-aged white people with their idiot placards in hand, ready to do cultural battle. They are here to protest Obama’s “socialist” health care bill — you know, the one that even a bloodsucking capitalist interest group like Big Pharma spent $150 million to get passed.

These teabaggers don’t know that, however. All they know is that a big government program might end up using tax dollars to pay the medical bills of rapidly breeding Dominican immigrants. So they hate it. They’re also in a groove, knowing that at the polls a few days earlier, people like themselves had a big hand in ousting several Obama-allied Democrats, including a governor of New Jersey who just happened to be the former CEO of Goldman Sachs. A sign held up by New Jersey protesters bears the warning, “If You Vote For Obamacare, We Will Corzine You.”

I approach a woman named Pat Defillipis from Toms River, New Jersey, and ask her why she’s here. “To protest health care,” she answers. “And then amnesty. You know, immigration amnesty.”

I ask her if she’s aware that there’s a big hearing going on in the House today, where Barney Frank’s committee is marking up a bill to reform the financial regulatory system. She recognizes Frank’s name, wincing, but the rest of my question leaves her staring at me like I’m an alien.

“Do you care at all about economic regulation?” I ask. “There was sort of a big economic collapse last year. Do you have any ideas about how that whole deal should be fixed?”

“We got to slow down on spending,” she says. “We can’t afford it.”

“But what do we do about the rules governing Wall Street . . .”

She walks away. She doesn’t give a fuck. People like Pat aren’t aware of it, but they’re the best friends Obama has. They hate him, sure, but they don’t hate him for any reasons that make sense. When it comes down to it, most of them hate the president for all the usual reasons they hate “liberals” — because he uses big words, doesn’t believe in hell and doesn’t flip out at the sight of gay people holding hands. Additionally, of course, he’s black, and wasn’t born in America, and is married to a woman who secretly hates our country.

These are the kinds of voters whom Obama’s gang of Wall Street advisers is counting on: idiots. People whose votes depend not on whether the party in power delivers them jobs or protects them from economic villains, but on what cultural markers the candidate flashes on TV. Finance reform has become to Obama what Iraq War coffins were to Bush: something to be tucked safely out of sight.

Around the same time that finance reform was being watered down in Congress at the behest of his Treasury secretary, Obama was making a pit stop to raise money from Wall Street. On October 20th, the president went to the Mandarin Oriental Hotel in New York and addressed some 200 financiers and business moguls, each of whom paid the maximum allowable contribution of $30,400 to the Democratic Party. But an organizer of the event, Daniel Fass, announced in advance that support for the president might be lighter than expected — bailed-out firms like JP Morgan Chase and Goldman Sachs were expected to contribute a meager $91,000 to the event — because bankers were tired of being lectured about their misdeeds.

“The investment community feels very put-upon,” Fass explained. “They feel there is no reason why they shouldn’t earn $1 million to $200 million a year, and they don’t want to be held responsible for the global financial meltdown.”

Which makes sense. Shit, who could blame the investment community for the meltdown? What kind of assholes are we to put any of this on them?

This is the kind of person who is working for the Obama administration, which makes it unsurprising that we’re getting no real reform of the finance industry. There’s no other way to say it: Barack Obama, a once-in-a-generation political talent whose graceful conquest of America’s racial dragons en route to the White House inspired the entire world, has for some reason allowed his presidency to be hijacked by sniveling, low-rent shitheads. Instead of reining in Wall Street, Obama has allowed himself to be seduced by it, leaving even his erstwhile campaign adviser, ex-Fed chief Paul Volcker, concerned about a “moral hazard” creeping over his administration.

“The obvious danger is that with the passage of time, risk-taking will be encouraged and efforts at prudential restraint will be resisted,” Volcker told Congress in September, expressing concerns about all the regulatory loopholes in Frank’s bill. “Ultimately, the possibility of further crises — even greater crises — will increase.”

What’s most troubling is that we don’t know if Obama has changed, or if the influence of Wall Street is simply a fundamental and ineradicable element of our electoral system. What we do know is that Barack Obama pulled a bait-and-switch on us. If it were any other politician, we wouldn’t be surprised. Maybe it’s our fault, for thinking he was different.

Watch Matt Taibbi discuss “The Big Sellout” in a video on his blog, Taibblog.

[From Issue 1093 — December 10, 2009]

Source: Rolling Stone

Obama just followed his marching orders; just like Donald Trump.