See also:

– The Solution For Greece (Max Keiser, Matt Taibbi and Catherine Austin Fitts)

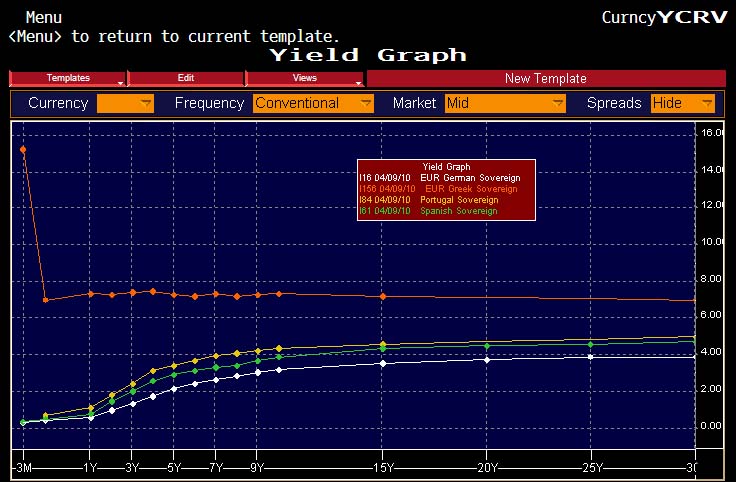

If this information is correct, it is all over. Bloomberg calculates the yield on the Greek 3 Month as determined by the bid, or where investors are willing to buy it, based on BVAL sources at 21.3%. In all honesty the bid/offer market in the 3 Month are all over the place. HDAT gives it as 99.650×99.840, BVAL is at 99.470×99.773. The HDAT bid implies a yield of 14.049%, which is still game over for Greece.

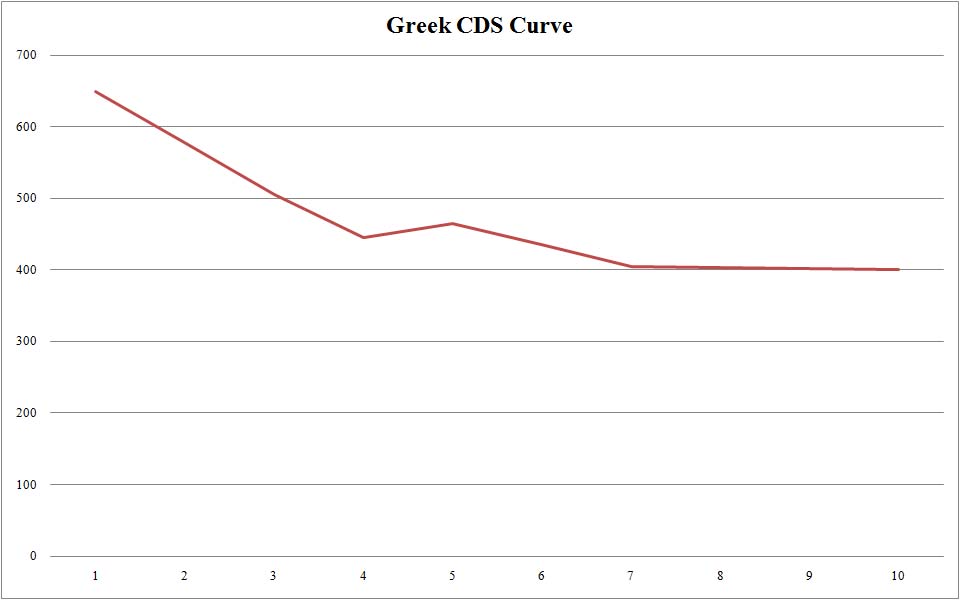

Another way to see the carnage is the Greek CDS curve: 3M-5Y is at -185 bps!

Why is all of this relevant? Because as Market News confirms as we initially noted, Greece plans to sell €600 million in 6 Month and €600 million in 12 Month Bills on April 13. Sorry, if the 3M is anywhere close to 14% bid (let alone 21%), this is not happening.

In addition, the country faces E8.22 billion in bond redemptions on Apr 20, E1.585 billion in T-bill redemptions on Apr 23, a E2.278 billion coupon payment on May 10 and E8.086 billion in bond redemption on May 19. The PDMA debt chief Petros Christodoulou has already hinted that April’s funding needs are taken care of, but that the country needs to raise E11.6 billion by May.

Also, apparently the American syndication is not going too hot. Greece has now moved on to the bubble of last resort: Asia.

Christodoulou added that Greece will soon do a roadshow in Asia and the U.S. Soon after that, at the end of April or the very beginning of May, “we could be in the market with a global bond deal in dollars,” he said.

Submitted by Tyler Durden on 04/09/2010 07:47 -0500

Source: ZeroHedge